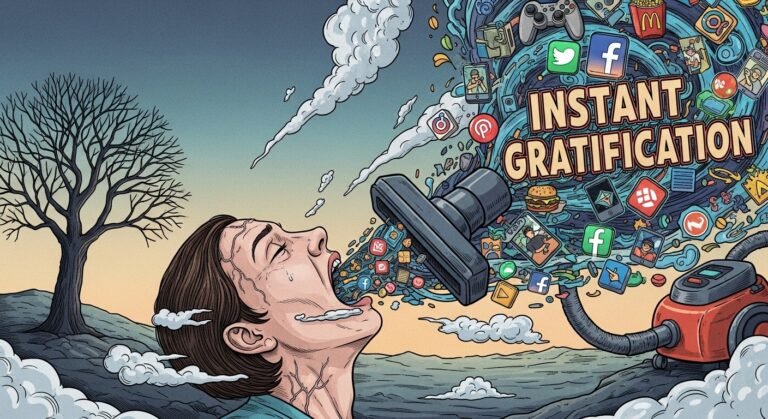

Instant Gratification Is Sucking the Air Out of the Bitcoin Market captures a growing sentiment among long-term investors, analysts, and even seasoned traders. Bitcoin was originally built on a vision of patience, decentralization, and a long-term store of value that rewarded conviction over time. However, the modern crypto landscape looks very different. Short-term speculation, viral hype cycles, leveraged trading, and constant price-checking have changed how participants interact with Bitcoin. Instead of steady accumulation and belief in the underlying technology, the market is increasingly driven by the desire for immediate profits and fast emotional payoffs.

Instant gratification has become deeply embedded in crypto culture. Social media platforms amplify every price movement, influencers promise overnight gains, and trading apps make it easier than ever to buy and sell with a single tap. This environment has consequences. Liquidity shifts rapidly, volatility spikes on minor news, and long-term capital often sits on the sidelines waiting for “perfect” moments that rarely arrive. As a result, many argue that instant gratification is sucking the air out of the bitcoin market by weakening patience, distorting price discovery, and discouraging the kind of long-term holding that historically fueled Bitcoin’s strongest bull cycles.

We will explores how instant gratification is sucking the air out of the bitcoin market, why this behavioral shift matters, and what it means for Bitcoin’s future. By examining investor psychology, market structure, and evolving narratives, we can better understand why Bitcoin sometimes struggles to gain momentum even during periods of strong fundamentals.

Instant Gratification Is Sucking the Air

Instant gratification in the Bitcoin market refers to the growing expectation of immediate results, whether that means fast price appreciation, quick trades, or rapid confirmation that an investment decision was correct. In earlier cycles, Bitcoin investors often accepted long periods of consolidation and drawdowns as part of a broader adoption curve. Today, many participants enter the market expecting short-term returns similar to meme stocks or viral altcoins.

This shift is partly cultural and partly technological. Trading platforms now offer real-time price action, instant notifications, and high-leverage products that reward short-term speculation. Social media reinforces this mindset by celebrating quick wins and rarely highlighting the patience required to survive bear markets. When price action stalls, frustration builds quickly, leading to sell-offs that drain momentum.

As instant gratification is sucking the air out of the bitcoin market, patience is no longer the default strategy. Instead, Bitcoin is often treated like a high-speed trading instrument rather than a long-term monetary experiment. This change in behavior has a profound effect on how capital flows through the market.

How Short-Term Thinking Impacts Bitcoin Price Action

When instant gratification dominates investor behavior, Bitcoin price action becomes more reactive and less reflective of fundamentals. Instead of steady accumulation based on macro trends, adoption metrics, or network growth, price movements are increasingly tied to headlines, rumors, and short-lived narratives.

Short-term traders often exit positions quickly if Bitcoin does not move as expected. This creates a market environment where rallies struggle to sustain themselves. Even modest price increases can trigger waves of profit-taking, preventing the kind of extended trends seen in earlier bull markets. Over time, this dynamic reinforces the idea that Bitcoin is “stuck,” further discouraging long-term participation.

Because instant gratification is sucking the air out of the bitcoin market, volatility can rise without meaningful direction. Sharp moves up or down may occur, but follow-through is limited. This frustrates both bulls and bears, creating a sense of stagnation even when underlying demand remains strong.

The Role of Social Media and Market Narratives

Social media plays a central role in reinforcing instant gratification. Platforms reward speed, emotion, and simplicity, which often clashes with Bitcoin’s complex economic and technological foundations. Viral posts focus on short-term price predictions, dramatic charts, and sensational claims, pushing nuanced discussions to the background.

When narratives shift rapidly, market participants feel pressured to act immediately or risk missing out. This fear-driven behavior reduces thoughtful decision-making and encourages constant repositioning. Over time, the market becomes saturated with reactive capital rather than patient capital.

As instant gratification is sucking the air out of the bitcoin market, narratives lose staying power. Each new theme burns brightly for a short time and then fades, leaving behind exhausted traders and diminished enthusiasm. This cycle can suppress long-term confidence, even among those who still believe in Bitcoin’s fundamentals.

Liquidity Drain and the Absence of Conviction

Liquidity thrives on confidence and time. When investors believe in a long-term thesis, they are more willing to allocate capital and hold through volatility. Instant gratification undermines this process by encouraging rapid entry and exit, which can drain liquidity from the market.

Instead of deep pools of committed capital, Bitcoin increasingly sees fragmented liquidity that moves quickly between assets. This makes it harder for sustained trends to develop and easier for small shocks to cause outsized price reactions. In such an environment, even positive developments may fail to generate lasting momentum.

The idea that instant gratification is sucking the air out of the bitcoin market becomes especially clear during periods of consolidation. Rather than viewing sideways movement as accumulation, many traders interpret it as failure and withdraw capital, further reducing liquidity and reinforcing stagnation.

The Psychological Cost of Constant Stimulation

Bitcoin markets now operate in an environment of constant stimulation. Prices update every second, news breaks around the clock, and opinions flood timelines nonstop. While this creates engagement, it also creates fatigue. Investors become emotionally drained, making impulsive decisions driven by boredom or frustration rather than strategy.

This psychological toll discourages long-term thinking. When the market fails to deliver excitement, attention shifts elsewhere. Over time, this weakens the collective focus needed to sustain major trends. Bitcoin does not lose its value proposition, but it loses mindshare. As instant gratification is sucking the air out of the bitcoin market, the patience required to benefit from Bitcoin’s long-term cycles becomes increasingly rare. This shift in mindset may be one of the most underestimated challenges facing the asset today.

H2 Bitcoin’s Long-Term Value Versus Short-Term Expectations

Bitcoin was designed to operate on a long time horizon. Its fixed supply, predictable issuance, and decentralized structure reward those willing to wait. Historically, the biggest gains accrued to investors who held through multiple cycles, ignoring short-term noise.

However, modern market participants often approach Bitcoin with expectations shaped by faster-moving assets. When these expectations are not met, disappointment follows. This disconnect between Bitcoin’s design and investor behavior creates tension within the market.

The belief that instant gratification is sucking the air out of the bitcoin market highlights this mismatch. Bitcoin has not changed fundamentally, but the way people engage with it has. Understanding this gap is essential for interpreting current market dynamics.

H3 The Decline of the HODL Mentality

The HODL mentality once defined Bitcoin culture. Holding through volatility was seen as a badge of honor and a rational response to long-term conviction. While long-term holders still exist, their influence on market sentiment has diminished.

Newer participants often prioritize flexibility and speed over conviction. They may admire Bitcoin’s story but lack the patience to endure prolonged drawdowns or sideways action. As a result, the stabilizing effect of committed holders weakens. When instant gratification is sucking the air out of the bitcoin market, the decline of the HODL mentality becomes both a symptom and a cause. Less holding leads to more volatility, which further discourages holding.

H3 Speculation Versus Adoption

Speculation has always played a role in Bitcoin’s growth, but adoption was once the dominant narrative. Discussions focused on digital gold, censorship resistance, and global accessibility. Today, speculation often overshadows these themes.

When price action stalls, adoption stories struggle to gain attention. This imbalance skews market perception, making Bitcoin seem less relevant during quiet periods. In reality, adoption often progresses steadily regardless of short-term price moves. As instant gratification is sucking the air out of the bitcoin market, the quieter, slower signals of adoption are drowned out by louder, faster speculation-driven narratives.

The Influence of Leverage and Derivatives

The expansion of leverage and derivatives trading has intensified short-term behavior in the Bitcoin market. These instruments magnify gains and losses, encouraging frequent trading and rapid position changes. While they add liquidity, they also increase fragility.

Highly leveraged markets are sensitive to minor price movements, leading to cascades of liquidations that distort price discovery. This environment rewards speed over patience and reinforces the appeal of instant gratification. When instant gratification is sucking the air out of the bitcoin market, leverage acts as an accelerant. It amplifies emotional reactions and shortens time horizons, making sustained trends harder to maintain.

Why Sideways Markets Feel Worse Than Bear Markets

Interestingly, many investors find sideways markets more frustrating than outright bear markets. Declines at least offer clarity and potential buying opportunities. Sideways action, by contrast, feels stagnant and unproductive.

Instant gratification exacerbates this frustration. Without clear movement, attention wanes and capital drifts away. This dynamic can persist even when fundamentals improve, delaying the market’s response. The perception that instant gratification is sucking the air out of the bitcoin market becomes especially strong during these periods. The lack of immediate reward overshadows long-term potential, shaping negative sentiment.

Rebuilding Patience in the Bitcoin Market

Restoring patience requires a shift in perspective. Investors must reconnect with Bitcoin’s original value proposition and accept that meaningful change often unfolds slowly. This does not mean ignoring risks, but it does mean resisting constant reaction.

Education plays a key role. Understanding bitcoin fundamentals, network metrics, and historical cycles can help counter the urge for instant results. When investors see the bigger picture, short-term noise loses some of its power. If instant gratification is sucking the air out of the bitcoin market, then patience is the oxygen it needs to recover. Encouraging long-term thinking may be essential for the next phase of growth.

The Role of Long-Term Holders in Market Stability

Long-term holders act as anchors during volatile periods. Their conviction reduces available supply and dampens extreme price swings. When their influence weakens, markets become more reactive.

Data consistently shows that periods of accumulation by long-term holders often precede major rallies. However, these phases require time and discipline, qualities that instant gratification undermines.

As instant gratification is sucking the air out of the bitcoin market, empowering long-term holders through education and narrative shifts could help restore balance.

Institutional Participation and Time Horizons

Institutions often operate on longer time horizons than retail traders, but they are not immune to short-term pressures. Performance metrics, quarterly reporting, and market sentiment can influence their behavior.

When institutions adopt Bitcoin primarily as a trade rather than a strategic allocation, they contribute to short-term volatility. Conversely, when they view Bitcoin as a long-term hedge, they add stability. The challenge lies in aligning institutional incentives with Bitcoin’s long-term nature. Otherwise, instant gratification continues to dominate, sucking the air out of the bitcoin market even at higher levels of participation.

Bitcoin Cycles and the Illusion of Permanence

Every market phase feels permanent while it lasts. During rallies, optimism seems endless. During stagnation, pessimism takes hold. Instant gratification intensifies these emotional extremes by narrowing focus to the present moment.

History shows that Bitcoin cycles eventually shift, often when least expected. Recognizing this pattern can help investors resist the urge for immediate validation. Understanding that instant gratification is sucking the air out of the bitcoin market allows participants to step back and see current conditions as part of a broader cycle rather than a final verdict.

The Long-Term Outlook Despite Short-Term Pressure

Despite short-term challenges, Bitcoin’s long-term outlook remains tied to macro trends such as monetary policy, digital scarcity, and global financial uncertainty. These forces operate on timelines far longer than social media cycles.

When short-term behavior dominates, these structural drivers may be overlooked. However, they continue to shape demand beneath the surface. Even if instant gratification is sucking the air out of the bitcoin market today, the underlying framework that supported past growth still exists, waiting for patience to return.

Conclusion

The idea that instant gratification is sucking the air out of the bitcoin market reflects a deeper shift in investor psychology. Bitcoin has not lost its fundamentals, but the market’s relationship with time has changed. Short-term thinking, amplified by social media, leverage, and constant stimulation, has weakened patience and distorted price dynamics. This has led to fragile liquidity, stalled trends, and widespread frustration.

Reversing this trend does not require new technology or dramatic events. It requires a cultural shift back toward long-term conviction, education, and perspective. Bitcoin’s design rewards those who understand that value often emerges slowly. When patience returns, the air will flow back into the market, and the conditions for sustainable growth can reemerge.

FAQs

Q: Why is instant gratification such a problem for the Bitcoin market today?

Instant gratification encourages short-term decision-making that clashes with Bitcoin’s long-term design. When investors expect immediate results, they are more likely to exit positions quickly, reducing liquidity and weakening sustained trends. This behavior amplifies volatility and creates frustration during consolidation phases.

Q: How does social media contribute to instant gratification in Bitcoin trading?

Social media accelerates information flow and emotional reactions by highlighting short-term price movements and sensational narratives. This constant stimulation pushes traders to act quickly rather than think strategically, reinforcing the cycle where instant gratification is sucking the air out of the bitcoin market.

Q: Does this mean Bitcoin can no longer experience strong bull markets?

Not necessarily. Bitcoin has historically moved in cycles, and periods dominated by short-term thinking often precede shifts back toward long-term accumulation. While instant gratification can delay momentum, it does not eliminate Bitcoin’s ability to trend when patience and conviction return.

Q: What role do long-term holders play in countering instant gratification?

Long-term holders provide stability by reducing available supply and maintaining conviction during volatile periods. Their behavior helps anchor the market and create conditions for sustained rallies, even when short-term sentiment is weak.

Q: How can individual investors avoid the trap of instant gratification in Bitcoin?

Investors can focus on education, historical context, and personal time horizons. By understanding Bitcoin’s fundamentals and accepting that meaningful growth takes time, individuals can resist emotional reactions and make more disciplined decisions in a market shaped by constant noise.