The global FinTech sector entered 2026 with optimism built on years of digital transformation, rapid innovation, and strong investor appetite. However, as the year unfolds, a noticeable slowdown has emerged, leading analysts to describe the current climate as one where 2026 FinTech funding faces holiday hangover conditions. After a festive surge of deals, valuations, and ambitious expansion plans in previous cycles, investors appear to be nursing caution, reassessing risks, and tightening capital flows.

This so-called holiday hangover does not signal the end of FinTech innovation. Instead, it reflects a natural correction after periods of exuberance. Venture capital firms, private equity players, and even corporate investors are becoming more selective, prioritizing sustainable business models over aggressive growth narratives. Startups, in turn, are adjusting strategies, focusing on profitability, efficiency, and long-term value creation.

Understanding why 2026 FinTech funding faces holiday hangover dynamics requires examining broader economic conditions, investor psychology, regulatory changes, and evolving market expectations. This article explores the roots of the slowdown, its implications for startups and investors, and what the future may hold for the FinTech ecosystem.

Understanding the Meaning of the FinTech Funding Holiday Hangover

When observers say 2026 FinTech funding faces holiday hangover, they are describing a period of reduced investment activity following years of heightened enthusiasm. Much like the lull after a festive season, this phase is marked by slower deal-making, longer due diligence processes, and more conservative valuations.

In previous years, abundant liquidity and low interest rates fueled a wave of FinTech investments. Startups focusing on payments, digital banking, lending, blockchain, and financial technology innovation attracted massive funding rounds. As economic conditions shifted, investors began questioning whether all these ventures could deliver sustainable returns.

The hangover metaphor also reflects psychological factors. Investors who moved quickly in earlier cycles are now taking time to digest outcomes, analyze performance data, and reassess portfolios. This recalibration is a normal part of market evolution and does not necessarily indicate declining confidence in FinTech as a sector.

Macroeconomic Factors Shaping 2026 FinTech Funding

A key reason 2026 FinTech funding faces holiday hangover conditions lies in the broader macroeconomic environment. Inflationary pressures, fluctuating interest rates, and uneven global growth have influenced investor behavior across sectors. Higher borrowing costs make capital more expensive, reducing the willingness of investors to fund high-risk ventures.

Central banks’ policies have also played a role. As monetary tightening continues in some regions, liquidity has become scarcer. This shift forces investors to prioritize capital preservation and risk-adjusted returns. FinTech startups, particularly those reliant on continuous funding to sustain operations, feel the impact acutely.

Additionally, geopolitical uncertainties and supply chain disruptions contribute to cautious sentiment. While FinTech companies are often digital-first, they are not immune to global economic volatility. These conditions collectively explain why funding momentum has slowed in 2026.

Investor Sentiment and Changing Risk Appetite

Investor sentiment is central to understanding why 2026 FinTech funding faces holiday hangover effects. During boom periods, fear of missing out often drives rapid investment decisions. In contrast, the current climate favors patience and scrutiny.

Venture capital firms are focusing more on fundamentals such as revenue stability, customer retention, and compliance readiness. Investors are less inclined to back unproven concepts or speculative growth projections. This shift reflects a broader reevaluation of risk appetite after mixed results from earlier FinTech investments.

Institutional investors, in particular, are demanding clearer paths to profitability. Startups that once relied on growth-at-all-costs strategies now face pressure to demonstrate operational discipline. While this environment is challenging, it can also strengthen the sector by rewarding resilient business models.

Valuation Corrections and Their Impact on Startups

Another reason 2026 FinTech funding faces holiday hangover dynamics is the widespread correction in startup valuations. In prior years, valuations soared as competition for deals intensified. As market conditions changed, many of these valuations proved unsustainable.

Lower valuations affect startups in multiple ways. Founders may experience dilution when raising new rounds, and some companies may delay fundraising altogether. Others may pursue mergers or acquisitions as alternative growth strategies.

Despite these challenges, valuation corrections can have positive long-term effects. More realistic pricing aligns expectations between founders and investors, reducing pressure to achieve unrealistic growth targets. Over time, this recalibration can create a healthier funding ecosystem.

The Role of Regulation in Slowing FinTech Investment

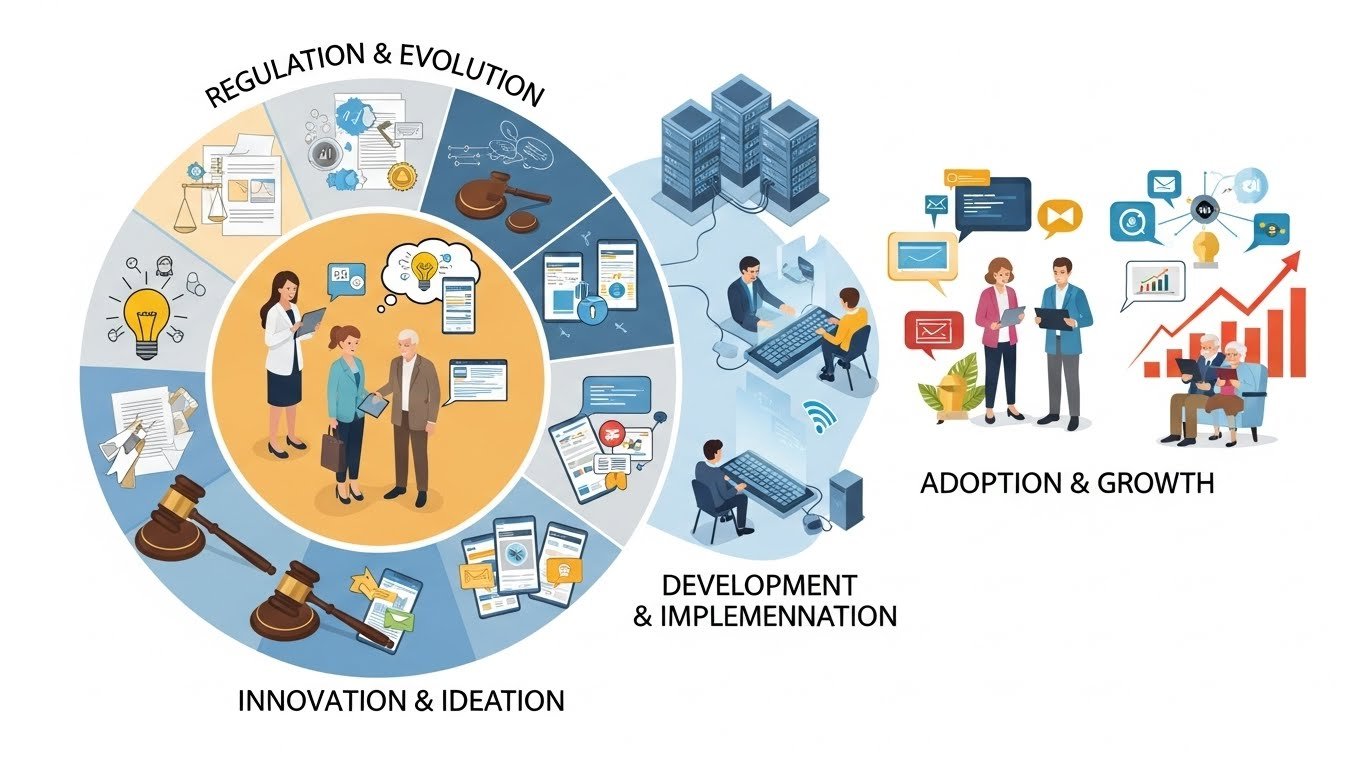

Regulatory developments also contribute to why 2026 FinTech funding faces holiday hangover conditions. As FinTech solutions increasingly intersect with core financial systems, regulators are paying closer attention. New compliance requirements, data protection rules, and consumer protection standards add complexity to operations.

While regulation is essential for stability and trust, it can increase costs and slow innovation. Investors factor these considerations into funding decisions, particularly for startups operating in highly regulated segments like digital banking, payments, and regulatory technology solutions.

In some cases, regulatory uncertainty creates hesitation. Investors may delay funding until clearer guidelines emerge, especially in areas such as digital assets and cross-border payments. This cautious approach further contributes to the funding slowdown observed in 2026.

Sector-Specific Trends Within FinTech Funding

Although 2026 FinTech funding faces holiday hangover overall, not all subsectors are affected equally. Payments and digital wallets, for example, continue to attract interest due to their widespread adoption and recurring revenue models. However, competition is intense, and differentiation is crucial.

Lending-focused Fin Techs face greater scrutiny, particularly regarding credit risk and default rates. Investors are carefully evaluating underwriting models and exposure to economic downturns. Meanwhile, embedded finance solutions remain attractive, as they integrate financial services into non-financial platforms.

Blockchain and digital asset startups experience mixed conditions. While speculative projects struggle, infrastructure-focused ventures with clear use cases continue to secure funding. These nuances highlight that the hangover is not uniform but varies across FinTech segments.

Startups Are Adapting to the Funding Slowdown

In response to the reality that 2026 FinTech funding faces holiday hangover challenges, startups are adapting strategies. Cost optimization has become a priority, with many companies streamlining operations and extending cash runways.

Founders are also refining value propositions, focusing on core products rather than expansive roadmaps. By demonstrating traction and customer value, startups aim to stand out in a competitive funding environment.

Partnerships and strategic alliances are another adaptation strategy. Collaborating with established financial institutions or technology firms can provide credibility, resources, and alternative growth paths. These adjustments reflect resilience and adaptability within the FinTech ecosystem.

The Perspective of Venture Capital Firms in 2026

From the venture capital perspective, the idea that 2026 FinTech funding faces holiday hangover conditions is less about pessimism and more about discipline. Investors emphasize portfolio management, supporting existing investments while being selective with new deals.

VC firms are spending more time on due diligence, evaluating market size, regulatory exposure, and execution capabilities. This thorough approach aims to reduce downside risk and improve long-term returns.

Many investors also view the current environment as an opportunity. Lower valuations and reduced competition can create favorable entry points for high-quality startups. In this sense, the hangover period may lay the foundation for the next wave of innovation.

Comparing 2026 to Previous FinTech Cycles

To fully grasp why 2026 FinTech funding faces holiday hangover dynamics, it helps to compare this period with earlier cycles. The FinTech sector has experienced multiple waves of enthusiasm and correction since its emergence.

Previous downturns often followed rapid technological shifts or regulatory changes. Each time, the sector emerged stronger, with clearer business models and more mature players. The current slowdown fits this historical pattern.

Unlike earlier cycles, today’s FinTech ecosystem is more integrated into mainstream finance. This maturity suggests that while funding may slow temporarily, the long-term trajectory remains positive. Lessons learned during this period could shape more sustainable growth in the future.

Global Differences in FinTech Funding Trends

While the narrative that 2026 FinTech funding faces holiday hangover is broadly accurate, regional variations exist. Some markets experience sharper slowdowns due to local economic conditions or regulatory challenges.

In regions with supportive regulatory frameworks and strong digital adoption, funding remains relatively resilient. Emerging markets, in particular, continue to attract interest for solutions addressing financial inclusion and underserved populations.

These global differences underscore the importance of context when evaluating FinTech funding trends. Startups and investors alike must consider regional dynamics alongside global narratives.

Long-Term Implications for the FinTech Ecosystem

The fact that 2026 FinTech funding faces holiday hangover conditions carries important long-term implications. One significant outcome may be consolidation, as weaker players exit the market or merge with stronger competitors.

Talent dynamics may also shift. As startups adjust hiring plans, experienced professionals may move toward established firms or launch new ventures with more disciplined approaches. This talent redistribution can strengthen the ecosystem over time.

Innovation is unlikely to stall. Instead, it may become more focused, addressing real-world problems with scalable solutions. The hangover phase may ultimately lead to a more robust and credible FinTech industry.

Conclusion

The observation that 2026 FinTech funding faces holiday hangover reflects a period of recalibration rather than decline. Economic pressures, changing investor sentiment, valuation corrections, and regulatory developments all contribute to a more cautious funding environment.

While challenges exist, this phase also presents opportunities. Startups that adapt by focusing on fundamentals, efficiency, and customer value can emerge stronger. Investors who deploy capital strategically may benefit from improved risk-adjusted returns.

As the FinTech sector continues to evolve, the current hangover may be remembered as a necessary pause that paved the way for sustainable growth and innovation in the years ahead.

FAQs

Q: Why is 2026 described as a holiday hangover year for FinTech funding?

The term reflects a slowdown in investment activity following years of strong growth and enthusiasm. Investors are reassessing risks, valuations, and business models, leading to more cautious funding decisions across the FinTech sector.

Q: Does the funding slowdown mean FinTech innovation is declining?

No, innovation continues, but it is becoming more focused and disciplined. Startups are prioritizing sustainable revenue models and real-world impact rather than rapid expansion without profitability.

Q: Which FinTech sectors are most affected by the funding hangover?

Lending and highly speculative segments face greater scrutiny, while payments, embedded finance, and infrastructure-focused solutions continue to attract interest, albeit with stricter evaluation criteria.

Q: How are FinTech startups adjusting to reduced funding availability?

Startups are optimizing costs, extending cash runways, refining core offerings, and pursuing strategic partnerships. These measures help them navigate a more selective investment environment.

Q: What does the future look like after the 2026 FinTech funding hangover?

The long-term outlook remains positive. The current phase may lead to stronger companies, healthier valuations, and more sustainable growth, setting the stage for renewed investment momentum in the future.