XRP News Today XRP Under Pressure as US Banks Push Back XRP News Today is dominated by growing concern as XRP comes under renewed pressure amid increasing resistance from US banks toward the broader cryptocurrency industry. Once seen as a bridge between traditional finance and blockchain innovation, XRP now finds itself caught in the middle of a complex standoff between established banking institutions and the evolving digital asset ecosystem. As banks reassess their exposure to crypto-related risks, XRP’s price action and market sentiment reflect this tension, leaving investors questioning what the future holds.

The current situation is not merely about price volatility. It highlights deeper structural challenges facing cryptocurrencies that aim to integrate with legacy financial systems. XRP was designed to streamline cross-border payments and enhance liquidity for banks, but as US banks push back on crypto adoption, that original narrative faces scrutiny. XRP News Today requires a closer look at regulatory pressure, institutional hesitation, market psychology, and Ripple’s long-term strategy to understand why XRP is under pressure and whether this phase represents a setback or a test of resilience.

XRP Is Under Pressure

XRP’s recent struggles stem from a convergence of regulatory caution, institutional risk management, and shifting market sentiment. While the broader crypto market experiences cycles of optimism and fear, XRP’s unique positioning makes it especially sensitive to actions taken by banks and regulators.

US banks have become more conservative as oversight intensifies. This cautious stance has created uncertainty around crypto partnerships, liquidity solutions, and payment innovations. As a result, XRP News Today reflects a market grappling with conflicting signals, where technological potential clashes with institutional hesitation.

The Role of US Banks in Shaping Crypto Sentiment

US banks play a powerful role in influencing crypto market confidence. Their policies, partnerships, and public positions often signal how comfortable traditional finance is with digital assets.

Increased Risk Aversion Among Banks

In recent months, banks have prioritized risk reduction. Concerns around compliance, capital requirements, and regulatory scrutiny have encouraged many institutions to limit or delay crypto-related initiatives. This environment makes banks less willing to experiment with blockchain solutions, even those designed to complement existing systems.

As US banks push back on crypto, XRP feels the impact more directly than many other digital assets because of its close association with financial institutions.

Compliance and Regulatory Pressure

Banks operate under strict regulatory frameworks. Any ambiguity surrounding crypto assets can trigger conservative decision-making. XRP News Today reflects how regulatory uncertainty, even when partially resolved, continues to influence institutional behavior.

Banks must ensure that every product and partnership aligns with evolving rules. This necessity slows adoption and contributes to downward pressure on assets like XRP that depend on institutional trust.

XRP’s Original Vision and Current Challenges

XRP was created to address inefficiencies in global payments. Its fast settlement times and low transaction costs positioned it as a practical alternative to traditional systems. However, fulfilling this vision requires cooperation from banks, payment providers, and regulators.

Bridging Traditional Finance and Blockchain

Ripple’s strategy focused on working within the existing financial system rather than replacing it. This approach differentiated XRP from many cryptocurrencies that emphasized decentralization over integration.

While this strategy offered early advantages, it also exposed XRP to institutional pushback when banks became more cautious. XRP News Today shows how reliance on traditional finance can be both a strength and a vulnerability.

Perception Versus Reality

Despite XRP’s technical capabilities, perception plays a critical role in market dynamics. When US banks push back on crypto, even temporarily, it creates the impression that adoption is stalling. This perception can influence traders and investors, amplifying price pressure beyond what fundamentals alone might justify.

Market Reaction and Investor Sentiment

Investor sentiment is highly reactive to institutional signals. XRP’s price movements often reflect broader confidence or concern about its future role in finance.

Short-Term Selling Pressure

As banks adopt a cautious stance, some investors interpret this as a bearish signal. Short-term traders may exit positions, increasing selling pressure. XRP News Today captures this feedback loop, where institutional hesitation leads to market anxiety.

Long-Term Holders and Strategic Patience

Not all investors react the same way. Long-term holders often view periods of pressure as temporary obstacles rather than permanent setbacks. They focus on XRP’s underlying technology and Ripple’s continued efforts to expand globally. This divide between short-term sentiment and long-term conviction adds complexity to XRP’s market behavior.

Ripple’s Response to Banking Resistance

Ripple has consistently adapted its strategy in response to changing conditions. While US banks push back on crypto, Ripple continues to explore alternative pathways for growth.

Expanding Beyond the US Market

One response has been increased focus on international markets. Financial institutions outside the US often operate under different regulatory frameworks and may be more open to blockchain-based payment solutions. This global approach reduces reliance on US banks and diversifies adoption channels.

Strengthening Use Cases Outside Banking

Ripple is also emphasizing applications beyond traditional banking. Payment corridors, remittances, and enterprise solutions offer opportunities for XRP adoption even when banks are hesitant.

XRP News Today reflects this strategic shift as Ripple seeks resilience through diversification.

Regulatory Environment and Its Influence on XRP

Regulation remains one of the most significant factors shaping XRP’s outlook. Even incremental changes in policy can have outsized effects on market confidence.

Evolving Regulatory Landscape

Regulators are still defining how cryptocurrencies fit into existing financial laws. While progress has been made, uncertainty persists. Banks respond to this uncertainty by prioritizing caution, which indirectly affects XRP.

XRP News Today often highlights how regulatory developments, even when neutral, can be interpreted negatively by markets eager for clarity.

The Importance of Clear Guidelines

Clear and consistent regulations could ease bank concerns and reopen pathways for adoption. Many analysts believe that once regulatory frameworks stabilize, banks may reconsider their stance, potentially relieving pressure on XRP.

Comparison With Other Cryptocurrencies

XRP’s situation contrasts with other major cryptocurrencies that do not rely as heavily on banking integration.

Different Exposure to Institutional Decisions

Assets like Bitcoin and Ethereum are less dependent on bank partnerships. Their value propositions center on decentralization and network effects, making them less sensitive to institutional pushback.

XRP’s close ties to financial institutions make it uniquely vulnerable when US banks push back on crypto.

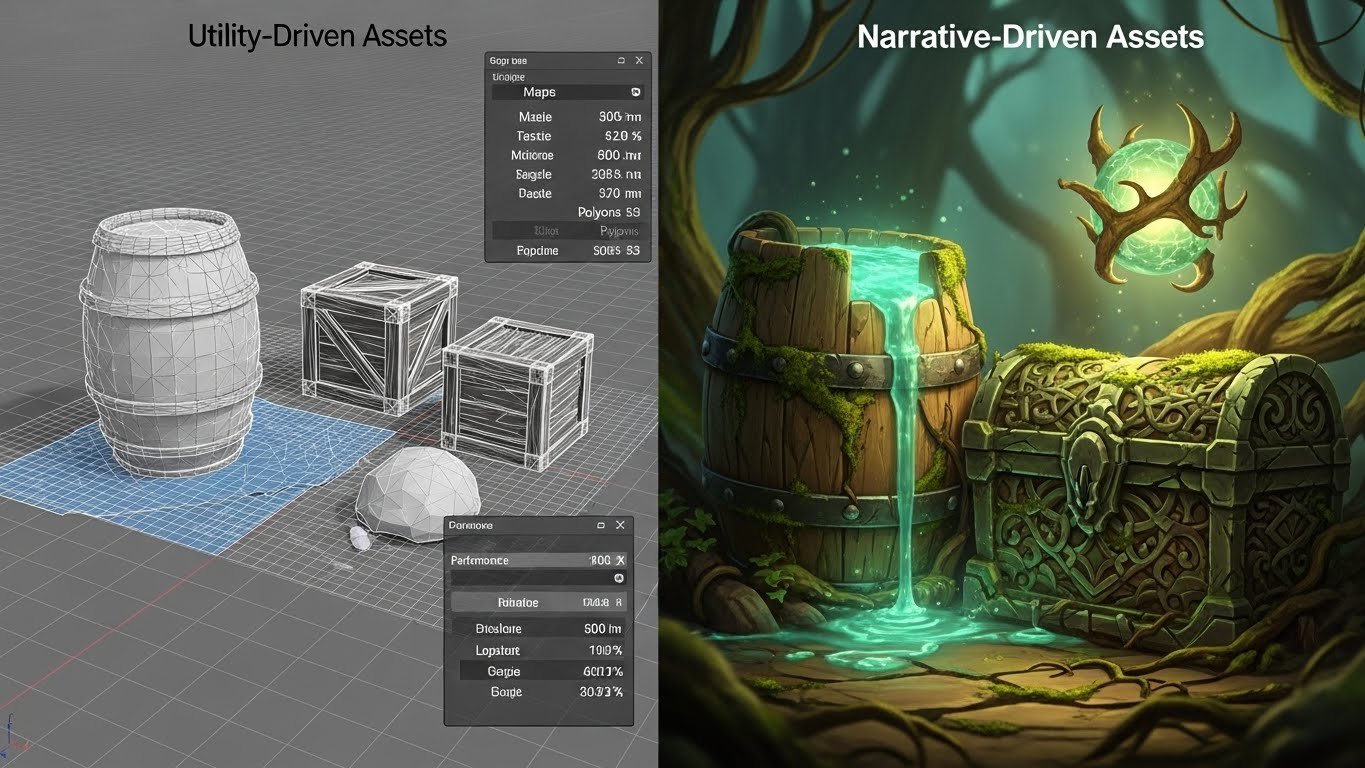

Utility-Driven Vs Narrative-Driven Assets

XRP’s value is closely linked to utility. When adoption slows, price pressure increases.

In contrast, narrative-driven assets may continue to attract speculative interest even without clear institutional backing.

Broader Implications for the Crypto Industry

The pressure on XRP highlights broader tensions between crypto innovation and traditional finance. As banks reassess their role in a digital future, crypto projects that seek collaboration must navigate complex dynamics.

A Test Case for Bank-Crypto Relationships

XRP’s experience serves as a test case for how banks and crypto can coexist. The outcome may influence how other projects approach institutional partnerships.

Shaping Future Strategies

Crypto companies may learn from XRP’s challenges and design strategies that balance integration with independence. XRP News Today offers valuable insights into the evolving relationship between legacy finance and blockchain.

Potential Scenarios for XRP Going Forward

Several scenarios could unfold depending on how banks, regulators, and markets respond in the coming months.

Continued Pressure and Consolidation

If banks maintain a cautious stance, XRP may experience prolonged consolidation. Prices could remain under pressure as markets wait for clearer signals.

Gradual Recovery Through Global Adoption

Alternatively, increased adoption outside the US could offset domestic resistance. Successful international partnerships may restore confidence and support gradual recovery.

Regulatory Breakthrough as a Catalyst

A significant regulatory breakthrough could change sentiment quickly. Clear guidelines could encourage banks to reengage, potentially lifting pressure on XRP.

The Role of Market Psychology in XRP News Today

Market psychology amplifies both positive and negative developments. Fear, uncertainty, and doubt can spread rapidly, especially in assets closely tied to institutional behavior.

Understanding this psychological dimension helps explain why XRP News Today often emphasizes pressure even when underlying progress continues behind the scenes.

Long-Term Outlook for XRP Amid Banking Pushback

Despite current challenges, XRP’s long-term outlook remains a subject of debate. Its technology continues to offer solutions to real-world problems, and Ripple’s persistence suggests adaptability.

Long-term success may depend on patience, regulatory evolution, and the willingness of financial institutions to embrace innovation once uncertainty subsides.

Conclusion

XRP News Today paints a complex picture of an asset under pressure as US banks push back on crypto. This pressure reflects not only market volatility but also deeper structural tensions between traditional finance and blockchain innovation. XRP’s close relationship with banks makes it especially sensitive to institutional caution, but it also positions the asset uniquely for future integration if conditions improve.

While short-term sentiment remains cautious, XRP’s story is far from over. Regulatory clarity, global expansion, and evolving use cases could eventually shift the narrative. For now, XRP News Today serves as a reminder that progress in crypto is rarely linear and that resilience often emerges through periods of challenge.

FAQs

Q: Why is XRP under pressure as US banks push back on crypto

XRP is under pressure because US banks are becoming more risk-averse due to regulatory scrutiny and compliance concerns, which directly affects assets like XRP that rely on institutional adoption.

Q: Does banking resistance mean XRP’s technology is flawed

Banking resistance does not indicate that XRP’s technology is flawed. The pressure is largely regulatory and institutional rather than technical, as XRP’s payment capabilities remain intact.

Q: How does US bank pushback impact XRP more than other cryptocurrencies

XRP is more affected because its core use case involves integration with banks, whereas other cryptocurrencies rely less on traditional financial institutions.

Q: Can XRP recover if US banks continue to resist crypto

XRP could recover through increased adoption in international markets and alternative use cases, even if US banks remain cautious in the short term.

Q: What should long-term investors consider when following XRP News Today

Long-term investors should consider XRP’s technology, Ripple’s global strategy, regulatory developments, and the distinction between short-term market pressure and long-term potential.