$1.06 Billion Signal Ethereum Just Flashed a Major Market Clue the cryptocurrency market thrives on signals, momentum, and capital flows, and few assets command as much attention as Ethereum. In recent days, a staggering $1.06 billion movement associated with Ethereum has captured the attention of traders, analysts, and long-term investors alike. This sudden surge is not merely a number on a chart; it represents a critical market signal that may hint at Ethereum’s next major direction. As the second-largest cryptocurrency by market capitalization, Ethereum often acts as a bellwether for the broader digital asset ecosystem, influencing sentiment across decentralized finance, NFTs, and emerging blockchain innovations.

Understanding what this $1.06 billion signal truly represents requires a deeper look into market behavior, on-chain data, and the broader macroeconomic context shaping crypto markets today. Ethereum has evolved far beyond being just a smart contract platform. It now sits at the intersection of blockchain innovation, decentralized finance, and institutional adoption. When large amounts of capital move rapidly in or out of Ethereum, it often reflects shifts in confidence, strategy, and expectations among sophisticated market participants.

We will explores the meaning behind Ethereum’s recent $1.06 billion market signal, why it matters right now, and how it could shape price action and sentiment in the coming weeks. By examining on-chain metrics, market psychology, and historical precedents, we can better understand whether this moment marks a turning point, a warning sign, or the early stages of a larger trend.

$1.06 Billion Signal Ethereum

The $1.06 billion figure represents a rapid and concentrated movement of capital tied to Ethereum within a short period. Such movements are rarely random. In crypto markets, large capital flows often come from institutional investors, large funds, or coordinated activity by whales who possess significant influence over price dynamics. When Ethereum experiences this scale of movement, it sends a message to the market that something meaningful is unfolding beneath the surface.

This signal becomes even more important when viewed through the lens of on-chain analytics. Blockchain data allows analysts to track large transactions, exchange inflows and outflows, and changes in wallet behavior. A sudden spike in capital movement can indicate accumulation, distribution, or repositioning ahead of a major market event. Ethereum’s transparent ledger makes it possible to observe these changes in near real time, offering clues that traditional markets often obscure.

In this case, the speed and size of the $1.06 billion movement suggest heightened conviction. Whether bullish or cautious, such conviction tends to precede volatility. Ethereum has historically responded to similar signals with decisive price action, making this moment particularly significant for traders seeking to anticipate the next move.

Ethereum Commands Market Attention

Ethereum occupies a unique position in the crypto ecosystem. Unlike many digital assets that rely primarily on speculation, Ethereum underpins a vast network of applications and protocols. Smart contracts, decentralized exchanges, lending platforms, and NFT marketplaces all rely on Ethereum’s infrastructure. This utility gives Ethereum intrinsic value beyond simple price appreciation.

When Ethereum flashes a major market signal, it resonates across multiple sectors. DeFi protocols may see shifts in liquidity, NFT activity can fluctuate, and layer-two scaling solutions often experience changes in usage. This interconnectedness amplifies the impact of large capital movements, making Ethereum’s signals especially powerful.

Additionally, Ethereum’s ongoing evolution, including upgrades focused on scalability and efficiency, continues to attract long-term investors. These participants are less concerned with short-term price noise and more focused on structural growth. A $1.06 billion movement suggests that these investors may be adjusting positions based on new information or expectations, further reinforcing the importance of the signal.

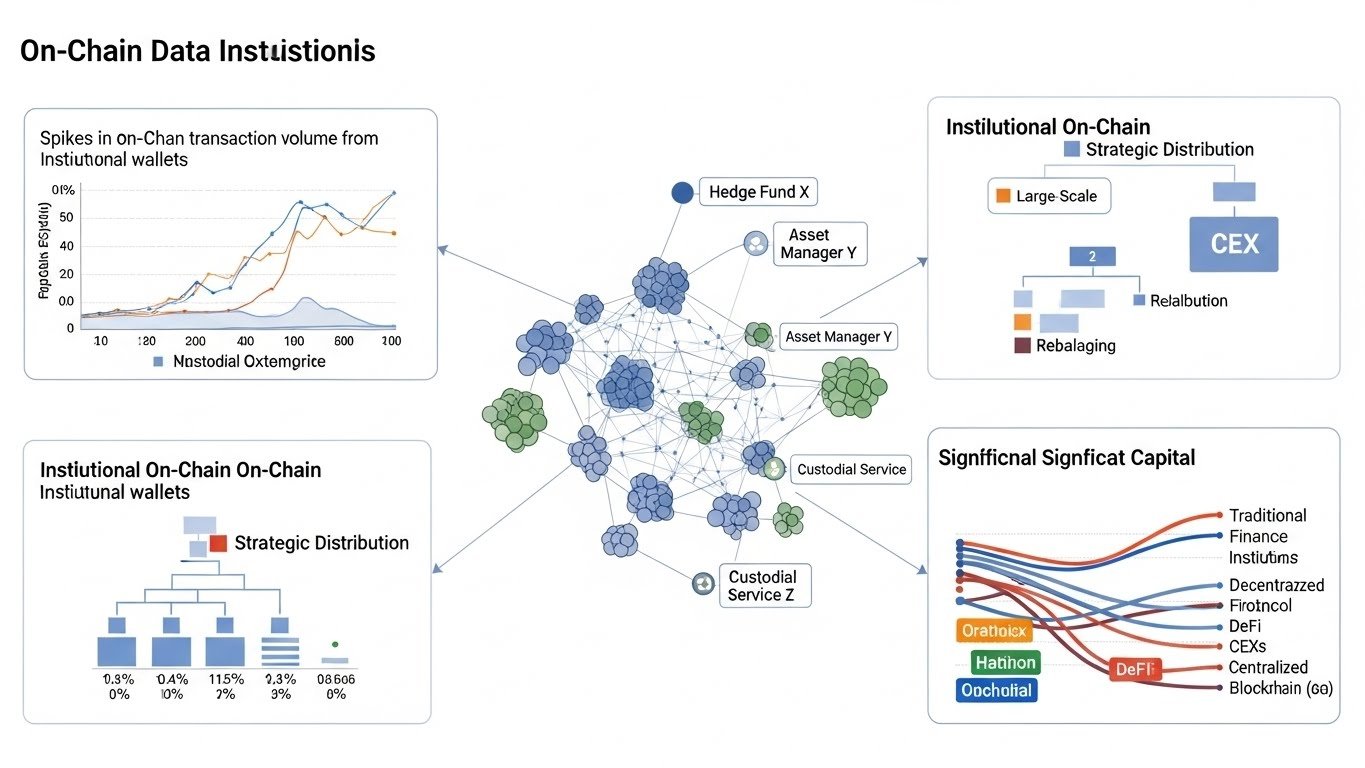

On-Chain Data and Institutional Behavior

One of the most compelling aspects of Ethereum’s recent activity is how closely it aligns with institutional behavior. Large transactions, often measured in tens or hundreds of millions, typically point to professional investors rather than retail traders. These institutions rely heavily on on-chain metrics to inform decisions, analyzing wallet activity, staking levels, and network usage.

The $1.06 billion signal may reflect a shift in how institutions perceive Ethereum’s near-term outlook. Increased inflows to cold storage wallets often suggest accumulation, while spikes in exchange deposits can indicate preparation for selling or hedging. Without speculating on a single motive, the sheer scale of the movement underscores heightened engagement from major players.

Institutional interest in Ethereum has grown steadily as regulatory clarity improves and financial products tied to digital assets gain acceptance. This growing legitimacy means that Ethereum’s market signals increasingly resemble those seen in traditional finance, where large capital flows often precede trend changes.

Market Psychology Behind Large Capital Movements

Markets are driven not only by fundamentals but also by psychology. When traders observe a $1.06 billion movement tied to Ethereum, it naturally influences sentiment. Fear of missing out, caution about potential corrections, and renewed confidence all emerge simultaneously, creating a complex emotional landscape.

Ethereum’s market signal can act as a catalyst for self-reinforcing behavior. If traders interpret the movement as bullish accumulation, buying pressure may increase, pushing prices higher. Conversely, if it is seen as distribution, caution may dominate, leading to short-term pullbacks. This psychological feedback loop is a defining characteristic of crypto markets, where information spreads rapidly and sentiment can shift within hours.

Understanding this dynamic is essential for interpreting Ethereum’s signal accurately. The market often reacts not just to what happened, but to what participants believe will happen next. In this sense, the $1.06 billion figure becomes a narrative driver as much as a statistical measure.

Historical Context of Ethereum Market Signals

Ethereum has flashed similar signals at key moments in its history. Past instances of large capital movements have often preceded significant price trends, both upward and downward. During periods of accumulation before major rallies, on-chain data frequently showed substantial inflows to long-term wallets. In contrast, before notable corrections, spikes in exchange activity hinted at profit-taking.

Comparing the current $1.06 billion movement to historical patterns provides valuable perspective. While no two market cycles are identical, recurring behaviors offer clues. Ethereum’s resilience through multiple cycles has reinforced its reputation as a long-term asset, making its signals particularly relevant for investors seeking to distinguish noise from meaningful trends.

This historical lens also highlights Ethereum’s maturation. Early market signals were often driven by speculative mania, whereas recent ones increasingly reflect strategic positioning by sophisticated participants. This evolution adds weight to the current signal and its potential implications.

The Role of Ethereum in the Broader Crypto Market

Ethereum’s influence extends beyond its own price chart. As a foundational platform for decentralized applications, Ethereum’s health directly affects the broader crypto market. When Ethereum experiences major capital movements, related assets often respond in tandem.

Layer-two solutions, staking derivatives, and DeFi tokens frequently mirror Ethereum’s momentum. A strong signal from Ethereum can boost confidence across these sectors, while a cautious signal may lead to widespread consolidation. This interconnected response amplifies the importance of understanding what Ethereum’s $1.06 billion movement signifies.

Moreover, Ethereum often acts as a bridge between Bitcoin and alternative cryptocurrencies. When capital rotates from Bitcoin into Ethereum, it can signal a broader shift toward higher-risk assets. Conversely, when Ethereum underperforms, it may indicate a defensive stance among investors. The current signal thus provides insight not only into Ethereum itself but also into overall market risk appetite.

Price Action and Technical Implications

From a technical analysis perspective, large capital movements often coincide with critical price levels. Ethereum’s recent activity may be occurring near support or resistance zones that traders closely monitor. The interaction between on-chain signals and technical indicators can strengthen the case for a potential breakout or breakdown.

Volume plays a crucial role in validating price moves. A $1.06 billion signal accompanied by increased trading volume suggests genuine conviction rather than temporary volatility. Technical traders often look for such confirmation before committing to positions, making this moment particularly noteworthy.

While technical analysis alone cannot predict outcomes, it provides a framework for interpreting market reactions. Combined with on-chain data and macro context, it helps form a more complete picture of what Ethereum’s signal may imply.

Macroeconomic Factors Influencing Ethereum

Ethereum does not exist in isolation. Global economic conditions, interest rates, and risk sentiment all influence crypto markets. Recent shifts in monetary policy expectations and investor attitudes toward risk assets have created a complex backdrop for Ethereum’s movement.

A large capital flow like $1.06 billion may reflect macro-driven repositioning. Investors could be adjusting exposure in response to inflation data, currency movements, or broader market volatility. Ethereum’s appeal as a technology-driven asset with long-term potential makes it particularly sensitive to these factors.

Understanding this macro context is essential for interpreting Ethereum’s signal accurately. It reminds investors that while on-chain data offers valuable insights, external forces often shape how those insights translate into price action.

Long-Term Implications for Ethereum Holders

For long-term Ethereum holders, the $1.06 billion signal serves as a reminder of the asset’s dynamic nature. Ethereum continues to evolve, attracting new users, developers, and investors. Large capital movements reflect this ongoing transformation and the shifting expectations that accompany it.

Rather than focusing solely on short-term price fluctuations, long-term participants often view such signals as checkpoints. They prompt reassessment of investment theses, risk management strategies, and portfolio allocation. Ethereum’s ability to attract significant capital even during uncertain conditions reinforces its status as a cornerstone of the crypto ecosystem.

This perspective highlights why Ethereum’s market signals matter beyond immediate trading opportunities. They offer insight into the network’s health, adoption trajectory, and role in shaping the future of decentralized technology.

Conclusion

Ethereum’s recent $1.06 billion market signal is more than a headline-grabbing statistic. It represents a convergence of capital, conviction, and anticipation at a pivotal moment for the crypto market. By examining on-chain data, market psychology, historical patterns, and macroeconomic influences, we gain a clearer understanding of why this signal matters and what it could mean moving forward.

While no single metric can predict the future with certainty, Ethereum’s ability to attract and move such significant capital underscores its enduring relevance. Whether this signal marks the beginning of a new trend or a period of consolidation, it highlights the importance of staying informed and analytical in a rapidly evolving market. For investors and enthusiasts alike, Ethereum’s flashing signal serves as both an opportunity and a reminder of the complexity that defines the world of digital assets.

FAQs

Q: What does the $1.06 billion Ethereum market signal actually indicate?

The $1.06 billion signal reflects a rapid and significant movement of capital tied to Ethereum within a short timeframe. Such a large shift often suggests heightened activity from institutional investors or major holders who are repositioning based on expectations of future market conditions. While it does not guarantee a specific price outcome, it typically signals increased volatility and growing market interest.

Q: Why are large Ethereum capital movements considered important by analysts?

Large capital movements stand out because they usually involve sophisticated participants rather than retail traders. Analysts track these movements using on-chain data to understand whether Ethereum is being accumulated for long-term holding or prepared for distribution. This insight helps interpret broader market sentiment and potential upcoming trends.

Q: How does Ethereum’s market signal affect the rest of the crypto ecosystem?

Ethereum plays a central role in decentralized finance and blockchain applications, so major signals often ripple across the market. When Ethereum experiences strong capital flows, related assets such as DeFi tokens and layer-two solutions may also see increased activity. This interconnected response makes Ethereum’s signals relevant beyond its own price.

Q: Can Ethereum’s $1.06 billion signal predict future price movements?

While the signal provides valuable context, it cannot predict price movements with certainty. It should be viewed alongside other factors such as technical analysis, macroeconomic conditions, and overall market sentiment. Together, these elements help form a more balanced and informed outlook.

Q: What should long-term Ethereum investors take away from this signal?

Long-term investors often see such signals as moments to reassess their strategy rather than react impulsively. The ability of Ethereum to attract significant capital reinforces its long-term relevance, but it also highlights the importance of patience, research, and risk management in navigating market cycles.