FinTech Futures Top Five News Stories Shaping the Week the fintech sector continues to evolve at remarkable speed, and the week ending 16 January 2026 has delivered a powerful snapshot of where digital finance is heading. From regulatory recalibration and artificial intelligence in banking to payments innovation and the maturing crypto landscape, the stories dominating headlines this week reveal an industry balancing innovation with responsibility. FinTech Futures has once again brought together the most influential developments shaping the global financial technology ecosystem.

This week’s top stories reflect a broader transition underway across financial services. Fintech firms are no longer operating at the edges of the financial system. Instead, they are becoming deeply integrated into mainstream banking, payments, lending, and wealth management. As a result, the conversations dominating fintech news are increasingly about scale, governance, resilience, and long-term value rather than pure disruption.

In this comprehensive FinTech Futures weekly roundup, we explore the top five fintech news stories of the week ending 16 January 2026. Each story highlights a critical trend influencing how financial services are built, regulated, and consumed. Together, they offer valuable insight into the direction fintech is taking and what industry participants should be watching closely.

Regulation Tightens as Fintech Enters a New Maturity Phase

Policymakers Refocus on Consumer Protection

One of the most significant fintech news themes this week is the renewed focus on regulation as digital finance becomes increasingly mainstream. Regulators across major financial markets are refining frameworks designed to protect consumers while allowing innovation to continue. Rather than blanket restrictions, policymakers are moving toward more targeted oversight that addresses specific risks associated with digital lending, embedded finance, and cross-border payments.

This regulatory recalibration reflects recognition that fintech is no longer experimental. Millions of consumers rely on fintech platforms for everyday financial needs, making stability and transparency essential. The latest regulatory discussions emphasize clearer disclosure standards, stronger governance requirements, and accountability for firms operating at scale. These developments mark a shift from reactive enforcement to proactive rulemaking.

What This Means for Fintech Companies

For fintech firms, this evolving regulatory environment presents both challenges and opportunities. Compliance costs may increase, but clearer rules also reduce uncertainty and can encourage institutional participation. Companies that invest early in robust compliance frameworks are likely to gain a competitive advantage as trust becomes a key differentiator.

From a FinTech Futures perspective, regulation is no longer viewed as a brake on innovation but as an enabler of sustainable growth. This week’s news underscores that fintech’s next chapter will be defined as much by governance as by technology.

Artificial Intelligence Accelerates Digital Banking Transformation

AI Moves From Experimentation to Core Infrastructure

Artificial intelligence has been a recurring theme in fintech news, but this week marked a notable shift in how AI is being positioned within financial services. Banks and fintech providers are increasingly embedding AI into core operations rather than treating it as an experimental add-on. Use cases ranging from fraud detection and credit assessment to personalized financial advice are becoming more sophisticated and widespread.

This transition reflects growing confidence in AI’s ability to deliver measurable value. Advances in machine learning models and data processing capabilities have made AI tools more accurate and scalable. As a result, AI is now central to improving efficiency, reducing risk, and enhancing customer experience across digital banking platforms.

Balancing Innovation With Ethical Considerations

Alongside this acceleration, ethical considerations are gaining prominence. Transparency, bias mitigation, and explainability are becoming essential requirements as AI systems influence financial decisions. Regulators and industry leaders alike are emphasizing the importance of responsible AI deployment.

This week’s FinTech Futures coverage highlights that AI adoption in fintech is no longer just about technological capability. It is equally about trust, accountability, and aligning innovation with societal expectations.

Payments Innovation Reshapes Global Commerce

Real-Time Payments Gain Momentum

Payments innovation remains a cornerstone of fintech evolution, and this week’s news reinforces the rapid shift toward real-time and frictionless transactions. Consumers and businesses increasingly expect instant settlement, seamless cross-border transfers, and integrated payment experiences.

Fintech providers are responding by expanding real-time payment capabilities and improving interoperability between systems. These developments are reshaping how money moves globally, reducing reliance on legacy infrastructure and lowering transaction costs.

Embedded Payments Become the Norm

Another key payments trend highlighted this week is the continued rise of embedded payments. Financial transactions are being woven directly into non-financial platforms, from e-commerce and ride-sharing to enterprise software. This integration blurs the line between financial services and everyday digital experiences.

For fintech firms, embedded payments represent a powerful growth avenue. For consumers, they offer convenience and speed. FinTech Futures notes that this shift is transforming payments from a standalone service into an invisible yet essential layer of digital commerce.

Crypto and Digital Assets Enter a Consolidation Phase

From Volatility to Infrastructure Building

Crypto and digital assets featured prominently in fintech news this week, but the tone has shifted from speculation to consolidation. The industry is increasingly focused on infrastructure, compliance, and real-world utility rather than rapid price movements. This maturation reflects lessons learned from earlier cycles and growing institutional involvement.

Key discussions center on custody solutions, settlement efficiency, and integration with traditional financial systems. As digital assets become more regulated and standardized, they are gradually finding a stable role within the broader fintech ecosystem.

Institutional Confidence and Cautious Optimism

Institutional participation in digital assets continues to grow, albeit cautiously. Financial institutions are prioritizing risk management and regulatory alignment as they explore blockchain-based solutions. This measured approach contrasts with the exuberance of previous years but signals long-term confidence in the technology’s potential.

FinTech Futures highlights that crypto’s evolution into a more infrastructure-focused sector could ultimately strengthen its position within global finance, even if near-term growth appears more restrained.

Embedded Finance Redefines Business Models

Financial Services Everywhere

Embedded finance has emerged as one of the most transformative fintech trends, and this week’s news underscores its expanding influence. Businesses across industries are integrating financial services directly into their platforms, offering payments, lending, and insurance without requiring users to leave the ecosystem.

This shift changes how financial products are distributed and consumed. Instead of standalone applications, financial services become contextual and on-demand. For fintech providers, this creates opportunities to partner with non-financial brands and reach new customer segments.

Implications for Traditional Banks

Traditional banks are responding by rethinking their role in the value chain. Rather than competing directly with embedded finance providers, many are positioning themselves as infrastructure partners. This collaboration-driven approach reflects a broader reconfiguration of the financial services landscape.

According to FinTech Futures analysis, embedded finance is not a passing trend but a structural shift that will continue to influence fintech strategy in the years ahead.

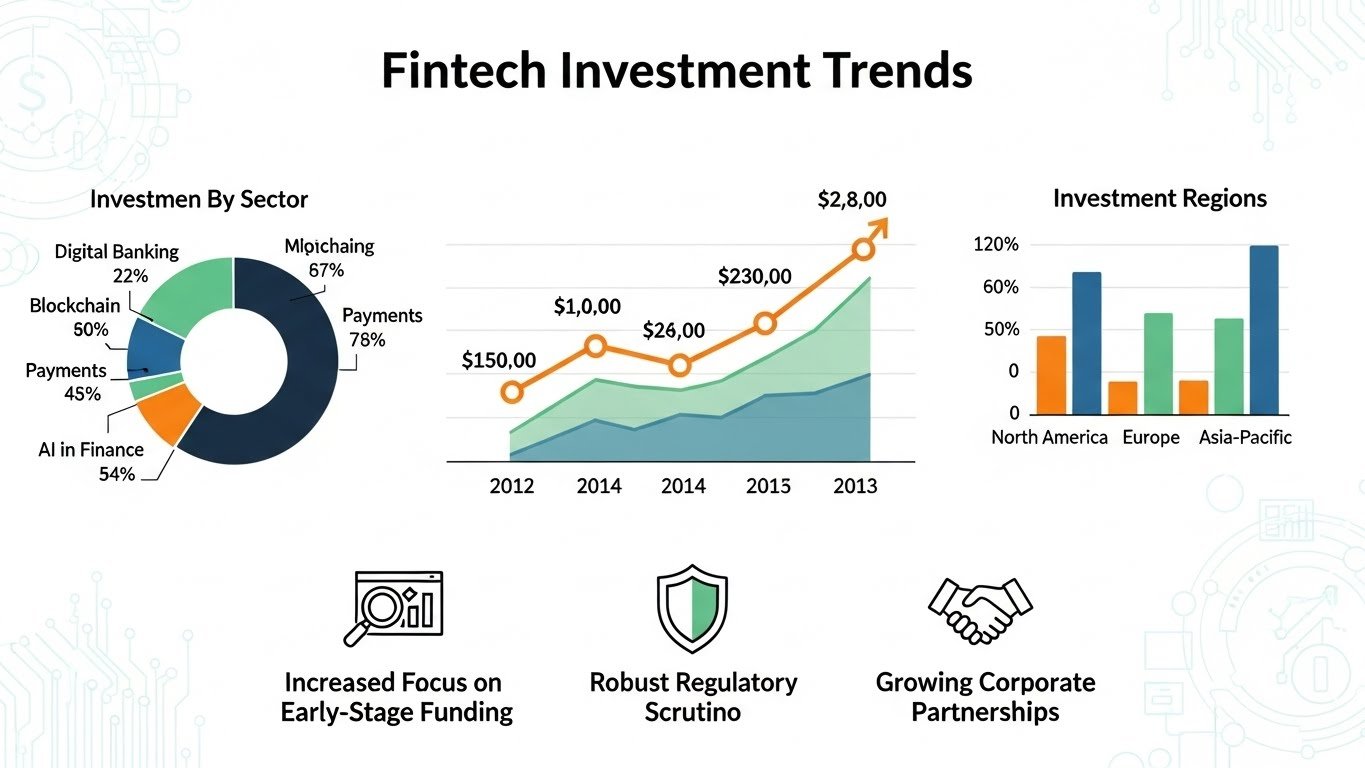

Fintech Investment Trends Show Selective Optimism

Capital Flows Become More Disciplined

Investment activity in fintech this week reflects a more disciplined approach compared to previous years. Investors are prioritizing sustainable business models, clear paths to profitability, and strong governance. While funding continues to flow into promising areas, it is increasingly selective.

This environment favors fintech companies with proven traction and differentiated offerings. Early-stage experimentation still exists, but the bar for investment has risen. FinTech Futures notes that this shift is helping to professionalize the sector and reduce excess.

Strategic Mergers and Partnerships

Alongside funding, strategic mergers and partnerships are gaining attention. Rather than pursuing rapid expansion independently, fintech firms are collaborating to accelerate growth and expand capabilities. These partnerships often focus on combining technology, distribution, and regulatory expertise.

This trend reflects a maturing market where scale and integration matter as much as innovation. It also highlights how fintech is becoming an integral part of the broader financial ecosystem.

The Bigger Picture for Fintech in 2026

Innovation With Accountability

Taken together, the top fintech news stories of the week ending 16 January 2026 point to an industry entering a new phase. Innovation remains central, but it is increasingly accompanied by accountability, regulation, and long-term thinking. Fintech is no longer defined solely by disruption but by its ability to deliver reliable, inclusive, and secure financial services.

This evolution benefits consumers, businesses, and the financial system as a whole. As fintech becomes embedded in everyday life, its success will depend on trust and resilience as much as technological prowess.

What to Watch in the Coming Weeks

Looking ahead, themes such as regulatory clarity, AI governance, payments infrastructure, and embedded finance are likely to remain in focus. How fintech companies navigate these areas will shape their competitive position and influence the broader financial landscape.

FinTech Futures will continue to track these developments, offering insight into how technology and finance intersect in an increasingly digital world.

Conclusion

The FinTech Futures top five news stories of the week ending 16 January 2026 capture an industry in transition. Regulation is becoming more refined, artificial intelligence is moving into the core of banking, payments innovation is reshaping commerce, digital assets are consolidating, and embedded finance is redefining how financial services are delivered.

Together, these stories illustrate fintech’s growing maturity and its expanding role within global finance. While challenges remain, the direction is clear. Fintech is evolving from a disruptive force into a foundational pillar of the modern financial system, and the developments of this week offer a compelling glimpse into that future.

FAQs

Q: Why is regulation such a dominant theme in fintech news this week?

Regulation is prominent because fintech has reached a level of scale where consumer protection and financial stability are critical. Policymakers are refining rules to support innovation while ensuring trust and accountability across digital financial services.

Q: How is artificial intelligence changing digital banking in 2026?

Artificial intelligence is moving from experimentation into core banking infrastructure. It is being used to enhance fraud prevention, personalize customer experiences, and improve operational efficiency, while raising important questions about ethics and transparency.

Q: What makes payments innovation so important for fintech growth?

Payments innovation drives convenience, speed, and global connectivity. Real-time and embedded payments are transforming how businesses and consumers transact, making payments a central pillar of fintech expansion.

Q: Is the crypto sector losing relevance in fintech?

Crypto is not losing relevance but entering a consolidation phase. The focus is shifting toward infrastructure, compliance, and real-world use cases, which may result in slower but more sustainable growth.

Q: How does embedded finance impact traditional financial institutions?

Embedded finance changes distribution models for financial services. Traditional banks are adapting by partnering with fintechs and positioning themselves as infrastructure providers rather than competing directly for end users.