The digital landscape has witnessed a remarkable transformation in recent years, with non-fungible tokens emerging as one of the most discussed innovations in technology and NFTs Explained digital commerce. These unique digital assets have captured the imagination of artists, collectors, investors, and technologists worldwide, creating entirely new markets and redefining how we think about ownership in the digital realm.

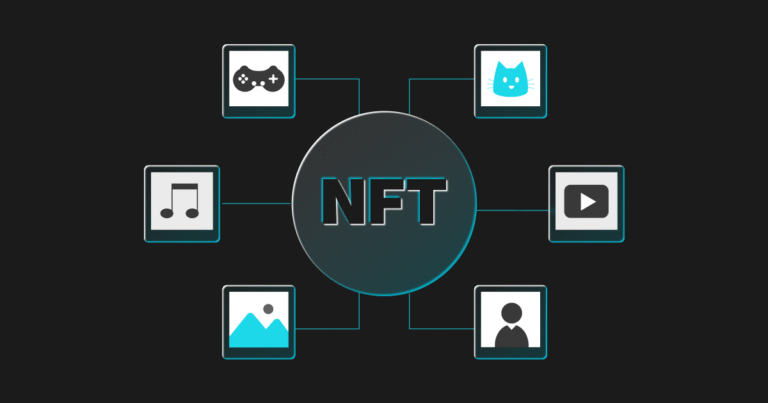

An NFT represents a revolutionary approach to establishing NFTs Explained authenticity and ownership for digital items. Unlike traditional digital files that can be copied endlessly without distinction, these blockchain-based tokens provide verifiable proof of ownership and authenticity for digital assets. From digital artwork selling for millions of dollars to virtual real estate in metaverse platforms, NFTs Explained. The applications of this technology continue to expand in unexpected directions.

What NFTs are, how they function, and their potential impact on various industries have become increasingly important for anyone interested in digital innovation, creative industries, or emerging technologies. This comprehensive guide explores the fundamental concepts behind non-fungible tokens, their practical applications, the technology that powers them, and what the future might hold for this groundbreaking digital innovation.

What Are NFTs and How Do They Work

Non-fungible tokens are unique digital certificates of ownership stored on a blockchain network. The term “non-fungible” simply means that each token is one-of-a-kind and cannot be exchanged on a one-to-one basis with another token, unlike fungible assets such as currency or cryptocurrency. Each NFT contains distinct information that makes it different from any other token, establishing its uniqueness and scarcity.

The technology behind these digital assets relies on blockchain technology, which serves as a decentralized digital ledger that records all transactions transparently and securely. When someone creates or “mints” an NFT, the blockchain records this creation along with details about the asset, its creator, and its ownership history. This creates an immutable record that anyone can verify, eliminating the possibility of counterfeiting or disputes over authenticity.

Smart contracts play a crucial role in how NFTs function. These self-executing programs written into the blockchain automatically enforce the terms and conditions associated with each token. For instance, a smart contract might ensure that the original creator receives a percentage of sales whenever their NFT is resold, providing ongoing revenue opportunities that traditional art sales cannot offer.

Most NFTs currently exist on the Ethereum blockchain, though other networks like Solana, Polygon, and Binance Smart Chain have also become popular platforms for minting and trading these digital assets. Each blockchain has its own characteristics regarding transaction speed, costs, and environmental impact, giving creators and collectors various options for engaging with NFT technology.

The Rise of Digital Art and Collectibles

The art world has experienced perhaps the most dramatic impact from NFT technology. Digital artists who previously struggled to monetize their work due to the ease of copying digital files now have a viable path to selling their creations as unique, verifiable assets. The sale of Beeple’s digital artwork “Everydays: The First 5000 Days” for sixty-nine million dollars at Christie’s auction house marked a watershed moment that brought mainstream attention to digital art ownership.

Beyond individual artworks, NFT collections have created entire communities around digital collectibles. Projects featuring thousands of unique characters or items, each with different traits and rarity levels, have attracted collectors who view these assets as both cultural artifacts and potential investments. The social aspect of owning pieces from popular collections has added a community-driven dimension to digital collecting that extends beyond mere financial speculation.

Digital collectibles range from profile pictures and avatar projects to virtual trading cards and animated creations. The scarcity embedded in these collections, often with preset limits on how many items exist, creates dynamics similar to traditional collectibles markets. However, the digital nature allows for innovative features like programmable rarity, interactive elements, and integration with other digital platforms and experiences.

The democratization of art creation and distribution represents another significant development. Artists from anywhere in the world can mint and sell their work without needing gallery representation or intermediaries. This direct connection between creators and collectors has opened opportunities for diverse voices and artistic styles that might have struggled to find audiences through traditional art market channels.

NFTs in Gaming and Virtual Worlds

The gaming industry has embraced NFT integration as a way to give players true ownership of in-game assets. Traditional video games grant players access to items, characters, or currency that remain under the game developer’s control. With NFTs, players can own these digital assets independently, potentially trading or selling them outside the game environment itself.

Play-to-earn models have emerged as a new gaming paradigm where players can earn NFTs or cryptocurrency through gameplay. This concept has gained particular traction in developing economies, where some players have turned gaming into a viable income source. Games built around this model create virtual economies where skill, strategy, and time investment translate into tangible value that players truly own.

Virtual worlds and metaverse platforms use NFTs to represent virtual real estate, wearable items for avatars, and other digital properties. Users who purchase virtual land parcels receive NFTs that prove their ownership, allowing them to develop, monetize, or resell these digital spaces. Fashion brands have begun creating virtual clothing and accessories as NFTs that avatars can wear across different platforms, creating new markets for digital fashion.

The interoperability potential of NFTs in gaming remains particularly exciting. Theoretically, assets minted as NFTs could work across multiple games and platforms, allowing players to use their digital items in different virtual environments. While technical and business challenges remain, this vision of portable digital assets represents a significant departure from the closed ecosystems that currently dominate gaming.

The NFT Marketplace

NFT marketplaces serve as the primary venues where these digital assets are bought, sold, and traded. Platforms like OpenSea, Rarible, and Foundation provide user-friendly interfaces that connect creators with collectors. Each marketplace has its own characteristics, fee structures, and community focus, catering to different segments of the NFT ecosystem.

The process of buying an NFT typically requires a digital wallet that holds cryptocurrency and connects to marketplace platforms. Prospective buyers browse available NFTs, place bids in auction-style listings, or purchase items at fixed prices. The blockchain records each transaction, updating the ownership record and providing both parties with transparent confirmation of the transfer.

Listing and selling NFTs involves several considerations for creators. They must choose which blockchain to use, set initial pricing or auction parameters, and determine whether to include royalties for future sales. Many platforms allow creators to add unlockable content that only reveals to the purchaser after the sale completes, adding extra value or exclusive materials for collectors.

Gas fees—the transaction costs associated with blockchain NFTs Explained operations—is essential for anyone engaging with NFTs. These fees fluctuate based on network congestion and can significantly impact the economics of buying or selling lower-priced items. Alternative blockchains with lower transaction costs have emerged partly in response to the high fees sometimes seen on Ethereum, offering more accessible options for newcomers.

Also Read: SKALE Elastic Sidechains Explained Simply: Your Complete Guide to Scalable Blockchain Solutions

Environmental Concerns and Solutions

The environmental impact of NFTs has sparked considerable debate within the technology and art communities. The energy consumption of proof-of-work blockchain systems, which require intensive computational processes to validate transactions, raises legitimate concerns about the carbon footprint of minting and trading digital assets. Critics argue that the environmental cost of creating a single NFT can be substantial, particularly on energy-intensive networks.

However, the conversation has evolved significantly as blockchain technology advances. Ethereum’s transition to a proof-of-stake consensus mechanism has dramatically reduced the network’s energy consumption by approximately ninety-nine percent. This shift addresses one of the most significant criticisms of NFTs while maintaining the security and functionality that makes the technology valuable.

Alternative blockchains designed with energy efficiency in mind offer creators environmentally conscious options for minting NFTs. Networks like Tezos and Flow were built using less energy-intensive consensus mechanisms from the start, providing viable platforms for creators and collectors concerned about environmental impact. These options demonstrate that NFT technology and environmental responsibility need not be mutually exclusive.

Carbon offset programs have also emerged within the NFT space, with some platforms and projects purchasing carbon credits to neutralize the environmental impact of their operations. While debates continue about the effectiveness of various offset approaches, these efforts reflect growing awareness and commitment to addressing environmental concerns within the community.

The Future of Non-Fungible Tokens

The future of NFTs extends far beyond art and collectibles into practical applications across numerous industries. Musicians are exploring NFTs as a way to distribute music, sell concert tickets, and create closer connections with fans. Authors and publishers are considering how these tokens might revolutionize book publishing and intellectual property rights. Even real estate transactions might eventually incorporate NFT technology for property deeds and ownership records.

Digital identity represents another promising application area. NFTs could serve as verifiable credentials for education, professional certifications, or membership in organizations. The immutable nature of blockchain records makes these digital certificates difficult to forge, potentially reducing fraud in credential verification while giving individuals greater control over their personal information.

Integration with physical assets bridges the digital and physical worlds. Luxury brands are attaching NFTs to physical products as certificates of authenticity, creating digital twins that prove provenance and combat counterfeiting. This hybrid approach combines the tangible satisfaction of physical ownership with the verifiable security that blockchain technology provides.

Regulatory frameworks for NFTs continue to evolve as governments and financial authorities work to understand and classify these digital assets. Questions about taxation, securities laws, and consumer protection remain subjects of ongoing development. Clear regulations could provide stability and legitimacy that encourage broader adoption while protecting participants in NFT markets.

Conclusion

Non-fungible tokens have emerged as a transformative technology that challenges traditional notions of ownership, value, and authenticity in the digital age. From revolutionizing how artists monetize their work to creating new gaming economies and virtual worlds, NFTs demonstrate the potential of blockchain technology to reshape numerous aspects of our increasingly digital lives.

While challenges remain—including environmental concerns, market volatility, and regulatory uncertainty—the ongoing evolution of NFT technology addresses many initial criticisms. The shift to more energy-efficient blockchain systems, the development of more sophisticated use cases beyond speculation, and growing mainstream acceptance suggest that these digital assets will continue playing a significant role in the digital economy.

Whether NFTs represent a passing trend or a fundamental shift in digital ownership remains a subject of debate. However, the technology’s ability to solve real problems around digital authenticity, creator compensation, and verifiable ownership indicates that the concepts behind NFTs will likely influence digital commerce and creative industries for years to come. These digital assets and their implications have become increasingly important for anyone navigating the evolving landscape of technology, art, and digital culture.

FAQs

Q: Are NFTs a good investment?

NFTs should be approached with caution as investments. The market can be highly volatile, with values fluctuating dramatically based on trends, hype, and collector interest. While some NFTs have sold for substantial amounts, many lose value over time. If you’re considering purchasing NFTs as investments, only spend what you can afford to lose, and research thoroughly.

Q: Can NFTs be copied or stolen?

The actual NFT token itself, which represents ownership, cannot be copied due to blockchain technology. However, the underlying digital file (like an image) can technically be copied or viewed by anyone. The NFT provides proof of ownership and authenticity, not exclusive viewing rights.

Q: What do I need to buy or create an NFT?

To purchase NFTs, you’ll need a digital wallet that supports cryptocurrency, typically Ethereum, though requirements vary by blockchain. Popular wallet options include MetaMask, Coinbase Wallet, and Trust Wallet. You’ll need to fund your wallet with the appropriate cryptocurrency to cover both the NFT purchase price and transaction fees.

Q: How do creators make money from NFTs?

Creators earn money from NFTs through initial sales when they first mint and sell their digital assets. Additionally, smart contracts can include royalty provisions that automatically pay the original creator a percentage each time their NFT is resold in secondary markets.

Q: What happens to my NFT if the marketplace shuts down?

Your ownership of the NFT itself remains secure on the blockchain even if a marketplace closes. The blockchain record of your ownership exists independently of any particular platform. However, if the NFT’s associated digital file was hosted by the marketplace or on centralized servers rather than decentralized storage systems like IPFS, you might lose access to viewing or displaying the file.