10 Information Technology Stocks Whale Activity Today Surges the technology sector has always attracted the attention of big-money investors, but days with intense whale activity tend to stand out from the rest. When large institutional players, hedge funds, and high-net-worth individuals begin shifting massive amounts of capital into or out of technology stocks, the moves can reveal early signals about broader market sentiment and future price trends.

In today’s session, several major information technology stocks have recorded unusual levels of trading volume, options activity, or block trades. These patterns often point to strategic positioning by institutional investors, especially during periods of economic uncertainty, earnings season, or major industry developments such as artificial intelligence adoption, cloud expansion, or semiconductor demand shifts.

Tracking smart money flows into technology companies is not about blindly following the whales. Instead, it is about understanding why large investors are positioning themselves in certain companies. Whether they are betting on AI stocks, strengthening positions in cloud computing leaders, or rotating into cybersecurity firms, whale activity can provide valuable insights into the future direction of the sector.

Below are ten information technology stocks that have seen notable whale activity in today’s session, along with an in-depth analysis of what these moves could mean for investors and the broader tech landscape.

10 Information Technology Stocks Whale Activity

Microsoft has remained a favorite among large investors, thanks to its dominant position in enterprise software, cloud infrastructure, and AI integration. In today’s trading session, the company saw heavy block trades and elevated options flow, suggesting that whales are either reinforcing long-term positions or preparing for potential upside.

Much of the bullish sentiment around Microsoft stems from its leadership in the cloud computing market through Azure, as well as its aggressive push into AI-powered productivity tools. With enterprise adoption of AI accelerating, institutional investors appear confident that Microsoft will remain a cornerstone of the large-cap tech ecosystem.

Why Whales Are Interested in Microsoft

The company’s diversified revenue streams, strong balance sheet, and recurring enterprise contracts make it a low-risk option within the tech sector. Additionally, its partnerships and investments in AI platforms position it as a long-term growth engine.

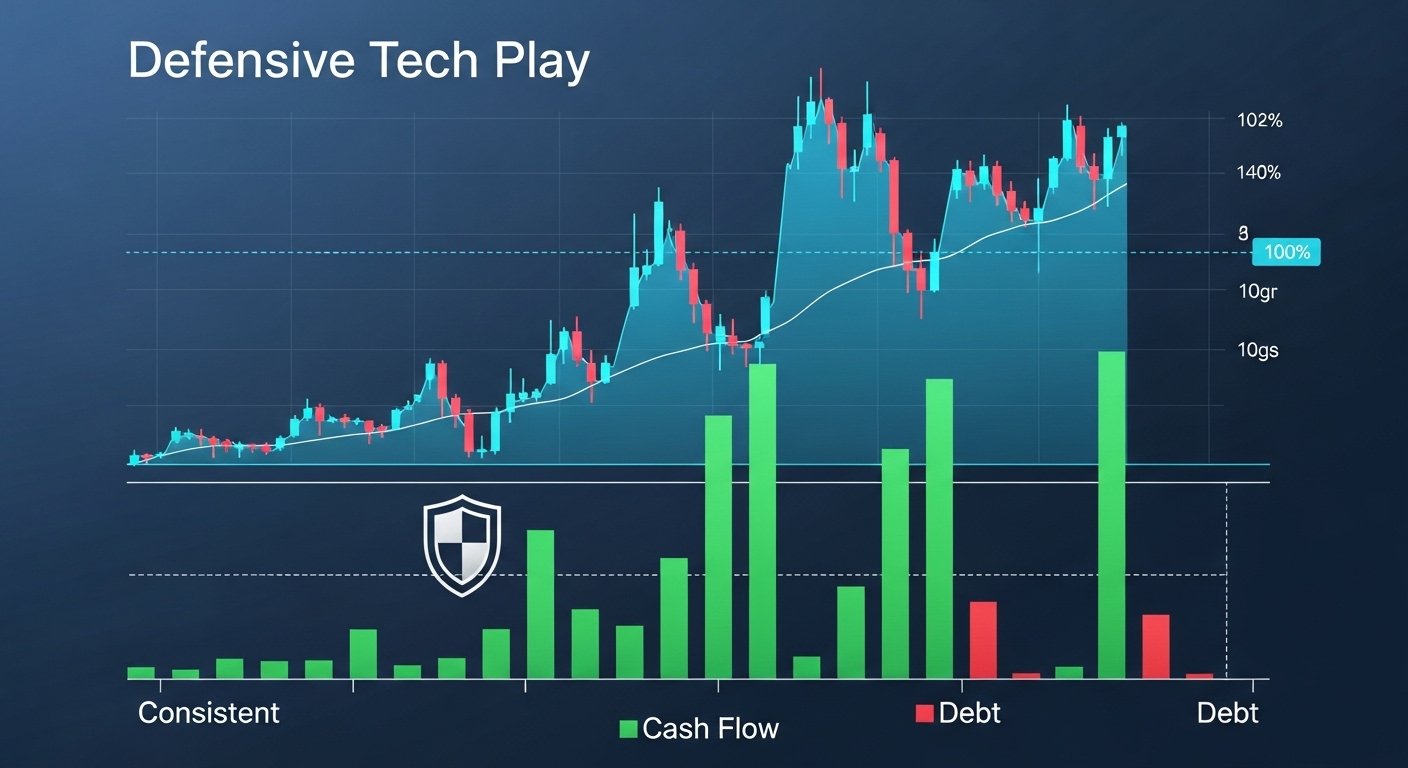

Apple Inc.: Defensive Tech Play with Strong Cash Flow

Apple continues to attract whale activity due to its reputation as a defensive technology stock. Despite slower smartphone growth in some regions, the company’s services division and ecosystem strength keep it appealing to long-term investors.

In today’s session, Apple recorded elevated institutional trading volumes, indicating that major players are either accumulating shares at key levels or repositioning ahead of product announcements or earnings.

The Appeal of Apple for Institutional Investors

Apple’s massive cash reserves, consistent buybacks, and strong brand loyalty make it a core holding for many funds. Its expansion into services, wearables, and digital payments provides additional growth channels beyond hardware.

NVIDIA Corporation: The Center of the AI Revolution

NVIDIA remains one of the most closely watched AI stocks in the market. Whale activity today reflects continued interest in the company’s leadership in graphics processing units and AI accelerators.

Large options trades suggest that institutions are betting on sustained demand for AI infrastructure, especially from data centers, cloud providers, and enterprise customers building machine learning capabilities.

AI Demand Driving Institutional Moves

The explosive growth of generative AI and data center expansion has made NVIDIA a central player in the tech ecosystem. Whales appear to be positioning for long-term gains tied to the ongoing AI boom.

Alphabet Inc.: Strategic Bets on Search, Cloud, and AI

Alphabet saw strong whale activity today, with notable block trades in both shares and options. The company’s leadership in digital advertising, along with rapid growth in its cloud segment, continues to attract institutional capital.

Investors are also watching Alphabet’s AI developments, as the company integrates machine learning into search, productivity tools, and advertising platforms.

Institutional Confidence in Alphabet’s Long-Term Strategy

Whales are likely focusing on Alphabet’s ability to balance mature revenue streams with emerging growth opportunities in AI and cloud computing. This combination makes it a compelling pick for long-term portfolios.

Amazon.com Inc.: Cloud Strength Offsets Retail Volatility

Amazon’s whale activity today highlights ongoing institutional confidence in its cloud computing division. Amazon Web Services remains one of the most profitable segments in the company’s portfolio.

Despite fluctuations in retail margins, whales appear to be focusing on AWS growth and the company’s expanding role in AI infrastructure.

Why Large Investors Are Accumulating Amazon

The company’s dominance in cloud infrastructure, logistics innovation, and digital services makes it a diversified technology powerhouse. Institutional investors often view it as a hybrid growth and infrastructure stock.

Meta Platforms Inc.: AI and Advertising Recovery Story

Meta has experienced renewed whale interest as the company continues to refine its digital advertising model and invest heavily in AI-driven content recommendations.

Today’s unusual options activity suggests that large investors may be positioning for continued earnings momentum or strategic announcements related to AI and social media monetization.

AI Integration Driving Optimism

Meta’s investment in AI-powered ad targeting and user engagement tools has improved revenue performance. Whales appear to be betting on sustained improvements in profitability and user growth.

Intel Corporation: Turnaround Play in Semiconductors

Intel has drawn attention from institutional traders due to its ongoing transformation into a semiconductor manufacturing leader. Today’s whale activity reflects interest in the company’s turnaround strategy.

Large investors may be anticipating benefits from government incentives, increased chip demand, and the company’s push into advanced manufacturing technologies.

Why Whales Are Watching Intel

Intel’s shift toward becoming a global foundry player and its focus on advanced nodes could reshape its competitive position in the semiconductor industry. This makes it an attractive value tech stock for institutions.

Advanced Micro Devices Inc.: Competitive Edge in Chips

AMD continues to see whale activity thanks to its strong position in data center processors and AI hardware. Institutional investors appear to be closely watching its competition with larger rivals.

Today’s options trades indicate that some whales are expecting continued growth in server chips and AI accelerators.

Growth Opportunities in AI and Data Centers

AMD’s expansion into high-performance computing and AI markets has strengthened its long-term outlook. Whales often favor companies with strong innovation pipelines and competitive positioning.

Salesforce Inc.: Enterprise Software Giant in Focus

Salesforce recorded significant whale activity today, particularly in options markets. The company remains a major player in customer relationship management software and enterprise cloud solutions.

Institutional investors are likely assessing the impact of AI features integrated into its platform, which could drive productivity gains for clients.

Why Whales Are Interested in Salesforce

The company’s recurring revenue model, strong enterprise client base, and growing AI capabilities make it a stable yet innovative software-as-a-service leader.

Cisco Systems Inc.: Stable Tech Dividend Play

Cisco’s whale activity today reflects its status as a reliable dividend-paying technology stock. The company’s focus on networking, cybersecurity, and enterprise solutions keeps it relevant in the digital economy.

Large investors may be positioning for steady income and moderate growth, especially during uncertain market conditions.

Institutional Appeal of Cisco

Cisco offers predictable cash flow, strong margins, and exposure to cybersecurity trends and network modernization, making it a dependable choice for conservative institutional portfolios.

What Whale Activity Really Means for Investors

Whale activity does not guarantee immediate price movement, but it often signals changing institutional sentiment. When large investors increase exposure to specific technology stocks, it usually reflects confidence in long-term fundamentals, sector trends, or upcoming catalysts.

However, it is important to remember that whales have different strategies than retail investors. Some trades may be hedges, arbitrage positions, or short-term options plays rather than outright bullish bets.

Still, consistent whale accumulation in technology stocks often aligns with broader trends such as AI adoption, cloud expansion, semiconductor demand, and enterprise software growth. Monitoring these patterns can provide valuable context for investment decisions.

Key Trends Behind Today’s Tech Whale Moves

Today’s whale activity across information technology stocks reflects several underlying trends shaping the market. One major factor is the rapid growth of AI infrastructure, which continues to drive demand for chips, cloud services, and software platforms. Another important trend is the shift toward recurring revenue models in enterprise technology. Companies offering subscription-based software or cloud services are attracting more institutional capital due to their predictable earnings.

Additionally, the ongoing digital transformation across industries has increased demand for cybersecurity, data analytics, and automation tools. Whales appear to be positioning themselves in companies that stand to benefit the most from these long-term shifts.

Conclusion

Today’s session highlighted strong whale activity across ten major information technology stocks, signaling continued institutional interest in the sector. From AI leaders and cloud giants to semiconductor innovators and enterprise software providers, the stocks attracting large capital flows reflect the key trends shaping the future of technology.

While whale activity alone should not drive investment decisions, it can provide valuable insights into how professional investors are positioning themselves. By understanding the motivations behind these large trades, investors can gain a clearer view of where the tech sector may be headed in the coming months.

As AI adoption accelerates, cloud infrastructure expands, and digital transformation continues across industries, technology stocks are likely to remain at the center of institutional attention. Watching whale activity in these companies can offer a useful glimpse into the strategies of the market’s most influential players.

FAQs

Q: What is whale activity in the stock market?

Whale activity refers to unusually large trades made by institutional investors, hedge funds, or high-net-worth individuals. These trades can involve large blocks of shares or significant options positions and often indicate strategic moves based on long-term outlooks or upcoming catalysts.

Q: Why do investors track whale activity in technology stocks?

Investors track whale activity because it can provide insights into how professional money managers are positioning their portfolios. Large capital flows into specific technology stocks may reflect confidence in industry trends such as AI, cloud computing, or semiconductor demand.

Q: Does whale activity guarantee a stock will rise?

Whale activity does not guarantee price increases. Some large trades are hedging strategies or short-term options plays. However, consistent institutional accumulation can indicate strong long-term confidence in a company’s fundamentals.

Q: How can retail investors use whale activity data?

Retail investors can use whale activity as a supporting indicator rather than a primary decision tool. By combining whale activity insights with fundamental analysis and technical trends, investors can make more informed decisions.

Q: Which technology sectors are attracting the most whale activity right now?

Sectors attracting the most whale activity include AI infrastructure, cloud computing, semiconductors, cybersecurity, and enterprise software. These areas are experiencing strong demand due to digital transformation and rapid technological advancements.