For the Bitcoin network to remain decentralized, secure, and operational, mining Bitcoins is crucial. As the network’s underlying ledger, it verifies Bitcoin transactions and adds them to the blockchain. Because it is decentralized, Bitcoin uses “miners” to create new coins and validate transactions rather than governments issuing money. Furthermore, Bitcoin mining has changed throughout the years, with new kinds of mining allowing more people to participate. On this page, you will find answers to frequently asked concerns about Bitcoin mining types and an examination of the process’s foundations and the many kinds of mining.

What is Bitcoin Mining?

“Mining” is short for “creating new Bitcoins” and “verifying and adding transactions to the public record known as the blockchain.”. Miners use processing power to solve complicated mathematical problems. As a reward for solving a difficulty, miners receive a fixed number of Bitcoins and a portion of the transaction fees from each block they helped create. Furthermore, Several factors make mining an absolute necessity:

- Decentralization: No single entity controls Bitcoin. Mining allows many participants to contribute to the network, ensuring its distributed nature.

- Security: Solving cryptographic puzzles ensures the blockchain remains secure, preventing tampering or double-spending of Bitcoin.

- Transaction validation: Miners confirm Bitcoin transactions, making them irreversible once recorded on the blockchain.

How Does Bitcoin Mining Work?

The consensus process that Bitcoin uses is known as Proof-of-Work (PoW). PoW necessitates a competition among miners to solve challenging mathematical problems. Once solved, the puzzles are straightforward to verify. This power-hungry puzzle-solving procedure guarantees that the network is secure from manipulation by anyone who doesn’t have control over the vast majority of its processing capacity. Furthermore, There are multiple stages to the mining process:

- Transaction pooling: Bitcoin transactions are broadcast to the network. Miners collect these transactions into a “block.”

- Puzzle-solving: Miners race to solve a cryptographic puzzle based on the block’s contents. This puzzle requires miners to find a specific value (called a nonce) that produces a hash (a string of letters and numbers) below a certain target value when combined with other data.

- Block validation: The first miner to solve the puzzle broadcasts the block to the network, and other miners verify the solution.

- Reward: The miner receives a block reward, currently 6.25 BTC, and any transaction fees associated with the transactions in the block.

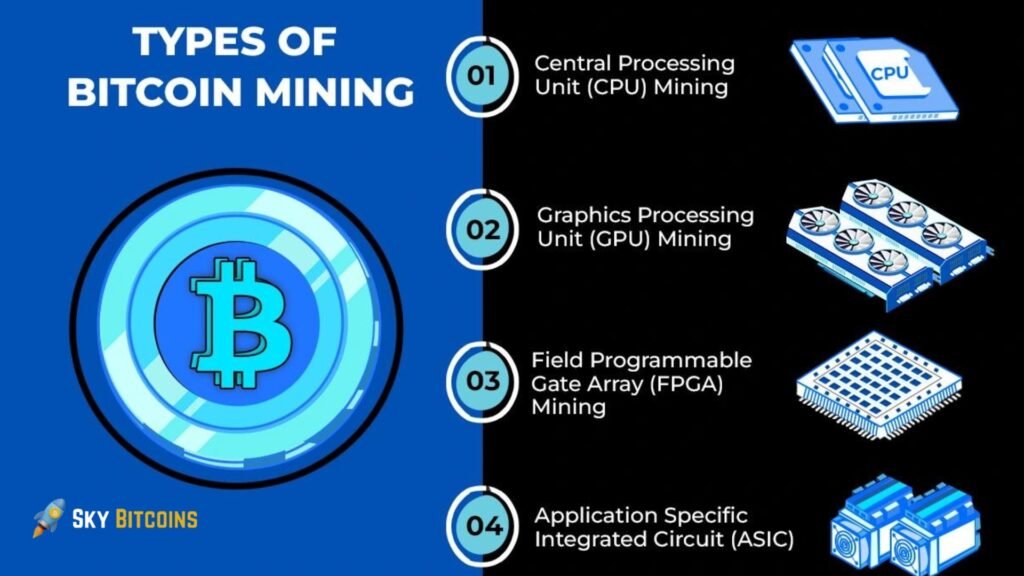

Types of Bitcoin Mining

Many new ways to participate have emerged as Bitcoin mining has progressed. The complexity, expense, and profitability of each approach are different.

Solo Mining

The “Solo mining” means that each miner works alone to crack the cryptographic codes and get their share of the profits. Solo mining was the norm in Bitcoin’s early days since it was easy for individuals to make a profit using ordinary computers, and the difficulty level of mining was low. The tremendous computing power needed and rising competition from large-scale mining companies have made solo mining considerably more difficult and less profitable for people today.

- Advantages:

- The full reward goes to the miner.

- Complete control over mining operations.

- Disadvantages:

- High cost of mining equipment and electricity.

- There is a lower chance of successfully mining a block due to competition.

Pool Mining

By joining forces, several miners can boost their odds of solving a block and collecting rewards through pool mining. Each pool member receives a portion of the reward for each successfully mined block according to their hash rate or the amount of computational power they supplied.

- Advantages:

- More consistent earnings are needed as rewards are shared among pool members.

- Reduced volatility in income.

- Disadvantages:

- Pool operators often charge fees, reducing profits.

- Reduced control over the mining process.

Cloud Mining

People can rent mining gear or hash power from third-party providers in the cloud, and those companies will take care of the actual mining. Users pay for contracts, and the provider takes care of the mining equipment’s upkeep, power, and operation.

- Advantages:

- There is no need for expensive hardware or high electricity costs.

- Simple and user-friendly for beginners.

- Disadvantages:

- There is a high risk of scams or fraudulent cloud mining services.

- Contracts often have lower profitability than direct mining.

ASIC Mining

The term “ASIC” refers to hardware developed with the express purpose of mining Bitcoin. Professional Bitcoin miners typically use these devices because they are far more efficient than regular computers or graphics processing units (GPUs). Regarding Bitcoin’s mining algorithm (SHA-256), ASIC miners are designed to be more efficient than ordinary gear.

- Advantages:

- Highly efficient and profitable.

- Used by large-scale miners.

- Disadvantages:

- Expensive to purchase and operate.

- Prone to rapid obsolescence due to technological advancements.

GPU Mining

Although GPU (Graphics Processing Unit) mining is now impractical due to Bitcoin’s increasing difficulty, it is still widely used to mine other cryptocurrencies. GPU mining is solving difficult mathematical problems using high-powered graphics cards.

- Advantages:

- It can be used to mine multiple cryptocurrencies.

- More versatile than ASIC miners.

- Disadvantages:

- Less efficient for Bitcoin mining compared to ASIC miners.

- Higher energy consumption.

Challenges and Future of Bitcoin Mining

Since Bitcoin mining requires a lot of processing power and energy, it has several problems. Here are a few of these challenges:

- Energy consumption: Environmental concerns are related to the massive amounts of electricity consumed by Bitcoin mining.

- Mining centralization: Mining has grown increasingly resource-intensive, leading to a concentration of power in the hands of a few entities through mining pools and massive mining operations. This concentration of power can undermine decentralization.

- Regulatory uncertainty: Since Bitcoin mining uses a lot of energy and poses financial dangers, governments worldwide are thinking about ways to control it.

Bitcoin mining is still evolving, even with all these obstacles. Possible changes include stricter regulations, an uptick in using renewable energy sources in power mining operations, and adopting more efficient mining techniques.

Also Read: Bitcoin Volatility: The Wild Ride of Crypto Markets Revealed

Conclusion

Bitcoin mining—a complicated yet crucial component—is required to maintain the network’s decentralization, security, and continuity. With various options, including solo, pool, cloud, ASIC, and GPU mining, miners can pick the one that works best regarding resources and objectives. Mining will remain an integral part of the Bitcoin ecosystem even as it is transformed by new ideas and challenges as the industry progresses.

FAQs

1. How long does it take to mine one Bitcoin?

Mining a single Bitcoin block typically takes 10 minutes and yields 6.25 BTC to the miner. Nevertheless, this payout is distributed amongst pooled miners or awarded to a single miner operating alone, contingent upon the amount of computing power accessible.

2. Is Bitcoin mining profitable?

Whether or not mining Bitcoins is profitable depends on several factors, such as the cost of electricity, the effectiveness of the equipment, and the price of Bitcoins at the moment. Compared to bigger mining operations or pool membership, which could offer more consistent income, mining solo is getting less profitable.

3. What is the Bitcoin halving?

In Bitcoin, halving reduces the reward for mining a block by half. This is done to control the amount of Bitcoin and occurs around every four years. In 2020, the reward per block was cut in half, going from 12.5 BTC to 6.25 BTC.

4. Do I need special hardware to mine Bitcoin?

To mine Bitcoin efficiently and profitably, specialized hardware called ASICs is required. The mining difficulty of Bitcoin has escalated to the point that GPUs or general-purpose computers are ineffective.

5. What happens when all 21 million Bitcoins are mined?

Payment to miners will end once the 21 million Bitcoins have been mined, which is anticipated to occur around 2140. Nevertheless, their incentive to keep the network running is the prospect of ongoing transaction profit.