Chainlink, a decentralized oracle network that allows smart contracts on blockchains to connect with real-world data safely, is one of the most prominent actors in the fast-evolving realm of blockchain and decentralized technology. With the expansion and diversification of decentralized finance (DeFi), Chainlink’s off-chain data provisioning role is now important. The cryptocurrency community has recently been captivated by the growing rumors and anticipation surrounding a Chainlink airdrop. In this article, learn more about Chainlink Airdrop, the possibility of an airdrop from Chainlink, and the ripple effects on the blockchain ecosystem.

Understanding Chainlink

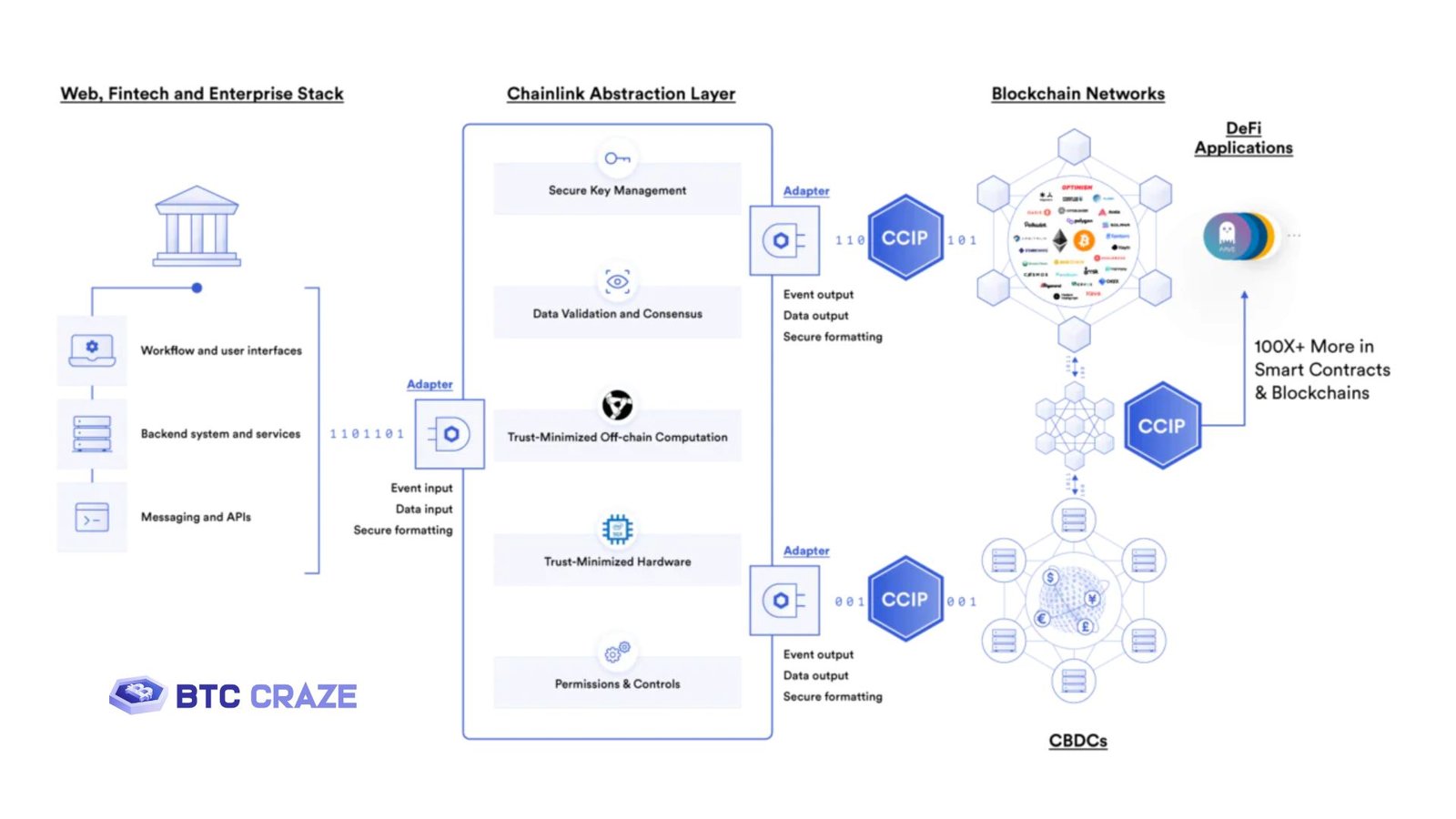

Knowing what Chainlink is and why it’s important in the blockchain realm is essential before getting into the details of an airdrop. Using Chainlink, a decentralized oracle network, smart contracts can safely communicate with third-party APIs, data sources, and even conventional payment systems. Smart contracts rely on this feature heavily since blockchains are intentionally designed to be isolated from the outside world for security reasons. Smart contracts can’t access data outside their original blockchain context unless an oracle like Chainlink is used.

For example, if you’re working with decentralized insurance or financial apps, your smart contracts on Ethereum might need weather data or price feeds to run. Chainlink addresses this issue by delivering trustworthy and immutable data via a distributed system of oracles. LINK, the Chainlink token, is an ERC-20 token that users can use to purchase data feeds and other services inside the Chainlink ecosystem. Node operators also use it as collateral to guarantee that their data is accurate and trustworthy.

What is an Airdrop?

In the cryptocurrency industry, a marketing tactic or incentive for early adopters and dedicated users is the delivery of free tokens to many wallet holders, commonly called an airdrop. Airdrops are a great way for projects to get their names out there, draw in new users, and encourage people to join the network. In most cases, to be eligible for an airdrop, the recipient must either have a certain cryptocurrency in their wallets or fulfill specific requirements.

Airdrops are popular in Bitcoin because they promote community interaction and decentralized ownership. Many successful organizations have launched their ecosystems with airdrops, including Ethereum tokens and DeFi protocols. For example, in 2020, Uniswap, a leading decentralized exchange, launched a highly successful airdrop. Users who have used the network before a particular date received 400 UNI tokens worth about $1,200. This airdrop rewarded early adopters and encouraged participation, accelerating platform growth.

Chainlink Airdrop: Reality or Speculation?

The cryptocurrency community has been speculating about the possibility of a Chainlink airdrop for a while now. The huge popularity of airdrops like Uniswap’s and Chainlink’s have left many LINK holders hoping for a comparable payout. Unfortunately, the Chainlink team has not yet publicly announced an upcoming airdrop.

The idea of an airdrop is not completely out of the question. Launching governance tokens, promoting new products, or expanding an ecosystem are common uses for airdrops. Staking is one of many significant improvements and developments that Chainlink has been working on; it has the potential to bring new opportunities for LINK holders to engage with the network.

An airdrop could be a smart move for Chainlink to distribute new products or governance tokens to existing LINK holders if they were to launch them. As an alternative, Chainlink’s staking method might use airdrop payouts, allowing users to earn more tokens to contribute to the network’s security.

Prospective airdrop volunteers must exercise caution and not fall for fraud, regardless of the rumors. Many scams in the Bitcoin industry claim to be airdrops but want to take your private keys or money. Before you trust any airdrop details, check Chainlink’s official channels, such as their website or social media profiles.

What Could a Chainlink Airdrop Look Like?

Looking at prior airdrops and Chainlink’s roadmap, we can hypothesize on a likely airdrop, although the details are still unknown. Decentralized finance (DeFi) platforms that leverage Chainlink’s data feeds may receive liquidity from users or governance tokens.

Staking Rewards Airdrop

Chainlink token holders could soon stake their LINK tokens to strengthen the network and earn rewards. If staking is enabled, early stakes could receive awards via airdrop to protect the network and encourage participation. This would improve network security and give early adopters additional LINK tokens or a new staking token.

Defi Liquidity Incentive Airdrop

Liquidity incentive airdrops are another potential outcome, considering Chainlink’s extensive connection with DeFi platforms. Chainlink could reward users who supply liquidity to platforms using Chainlink oracles. Airdropped prizes may be available to LINK holders in DeFi protocols like Aave, Synthetix, and Compound. This would boost Chainlink’s ecosystem and user engagement with DeFi platforms using its Oracle services.

Impact of a Chainlink Airdrop on the Blockchain Ecosystem

Increased Adoption and Participation

Many users would likely join the Chainlink network if the airdrop were linked to staking or governance. The number of LINK tokens on the market may decrease. When users stake or engage in governance activities, the token’s price is raised. Chainlink, a leading decentralized oracle service, might gain more influence in the DeFi. And blockchain industries if more people join. Ecosystem.

Greater Decentralization

More decentralization of power on the network may result from Chainlink’s introduction of a governance token via an airdrop. The community could vote on important choices, such as protocol improvements. In addition to giving people more agency, this would align with blockchain’s decentralized spirit.

Boost to the DeFi Ecosystem

The ecosystem could feel the effects of any airdrop linked to DeFi incentives because of Chainlink’s interaction with DeFi platforms. More liquidity and involvement across different decentralized platforms might be driven by Chainlink’s incentive program for users and producers of DeFi liquidity, which would further accelerate the expansion of decentralized finance.

Also Read: Blockchain Development Services: Transforming Industries in 2024

Conclusion

While rumors about a Chainlink airdrop grow, the project focuses on improving its capabilities. Chainlink will affect DeFi, smart contracts, and decentralized governance whether or not it airdrops. For now, LINK holders and blockchain enthusiasts are watching developments in hopes of participating. Stay aware and cautious when speculating in crypto, especially airdrops. Chainlink’s role in decentralized technology’s future is secure regardless of an airdrop.