Global FinTech deals over $100M surge driving funding higher in 2026, marking a defining moment for the financial technology industry. After years of market corrections, valuation resets, and cautious capital deployment, 2026 is shaping up to be a year where conviction returns at scale. Investors are no longer simply testing exposure to fintech; they are committing substantial capital to companies they believe will define the next generation of global financial infrastructure.

This surge in mega-deals is not driven by speculation alone. It reflects a deeper transformation in how financial services are built, delivered, and consumed worldwide. Fintech has evolved from a disruptive alternative into a foundational layer supporting payments, lending, compliance, identity, and data intelligence across economies. As a result, capital concentration is increasing, and large funding rounds are becoming a signal of market leadership rather than excess.

Global FinTech deals over $100M surge, pushing funding higher in 2026 because investors are prioritizing resilience, scale, and long-term profitability. This article explores what is fueling this momentum, how it differs from previous funding cycles, and what it means for fintech companies, investors, and the global financial system as a whole.

Global FinTech Deals Over $100M

The fintech sector has experienced multiple phases of growth, correction, and consolidation. What makes 2026 different is the clarity that has emerged around viable business models. Investors are no longer betting on abstract disruption but on companies that have proven they can operate profitably within complex regulatory and economic environments.

Global FinTech deals over $100M surge, pushing funding higher in 2026 because the industry has matured. Many fintech firms that were once startups are now established enterprises with global footprints, diversified revenue streams, and strong governance structures. These characteristics make them suitable for large institutional investments that require scale and predictability.

This turning point also reflects a shift in investor mindset. Instead of fearing macroeconomic uncertainty, investors are leveraging it to identify fintech companies that can thrive under pressure. Those that survived earlier downturns are now seen as durable, making them natural candidates for large funding rounds.

Investor Behavior and the Rise of High-Conviction Capital

One of the clearest drivers behind the surge is the rise of high-conviction investing. Venture capital, private equity, and sovereign funds are increasingly selective, focusing on fewer deals with larger check sizes. This approach reduces portfolio risk while increasing exposure to category leaders.

Global FinTech deals over $100M surge, pushing funding higher in 2026 as institutional capital flows into fintech at unprecedented levels. These investors are attracted by fintech’s ability to generate recurring revenue, scale efficiently, and embed itself deeply into everyday economic activity. Unlike consumer apps or speculative technologies, fintech services remain essential regardless of market conditions.

This behavior signals confidence not only in individual companies but in fintech as a long-term asset class. Large deals are becoming a vote of confidence in the sector’s enduring relevance.

The Macroeconomic Environment Supporting Mega-Deals

Macroeconomic stability plays a critical role in enabling large investments. By 2026, many global economies have adjusted to higher interest rate regimes, inflation expectations have moderated, and capital markets have regained balance. This environment encourages investors to deploy capital strategically rather than defensively.

Global FinTech deals over $100M surge, pushing funding higher in 2026 because fintech sits at the intersection of technology and essential services. Payments, credit, and financial data management remain critical even during economic slowdowns. This makes fintech more resilient than many other technology sectors.

Additionally, improved exit visibility through public markets and acquisitions has restored confidence. Investors are more willing to fund large rounds when they see realistic pathways to liquidity.

Regional Dynamics Shaping FinTech Mega-Deals

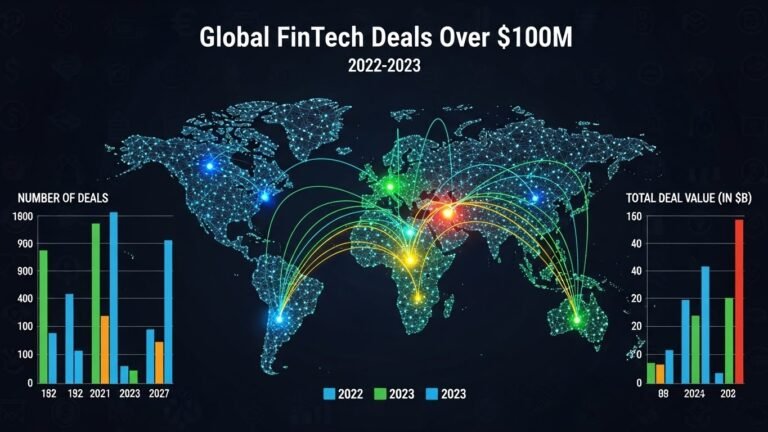

The surge in large fintech deals is a global phenomenon, but regional dynamics add important nuance. North America continues to lead in total funding volume, driven by deep capital pools and mature fintech ecosystems. However, Europe and Asia are rapidly closing the gap.

Global FinTech deals over $100M surge, pushing funding higher in 2026 as European fintech firms benefit from regulatory standardization and cross-border scalability. In Asia, massive digital adoption and innovation in payments and super-app ecosystems are attracting substantial investment.

Emerging markets also play a growing role. Fintech companies addressing financial inclusion, remittances, and mobile banking in Africa and Latin America are securing larger rounds as their impact and scalability become undeniable. These regional trends collectively reinforce the global funding surge.

FinTech Segments Attracting the Largest Investments

Not all fintech segments are benefiting equally from this surge. Capital is flowing disproportionately into areas that combine high demand with strong defensibility. Payments infrastructure, digital banking platforms, and financial data services are among the top beneficiaries.

Global FinTech deals over $100M surge, pushing funding higher in 2026 as embedded finance continues to expand. Companies that enable financial services to be integrated into non-financial platforms are becoming indispensable partners across industries. This embedded nature increases switching costs and strengthens long-term revenue visibility.

Risk management, compliance technology, and AI-driven financial analytics are also attracting significant funding. These segments address regulatory complexity and operational efficiency, making them essential for both fintech and traditional financial institutions.

The Role of Technology in Driving Larger Deal Sizes

Technological sophistication is another key factor behind the rise in mega-deals. Fintech companies that leverage artificial intelligence, machine learning, and advanced analytics are able to offer differentiated products and scale more efficiently.

Global FinTech deals over $100M surge, pushing funding higher in 2026 because investors are willing to back platforms with proprietary technology and defensible intellectual property. AI-powered fraud detection, personalized financial services, and automated compliance systems are particularly attractive due to their direct impact on cost reduction and risk mitigation.

Technology is no longer just an enabler but a core value driver. Companies that demonstrate technological leadership are rewarded with larger funding rounds and higher valuations.

Regulatory Maturity and Investor Confidence

Regulation has historically been a source of uncertainty for fintech. By 2026, many jurisdictions have made significant progress in establishing clear and consistent regulatory frameworks. This clarity reduces risk and encourages larger investments.

Global FinTech deals over $100M surge, pushing funding higher in 2026 as regulators and innovators find better alignment. Fintech companies that proactively engage with regulators and build compliance into their platforms are seen as safer long-term bets.

This regulatory maturity also facilitates cross-border expansion, enabling fintech firms to scale globally without constant structural adjustments. As a result, investors are more comfortable committing large amounts of capital.

Consolidation and the Strategic Use of Capital

Another defining feature of 2026 is consolidation. Large funding rounds are often used to finance acquisitions, expand into new markets, or invest in infrastructure. This strategic use of capital strengthens market leaders and accelerates industry consolidation.

Global FinTech deals over $100M surge, pushing funding higher in 2026 because companies are racing to secure dominant positions. Acquiring complementary technologies or regional competitors allows fintech firms to grow faster and more efficiently than organic expansion alone.

This consolidation benefits investors by reducing fragmentation and increasing the likelihood of sustainable returns.

Implications for Early-Stage FinTech Startups

While mega-deals dominate headlines, their impact extends to early-stage startups. The concentration of capital raises the bar for new entrants, who must demonstrate clear differentiation and scalability.

However, Global FinTech deals over $100M surge, pushing funding higher in 2026 also creates opportunities. Well-funded market leaders often acquire innovative startups to accelerate product development or enter new markets. This creates viable exit paths and encourages focused innovation.

For founders, the message is clear: building robust, compliant, and scalable solutions is essential in an environment where quality is prioritized over quantity.

How 2026 Differs From Previous FinTech Booms

Earlier fintech booms were often driven by rapid user growth and aggressive expansion, sometimes at the expense of profitability. The 2026 surge is different. Investors now emphasize sustainable margins, operational discipline, and long-term value creation.

Global FinTech deals over $100M surge, pushing funding higher in 2026 because lessons from past cycles have been internalized. Valuations are more grounded, due diligence is more rigorous, and expectations are clearer.

This disciplined approach reduces the risk of bubbles and supports a healthier, more resilient fintech ecosystem.

Long-Term Outlook for FinTech Funding

Looking beyond 2026, the factors driving large fintech deals are likely to persist. Digital finance continues to replace legacy systems, and new technologies will create additional opportunities for innovation.

Global FinTech deals over $100M surge, pushing funding higher in 2026 may represent a new baseline rather than a peak. As fintech becomes increasingly embedded in global commerce, large-scale funding is expected to remain a defining feature of the sector.

Future growth will depend on execution, adaptability, and the ability to navigate evolving regulatory and economic landscapes.

Conclusion

Global FinTech deals over $100M surge, pushing funding higher in 2026 because the industry has reached a new level of maturity and strategic importance. Investors are no longer chasing speculative disruption but are backing companies that form the backbone of modern financial systems. This shift toward high-conviction, large-scale investment reflects confidence in fintech’s long-term role in the global economy.

As capital concentrates in resilient, scalable platforms, the fintech landscape will continue to evolve through consolidation, innovation, and deeper integration into everyday life. While challenges remain, the surge in mega-deals signals a future where fintech is not just an alternative to traditional finance but a central pillar of it.

FAQs

Q: Why are Global FinTech deals over $100M surging in 2026?

Global FinTech deals over $100M are surging in 2026 due to increased investor confidence, clearer regulatory frameworks, and a focus on fintech companies with proven scalability, profitability, and long-term relevance.

Q: Does higher funding in mega-deals mean less innovation in fintech?

Higher funding concentration does not reduce innovation but changes its structure. Early-stage innovation continues, often supported by the prospect of acquisition by well-funded fintech leaders.

Q: Which regions are driving the largest fintech deals in 2026?

North America leads in total deal value, while Europe, Asia, and emerging markets are contributing significantly through scalable platforms focused on payments, digital banking, and financial inclusion.

Q: How does technology influence large fintech funding rounds?

Advanced technology such as artificial intelligence, data analytics, and automation increases efficiency and defensibility, making fintech companies more attractive for large investments.

Q: Is the surge in fintech mega-deals likely to continue after 2026?

While market conditions can evolve, the structural role of fintech in global finance suggests that strong funding activity, especially in large deals, is likely to continue beyond 2026.