The world of Bitcoin continues to captivate investors, technology enthusiasts, and financial institutions alike as we progress through 2025. As the pioneering cryptocurrency that sparked a global Bitcoin News digital currency revolution, Bitcoin remains at the forefront of financial innovation and technological advancement. Understanding the latest developments in the Bitcoin ecosystem is crucial for Bitcoin News anyone looking to participate in this transformative asset class, whether you’re a seasoned trader or someone just beginning to explore digital currencies.

The landscape surrounding Bitcoin has matured significantly since its inception in 2009. What started as an experimental peer-to-peer electronic cash system has evolved into a globally recognized store of value, often referred to as “digital gold.” Today’s Bitcoin news encompasses everything from institutional adoption and regulatory frameworks to technological upgrades and market dynamics that influence price movements across the broader cryptocurrency market. This comprehensive overview will explore the most significant developments shaping Bitcoin’s trajectory and what they mean for the future of decentralized finance.

Bitcoin’s Current Market Position

Bitcoin has firmly established itself as the dominant force within the cryptocurrency sector, maintaining the largest market capitalization among all digital assets. The Bitcoin price continues to demonstrate remarkable resilience despite periodic volatility that characterizes the crypto markets. Market analysts closely monitor various indicators, including trading volumes, on-chain metrics, and macroeconomic factors that influence investor sentiment toward this groundbreaking asset.

The maturation of Bitcoin trading infrastructure has contributed to increased market stability. Major cryptocurrency exchanges now offer sophisticated trading platforms with advanced tools for both retail and institutional investors. The introduction of Bitcoin exchange-traded funds in various jurisdictions has further legitimized the asset class, providing traditional investors with regulated vehicles to gain exposure to Bitcoin without directly holding the cryptocurrency.

Institutional participation has become a defining characteristic of the modern Bitcoin landscape. Corporations, hedge funds, and even sovereign wealth funds have allocated portions of their Bitcoin News portfolios to Bitcoin, recognizing its potential as a hedge against inflation and currency devaluation. Bitcoin News This institutional embrace has brought significant capital inflows and contributed to Bitcoin’s evolution from a speculative asset to a recognized component of diversified investment strategies.

Regulatory Developments Shaping the Bitcoin Ecosystem

The regulatory environment surrounding Bitcoin and cryptocurrencies has evolved considerably, with governments and financial authorities worldwide working to establish comprehensive frameworks. These regulatory developments play a crucial role in determining how Bitcoin can be used, traded, and integrated into existing financial systems. The United States, European Union, and Asian nations have each taken distinct approaches to cryptocurrency regulation, creating a complex global regulatory landscape.

Recent legislative initiatives have focused on clarifying tax treatment, establishing licensing requirements for cryptocurrency businesses, and implementing anti-money laundering measures. While some jurisdictions have embraced Bitcoin with open arms, creating favorable conditions for cryptocurrency innovation, others have adopted more cautious approaches, implementing stringent requirements or outright restrictions. This regulatory patchwork creates both challenges and opportunities for Bitcoin adoption across different regions.

The dialogue between the cryptocurrency industry and regulators has become increasingly constructive. Industry leaders recognize that clear regulatory frameworks can actually benefit Bitcoin’s long-term growth by providing legal certainty and consumer protections. Meanwhile, regulators are becoming more sophisticated in their understanding of blockchain technology and the nuances of decentralized systems, leading to more thoughtful policy approaches that balance innovation with investor protection.

Technological Innovations and Network Upgrades

The Bitcoin network continues to evolve through technological improvements designed to enhance scalability, security, and functionality. The Lightning Network, a layer-two scaling solution, has gained significant traction as it enables faster and cheaper Bitcoin transactions. This innovation addresses one of Bitcoin’s longstanding challenges by allowing near-instantaneous payments while maintaining the Bitcoin News security guarantees of the underlying blockchain.

Developers working on Bitcoin are constantly exploring ways to improve the protocol without compromising its core principles of decentralization and security. The Taproot upgrade, implemented in recent years, enhanced Bitcoin’s privacy features and smart contract capabilities, demonstrating that even a mature protocol can continue to evolve. These incremental improvements ensure that Bitcoin remains competitive and relevant as the broader cryptocurrency ecosystem develops.

Mining technology has also advanced considerably, with increased focus on energy Bitcoin News: efficiency, and sustainable mining practices. The conversation around Bitcoin’s environmental impact has prompted the industry to invest heavily in renewable energy sources for mining operations. Many mining facilities now operate using hydroelectric, solar, or wind power, addressing environmental concerns while maintaining the network’s security through proof-of-work consensus.

Bitcoin Adoption Trends Across Industries

The adoption of Bitcoin as a payment method and store of value continues to Bitcoin News expand across various sectors. Payment processors have integrated Bitcoin support, enabling merchants worldwide to accept cryptocurrency payments alongside traditional payment methods. This growing acceptance signals Bitcoin’s gradual transition from a purely speculative asset to a functional medium of exchange.

The remittance industry has identified Bitcoin and other cryptocurrencies as potential solutions to reduce costs and increase speed for cross-border money transfers. Traditional remittance Bitcoin News services often charge high fees and require several days for transactions to complete. Bitcoin’s borderless nature and ability to settle transactions within minutes present a compelling alternative for individuals sending money internationally.

Financial institutions have moved beyond mere observation to active participation in Bitcoin News the Bitcoin ecosystem. Banks now offer cryptocurrency custody services, enabling clients to securely store their digital assets. Some institutions have even begun providing Bitcoin-related investment products, acknowledging customer demand for cryptocurrency exposure within traditional banking relationships. This integration of Bitcoin into mainstream financial services represents a significant milestone in the asset’s journey toward widespread acceptance.

Market Analysis and Price Dynamics

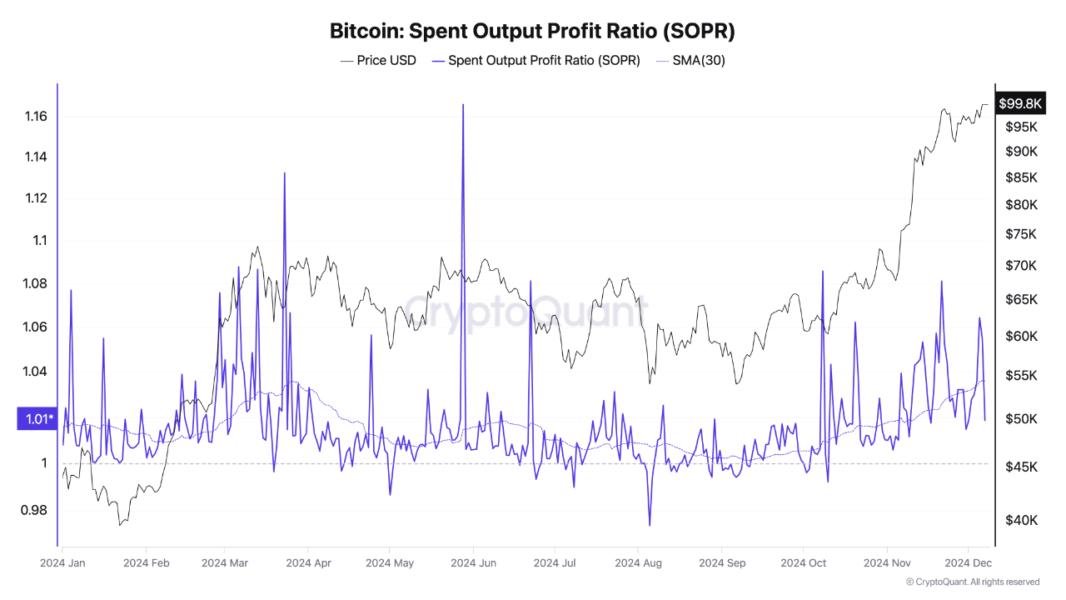

Understanding the factors that influence Bitcoin price movements requires examining both technical indicators and fundamental developments. The cryptocurrency market operates twenty-four hours a day, seven days a week, creating a dynamic trading environment where news and events can trigger immediate price reactions. Traders employ various analytical methods, including chart patterns, volume analysis, and momentum indicators, to make informed trading decisions.

The concept of Bitcoin halving events, which occur approximately every four years and reduce the rate of new Bitcoin creation, has historically correlated with significant price cycles. These programmed supply reductions create scarcity dynamics that many analysts believe contribute to long-term price appreciation. The most recent halving event continues to influence market sentiment as participants anticipate its effects on supply and demand equilibrium.

Macroeconomic conditions significantly impact Bitcoin valuations as investors weigh cryptocurrency allocations against traditional assets. Factors such as inflation rates, central bank policies, and global economic stability influence whether investors view Bitcoin as a risk asset or a haven. The correlation between Bitcoin and traditional markets fluctuates over time, reflecting changing perceptions of cryptocurrency’s role within broader investment portfolios.

Also Read: Bitcoin News Latest Updates & Market Trends for 2025

Security Considerations and Best Practices

Security remains paramount for anyone holding or transacting with Bitcoin. The irreversible nature of blockchain transactions means that lost or stolen Bitcoin cannot be recovered through traditional means like credit card chargebacks. Understanding proper security practices is essential for protecting digital assets from theft, loss, or unauthorized access.

Hardware wallets have emerged as the gold standard for Bitcoin storage, providing offline security that protects private keys from internet-connected devices vulnerable to hacking. These physical devices store cryptographic keys in secure elements, requiring physical confirmation for transactions. For individuals holding significant Bitcoin amounts, hardware wallets offer peace of mind through robust security architecture.

The cryptocurrency community emphasizes the importance of personal responsibility in asset security. Unlike traditional banking, where institutions provide fraud protection and account recovery services, Bitcoin users must take proactive measures to safeguard their holdings. This includes implementing strong passwords, enabling two-factor authentication on exchange accounts, and maintaining secure backups of wallet recovery phrases in physically separate locations.

The Future Outlook for Bitcoin

Looking ahead, Bitcoin appears poised to continue its evolution as both a technological innovation and a financial asset. The ongoing development of layer-two solutions and potential future protocol improvements suggest that Bitcoin’s utility will expand while maintaining its core value propositions of decentralization and censorship resistance. As the cryptocurrency matures, it may increasingly function as infrastructure underlying various financial applications.

The intersection of Bitcoin with emerging technologies presents intriguing possibilities. Integration with artificial intelligence, Internet of Things devices, and decentralized finance platforms could unlock new use cases that extend Bitcoin’s reach beyond simple peer-to-peer transactions. These technological synergies may create entirely new economic models built on Bitcoin’s secure and transparent blockchain foundation.

Global economic uncertainties and concerns about monetary policy continue to drive interest in Bitcoin as an alternative asset class. As more individuals and institutions recognize the potential value of decentralized, programmatically scarce digital assets, Bitcoin’s role in the global financial system may expand significantly. Whether Bitcoin ultimately becomes a widely used medium of exchange, a store of value, or both, its impact on monetary systems and financial technology appears certain to endure.

Conclusion

The landscape of Bitcoin news reflects an asset class that has transcended its experimental origins to become a significant force in global finance. From regulatory developments and technological innovations to institutional adoption and market dynamics, Bitcoin continues to evolve in response to both opportunities and challenges. Understanding these multifaceted developments is essential for anyone seeking to navigate the cryptocurrency space effectively.

As Bitcoin matures, it demonstrates increasing resilience and broader acceptance across various sectors of the economy. The convergence of improved infrastructure, clearer regulatory frameworks, and growing recognition of cryptocurrency’s potential suggests that Bitcoin’s influence will continue expanding. Whether you’re an investor, technologist, or simply curious observer, staying informed about Bitcoin developments provides valuable insight into the future of money and decentralized systems.

The journey of Bitcoin from a whitepaper concept to a globally recognized asset represents one of the most remarkable financial innovations of the twenty-first century. As we move forward, the ongoing evolution of this pioneering digital currency will undoubtedly continue generating news, sparking debates, and shaping the future of how humanity stores and transfers value in an increasingly digital world.

Frequently Asked Questions

Q: What factors most significantly influence Bitcoin’s price movements?

Bitcoin’s price is influenced by multiple factors including supply and demand dynamics, regulatory announcements, institutional adoption, macroeconomic conditions, technological developments, and market sentiment. The halving events that reduce new Bitcoin supply approximately every four years also play a significant role. Additionally, global economic uncertainty often drives investors toward or away from Bitcoin depending on whether they view it as a risk asset or safe haven.

Q: How can I safely store my Bitcoin holdings?

The safest method for storing Bitcoin is using a hardware wallet, which keeps your private keys offline and protected from internet-based threats. For smaller amounts, reputable software wallets with strong security features can be appropriate. Never store significant amounts on exchanges for extended periods. Always maintain secure backups of your recovery phrases in multiple physical locations, and never share your private keys or seed phrases with anyone.

Q: Is Bitcoin legal in my country?

Bitcoin’s legal status varies significantly by jurisdiction. Most developed nations treat Bitcoin as legal property or a commodity, though regulations governing its use, trading, and taxation differ considerably. Some countries have embraced cryptocurrency with favorable regulations, while others have imposed restrictions or outright bans. It’s essential to research your specific country’s regulations and consult with legal or tax professionals familiar with cryptocurrency in your jurisdiction.

Q: How does Bitcoin differ from traditional currencies and other cryptocurrencies?

Bitcoin differs from traditional fiat currencies in that it operates on a decentralized network without central bank control, has a fixed supply cap of 21 million coins, and uses cryptographic security rather than relying on trusted institutions. Compared to other cryptocurrencies, Bitcoin prioritizes security and decentralization over features like smart contracts or faster transaction speeds. Its first-mover advantage, largest network effect, and proven track record distinguish it within the cryptocurrency ecosystem.

Q: What role might Bitcoin play in the future global financial system?

Bitcoin’s future role remains subject to debate, but several possibilities exist. It may function as a store of value similar to digital gold, serve as a hedge against inflation and currency devaluation, provide an alternative payment system for cross-border transactions, or become integrated into mainstream financial infrastructure through various applications. Its ultimate role will likely be determined by ongoing technological development, regulatory clarity, adoption trends, and how successfully it addresses scalability and usability challenges.