In August 2017, Bitcoin Cash (BCH) was established as a hard fork of Bitcoin (BTC). It aimed to increase the block size limit, improving scalability and transaction speed. Using a decentralized system incorporating a halving mechanism, Bitcoin Cash functions similarly to Bitcoin. Around every four years, or after 210,000 blocks have been mined, miners’ block reward is cut in half.

Bitcoin Cash’s economic architecture relies on the halving mechanism to reduce currency generation. In this essay, we will look at the background, significance, and network and community effects of Bitcoin Cash Halving History, which has existed for some time.

The Origins of Bitcoin Cash and the Fork

Looking back at Bitcoin Cash’s origins will help us comprehend its halving history. The Bitcoin community got quite worked up over the scalability problem, and Bitcoin Cash was established. According to some developers and miners, the increasing volume of Bitcoin transactions has caused congestion and skyrocketing transaction costs due to the inadequacy of the 1 MB block size restriction.

A group in the Bitcoin community wants to scale the network by increasing block size and transaction count. Bitcoin’s decentralization was retained despite concerns that larger block sizes would consolidate mining power. The disagreement caused a hard fork on August 1, 2017, creating Bitcoin Cash (BCH). Bitcoin Cash increased the block size to 8 MB (later 32 MB) to enable more transactions and make the network faster and more scalable than Bitcoin.

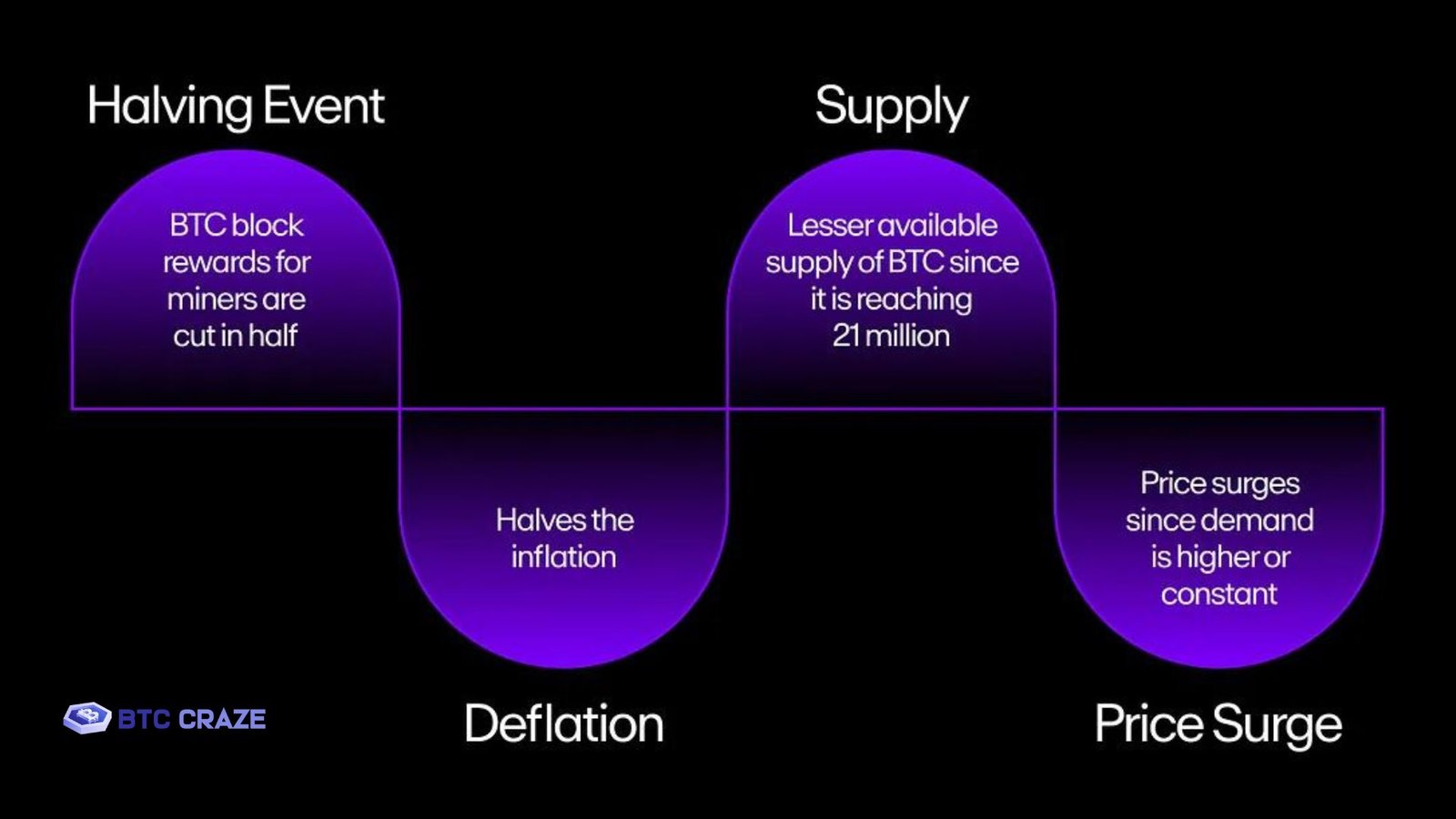

Bitcoin Cash Halving Mechanism

Its halving process and total supply cap of 21 million coins are just two technical similarities with Bitcoin. Every 210,000 blocks, Bitcoin Cash follows Bitcoin’s halving event, which lowers the block reward provided to miners by 50%. This procedure aims to keep the money supply deflationary by limiting the creation of new coins.

When Bitcoin Cash first launched, miners received 12.5 BCH for every block. At the first halving in April 2020, the block reward dropped to 6.25 BCH. The next halving, expected in 2024, will lower the payout to 3.125 BCH per block. Because they control inflation and progressively decrease the creation of new coins, halving events is essential to the network’s long-term viability. Reduced block rewards, though, can cut into miners’ profits, so they’re not without their problems.

Bitcoin Cash’s First Halving – April 2020

The first halving of Bitcoin Cash took place on April 8, 2020, with the mining of block number 630,000. This was a watershed moment in Bitcoin Cash history because it was the first time the block reward was reduced, going from 12.5 BCH to 6.25 BCH. This halving occurred exactly one month before Bitcoin’s halving, which was covered extensively in the media because of Bitcoin’s greater prominence and market share.

The halving of Bitcoin Cash had the same economic effects as Bitcoin: lower miner payouts, fewer new BCH entering circulation, and the hope of a price rise due to deflation. Bitcoin Cash’s initial halving affected the price and network differently. The supply cut was expected to raise prices, but there was no immediate change. Bitcoin Cash’s lower demand than Bitcoin and competition from other cryptocurrencies limited its price increase.

Mining miners’ profitability is greatly affected by the halving. Due to lowered block rewards, many smaller miners struggled to keep operations, reducing the network’s hash rate. Due to this hash rate drop, Bitcoin Cash was temporarily less secure, but the difficulty adjustment mechanism normalized things.

Comparisons with Bitcoin’s Halving

Every 210,000 blocks, Bitcoin Cash follows a procedure similar to Bitcoin’s halving, which involves reducing the block reward by half. Nonetheless, you should be aware of the following key distinctions between the two:

Market Size

Because of Bitcoin’s monopoly in the cryptocurrency market, investors pay closer attention to its halvings, and they often have a greater impact on price. Even though it’s still widely used, Bitcoin Cash is much smaller and less influential than Bitcoin, and its price halvings aren’t nearly as noticeable.

Mining Competition

The mining environment for Bitcoin is considerably broader, with more participants and fiercer competition for block rewards. However, due to Bitcoin Cash’s smaller mining ecosystem, halvings have a more noticeable impact on miners, particularly smaller players.

Public Attention

Media coverage and speculation surrounding Bitcoin halving occurrences are substantial, and they frequently cause price increases as investors prepare for the lower supply. While they are huge for the Bitcoin Cash community, the general public isn’t usually interested in halving the coin.

Economic Impact of Bitcoin Cash Halving

Two important elements, miner incentives and market supply, can be studied to understand the economic impact of Bitcoin Cash’s halvings.

Miner Incentives

Miners are under pressure when block rewards are halved since their profits decline until Bitcoin Cash prices rise. Halvings can make BCH mining unsustainable for many miners, especially those utilizing older or less efficient gear. Consequently, some miners might start mining Bitcoin instead of Bitcoin Cash, temporarily lowering the network’s security.

Bitcoin Cash’s built-in difficulty adjustment algorithm considers this and modifies the block mining difficulty according to the hash rate. This function helps stabilize the network after a halving by mining new blocks when the hashrate dips.

Market Supply and Demand

There will be less new Bitcoin Cash available for circulation when a halving event occurs, which should make it more scarce and so support price rise. However, market demand is the main factor determining how prices react to such events. There have been less significant price fluctuations following Bitcoin Cash halving occasions since the demand for cryptocurrency has not been as high as Bitcoin’s.

While Bitcoin enjoyed a more significant price surge in the months after the first halving in April 2020, Bitcoin Cash saw a far more muted one. This highlights the significance of demand in determining the economic effect of cuts.

The Future of Bitcoin Cash Halvings

The next halving of Bitcoin Cash is anticipated to occur in 2024, decreasing the block reward from 6.25 BCH to 3.125 BCH. As in prior halvings, investors and miners in the Bitcoin Cash community will be watching the event intently.

However, the Bitcoin Cash network’s long-term viability depends on its user base, transaction volume, and ecosystem expansion. Even though the halving process is meant to reduce inflation and boost scarcity, Bitcoin Cash’s success will depend on how well it performs against other cryptocurrencies and meets user needs.

Also Read: Bitcoin Crash 2024: Exploring Causes and Impacts

Conclusion

Bitcoin Cash’s economic design relies on its halving history, which mirrors Bitcoin’s while solving scalability difficulties. The 2020 first halving controlled Bitcoin Cash’s quantity and value and did not cause a price surge as expected. The second Bitcoin Cash halving in 2024 will need the community to examine miner incentives, network security, and market demand.

FAQs

1. What is Bitcoin Cash halving?

After 210,000 blocks have been mined, or every four years, the block reward for miners is cut in half. This process is called halving in Bitcoin Cash. Bitcoin Cash’s supply can be managed using this mechanism, which governs the creation rate.

2. When was Bitcoin Cash’s first halving?

In the first halving of Bitcoin Cash, which took place on April 8, 2020, the block reward was lowered from 12.5 BCH to 6.25 BCH.

3. How does Bitcoin Cash halving compare to Bitcoin halving?

Although the rules and timeline for Bitcoin Cash halving are identical to those for Bitcoin. The smaller market size and user base of Bitcoin Cash mean that the economic and market impact is typically less.

4. What happens to miners after a Bitcoin Cash halving?

Miners’ profits may take a hit after Bitcoin Cash halving since they get less money for creating new blocks. Miners may leave the network or switch to another cryptocurrency, even if the mechanism keeps the network stable.

5. Will Bitcoin Cash continue to experience halving events?

There will be a halving event for Bitcoin Cash every four years until the total supply reaches 21 million BCH, projected around 2140.