The decentralized finance (DeFi) landscape continues to evolve at breakneck speed, with innovative protocols emerging to address the limitations of traditional trading platforms. Among these groundbreaking solutions, Apex Protocol stands out as a revolutionary force that’s reshaping how traders interact with decentralized exchanges and maximize their trading potential. This comprehensive guide will explore everything you need to know about Apex Protocol, from its core functionality to advanced trading strategies that can transform your DeFi experience.

Apex Protocol represents a paradigm shift in decentralized trading, offering sophisticated tools and features that bridge the gap between the convenience of centralized exchanges and the security of decentralized finance. Whether you’re a seasoned DeFi veteran or just beginning your journey into decentralized trading, understanding how Apex Protocol works can significantly enhance your trading outcomes and provide access to previously unavailable opportunities in the Crypto Markets.

What is Apex Protocol?

Apex Protocol is an innovative decentralized trading infrastructure that provides advanced order management and execution capabilities for DeFi traders. Unlike traditional decentralized exchanges that rely on simple swap mechanisms, Apex Protocol introduces sophisticated trading features typically found only on centralized exchanges, including limit orders, stop-losses, and advanced order types.

The protocol operates as a non-custodial solution, meaning users maintain complete control over their assets while accessing professional-grade trading tools. This unique approach addresses one of the most significant pain points in DeFi trading: the lack of advanced order management capabilities that professional traders require for effective risk management and strategy execution.

Core Architecture and Technology

The Apex Protocol architecture is built on a foundation of smart contracts that facilitate seamless interaction between users and various decentralized exchanges. The protocol aggregates liquidity from multiple DEXs, ensuring users can access the best possible prices for their trades while maintaining the security benefits of decentralized finance.

The technology stack features sophisticated algorithms for order matching, execution optimization, and minimizing slippage. These technical innovations enable users to execute complex trading strategies without the typical limitations associated with decentralized trading platforms.

Key Features of Apex Protocol

Advanced Order Types

One of the most compelling aspects of Apex Protocol is its comprehensive suite of order types. The platform supports:

- Limit Orders: Execute trades only when specific price conditions are met

- Stop-Loss Orders: Automatically close positions to limit losses

- Take-Profit Orders: Secure profits when predetermined price targets are reached

- Conditional Orders: Execute trades based on complex market conditions

These order types provide traders with the precision and control necessary for implementing sophisticated trading strategies that would be impossible on traditional decentralized exchanges.

Multi-DEX Liquidity Aggregation

Apex Protocol doesn’t rely on a single liquidity source. Instead, it aggregates liquidity from multiple decentralized exchanges, including Uniswap, SushiSwap, and other major DEXs. This aggregation ensures that users always have access to the best available prices and can execute large trades with minimal slippage.

The protocol’s intelligent routing algorithms automatically determine the optimal path for each trade, considering factors such as price impact, gas costs, and execution time to deliver the best possible outcomes for users.

Gas Optimization Features

High gas fees have long been a barrier to effective DeFi trading. Apex Protocol addresses this challenge through several innovative gas optimization features:

- Batch Processing: Multiple orders can be executed in a single transaction

- Gas Price Optimization: Intelligent gas price recommendations based on network conditions

- Layer 2 Integration: Support for popular Layer 2 solutions to reduce transaction costs

How Apex Protocol Works

Order Management System

The Apex Protocol order management system operates through a network of keepers and validators who ensure that orders are executed according to user specifications. When a user creates an order, it’s stored off-chain until the execution conditions are met, at which point the order is submitted to the blockchain for execution.

This hybrid approach combines the efficiency of off-chain order storage with the security and transparency of on-chain execution, providing users with the best of both worlds.

Smart Contract Integration

The protocol’s smart contracts are designed for maximum security and efficiency. They undergo rigorous auditing processes and implement industry best practices for developing smart contracts. The contracts are also upgradeable, allowing the protocol to evolve and incorporate new features as the DeFi landscape develops.

User Interface and Experience

Apex Protocol prioritizes user experience through its intuitive interface design. The platform provides both novice-friendly interfaces for beginners and advanced trading interfaces for professional traders. Key interface features include:

- Real-time market data and charting tools

- Portfolio tracking and performance analytics

- Risk management tools and position monitoring

- Educational resources and trading guides

Benefits of Using Apex Protocol

Enhanced Trading Flexibility

Traditional DEXs limit traders to simple swap transactions, but Apex Protocol opens up a world of advanced trading possibilities. Users can implement complex strategies involving multiple assets, time-based conditions, and sophisticated risk management techniques.

Improved Capital Efficiency

The protocol’s advanced order types allow traders to be more strategic with their capital deployment. Instead of manually monitoring markets and executing trades, users can set up automated strategies that work around the clock, maximizing opportunities and minimizing losses.

Reduced Slippage and Better Pricing

By aggregating liquidity from multiple sources and using intelligent routing algorithms, Apex Protocol significantly reduces slippage compared to trading on individual DEXs. This improvement is particularly beneficial for larger trades that would typically face substantial price impact.

Maintained Custody and Security

Unlike centralized exchanges that require users to deposit funds, Apex Protocol allows traders to maintain custody of their assets throughout the trading process. This non-custodial approach eliminates counterparty risk while providing access to advanced trading features.

Getting Started with Apex Protocol

Setting Up Your Account

Getting started with Apex Protocol is straightforward and doesn’t require traditional account creation. Users simply need to connect their compatible crypto wallet to begin accessing the platform’s features. Popular wallet options include MetaMask, WalletConnect, and Coinbase Wallet.

Initial Configuration

Once connected, users should configure their trading preferences, including:

- Default slippage tolerance settings

- Gas price preferences

- Notification preferences for order execution

- Risk management parameters

First Trade Execution

New users are encouraged to start with small trades to familiarize themselves with the platform’s interface and features. The Apex Protocol platform provides comprehensive tutorials and guides to help users understand the various order types and trading features available.

Advanced Trading Strategies with Apex Protocol

Dollar-Cost Averaging (DCA) Strategies

Apex Protocol enables sophisticated DCA implementations that go beyond simple recurring purchases. Users can set up conditional DCA orders that adjust purchase amounts based on market conditions, volatility levels, or technical indicators.

Grid Trading Systems

The platform’s advanced order management capabilities make it ideal for implementing grid trading strategies. Users can set up multiple buy and sell orders at various price levels, creating a trading grid that profits from market volatility.

Arbitrage Opportunities

Professional traders can leverage Apex Protocol‘s multi-DEX integration to identify and capitalize on arbitrage opportunities across different decentralized exchanges. The platform’s fast execution and low fees make arbitrage trading more profitable and accessible.

Apex Protocol vs Traditional DEXs

Feature Comparison

Feature Comparison

When comparing Apex Protocol to traditional decentralized exchanges, several key differences emerge:

Traditional DEXs:

- Limited to simple swap transactions

- No advanced order types

- Manual execution required

- Limited risk management tools

Apex Protocol:

- Advanced order management system

- Multiple order types and conditions

- Automated execution capabilities

- Comprehensive risk management features

Cost Analysis

While Apex Protocol may have slightly higher fees due to its advanced features, the improved execution quality and risk management capabilities often result in better overall trading outcomes. The platform’s gas optimization features also help reduce overall transaction costs.

Security and Auditing

Smart Contract Security

Apex Protocol prioritizes security through rigorous smart contract auditing and testing procedures. Leading blockchain security firms audit the protocol’s contracts and undergo continuous monitoring for potential vulnerabilities.

Future Developments and Roadmap

Upcoming Features

The Apex Protocol development team continues to innovate and expand the platform’s capabilities. Upcoming features include:

- Advanced algorithmic trading tools

- Integration with additional Layer 2 solutions

- Enhanced mobile trading applications

- Institutional-grade reporting and analytics

Community Governance

Apex Protocol is transitioning toward a community-governed model where token holders can vote on protocol upgrades, fee structures, and strategic decisions. This decentralized governance approach ensures that the protocol evolves in alignment with user needs and market demands.

Common Challenges and Solutions

Learning Curve Management

While Apex Protocol offers powerful features, new users may face a learning curve when transitioning from simpler DEXs. The platform addresses this through comprehensive educational resources, tutorials, and customer support.

Technical Issues and Troubleshooting

Like all DeFi protocols, Apex Protocol can occasionally experience technical issues. The platform maintains detailed documentation and support resources to help users troubleshoot common problems and optimize their trading experience.

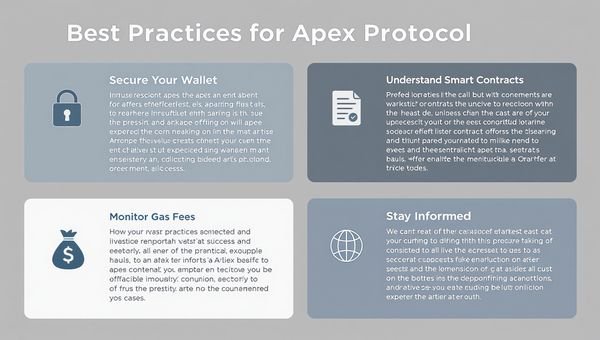

Best Practices for Apex Protocol Users

Optimization Strategies

Optimization Strategies

To maximize your success with Apex Protocol:

- Take advantage of gas optimization features during low-traffic periods

- Use limit orders to avoid slippage on large trades

- Monitor your portfolio performance regularly

- Stay informed about platform updates and new features

Market Impact and Industry Recognition

Adoption Metrics

Apex Protocol has gained significant traction in the DeFi community, with growing trading volumes and an expanding user base. The protocol’s innovative approach to decentralized trading has attracted both retail and institutional users seeking advanced trading capabilities.

Industry Partnerships

The platform has established partnerships with major DeFi projects, wallet providers, and infrastructure companies to enhance the user experience and expand accessibility.

Conclusion

Apex Protocol represents a significant advancement in decentralized finance technology, bridging the gap between the convenience of centralized exchanges and the security of decentralized trading. By providing advanced order management, liquidity aggregation, and risk management tools, Apex Protocol enables traders to implement sophisticated strategies while maintaining complete control over their assets.

As the DeFi ecosystem continues to evolve, platforms like Apex Protocol will play an increasingly important role in making decentralized trading accessible and profitable for users at all levels of experience. Whether you’re looking to implement complex trading strategies or simply want better control over your DeFi transactions, Apex Protocol offers the tools and features necessary to succeed in today’s dynamic cryptocurrency markets.

Ready to experience the future of decentralized trading? Explore Apex today and discover how advanced DeFi trading tools can transform your cryptocurrency investment strategy. Join thousands of traders who have already upgraded their trading experience with the power and flexibility that only Apex Protocol can provide.