Bitcoin Volatility: Since its invention in 2009 by the pseudonymous Satoshi Nakamoto, the first cryptocurrency, Bitcoin, has been the object of excitement, skepticism, and intense market interest. Not only has Bitcoin been the first blockchain-based money, but it has also been one of the most unpredictable assets in the history of contemporary finance, and it has also been the basis for thousands of other cryptocurrencies. Its price fluctuations, from skyrocketing highs to crushing lows, have garnered praise and criticism. The wild swings in Bitcoin’s value both excite and unsettle many investors, who see it as a rollercoaster ride that could end in massive gains or devastating losses. Here, we look at Bitcoin’s volatility, the factors that cause its price swings, how it stacks up against more conventional assets, and some tactics investors might employ to ride out the cryptocurrency market’s storms.

Understanding Bitcoin’s Volatility

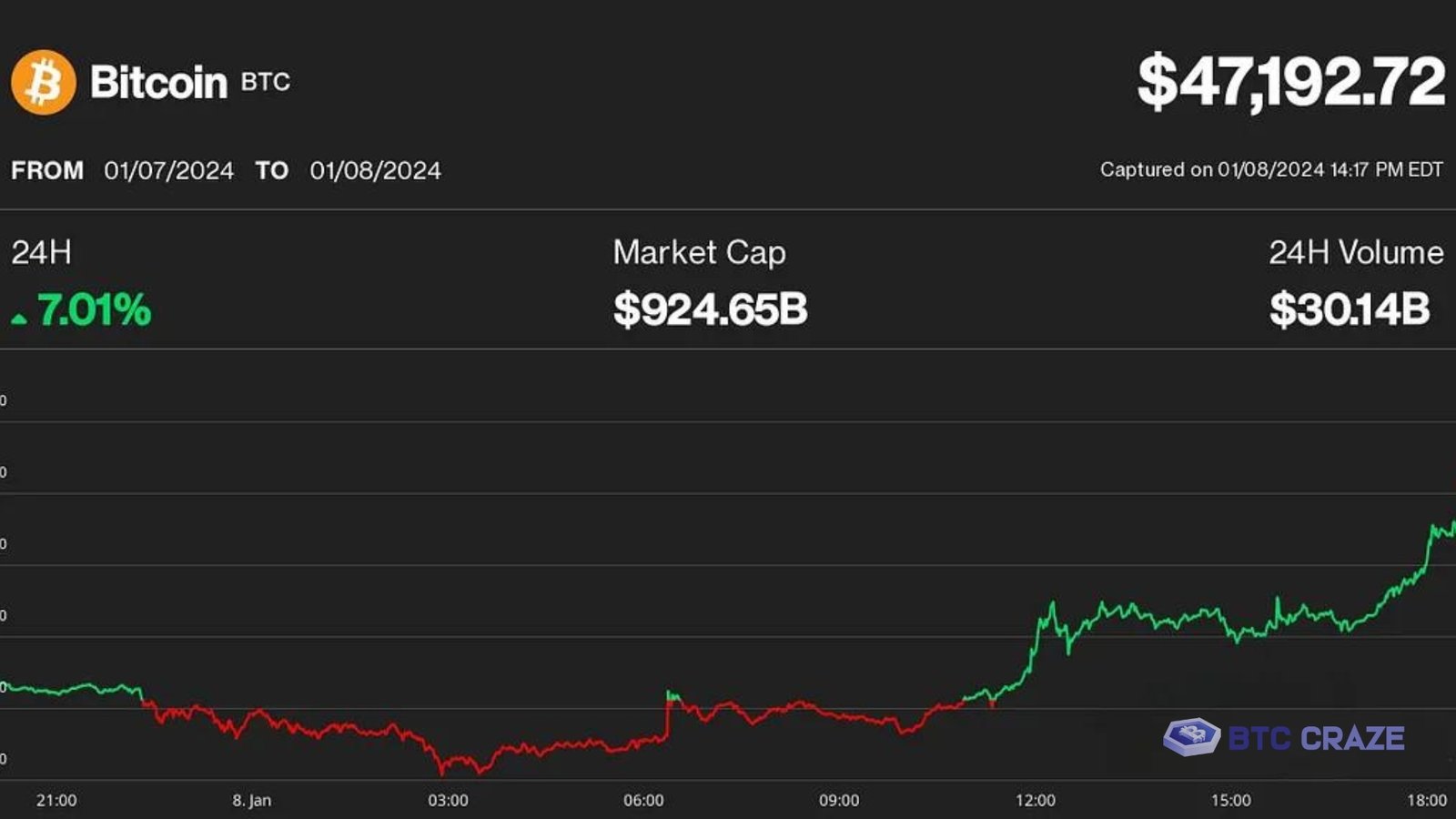

How much an asset’s price changes over a certain period is called its volatility. In the case of assets, volatility is defined as a high degree of price movements across relatively short time frames. Among Bitcoin’s most notable features is its volatility. The price of Bitcoin can go up and down far more dramatically than that of a stock or commodity in other marketplaces.Bitcoin, for example, has experienced days when its value increased or decreased by more than 10%, in contrast to more conventional financial markets such as the S&P 500 index, which usually experiences daily price fluctuations of less than 1%. Such high swings in value can cause rapid wealth accumulation or devastating loss.

Historical Examples of Bitcoin Volatility

Bitcoin’s history is replete with pivotal occasions that have demonstrated its volatile nature:

The 2017 Bull Run and Crash

Starting the year at less than $1,000, Bitcoin’s value soared to about $20,000 by December 2017. The media worldwide noticed this meteoric climb, which attracted regular people looking to buy or speculate in the market. But by the end of 2018, the price had dropped by more than 80%, to about $3,000, from its peak in early 2018. A hallmark of Bitcoin’s image as a risky investment was its boom-and-bust cycle.

March 2020 Crash

In the two days leading up to the COVID-19 epidemic, the price of Bitcoin fell from $9,000 to approximately $4,000—a 50% decline. Although this meltdown reflected market anxiety, Bitcoin recovered more quickly than most conventional assets and hit new heights by 2020’s close.

The 2021 Peak and 2022 Collapse

In 2021, Bitcoin hit a new all-time high, nearing $69,000 in November. Yet, by mid-2022, its price had collapsed by over 70%, falling below $20,000 as macroeconomic factors like rising interest rates, inflation, and global uncertainty influenced investor sentiment.

Why Is Bitcoin So Volatile?

Several factors contribute to Bitcoin’s extreme price fluctuations:

Speculation and Market Sentiment

Public opinion and speculation play a significant role in determining Bitcoin’s price. The value of Bitcoin, in contrast to more conventional assets linked to profits or actual production, is primarily determined by how people perceive its potential for growth in the future. Consequently, huge price movements can be caused by news events, whether they are positive or negative. Within hours, the price of Bitcoin can skyrocket or plummet in response to announcements of institutional adoption, regulatory crackdowns, or even the tweets of prominent personalities like Elon Musk.

Liquidity and Market Size

When contrasted with more established financial markets, Bitcoin is still in its infancy. The asset class is still less liquid than others, even if its market cap increases. Because of this, the price of Bitcoin can be significantly affected by big trades or moves made by “whales” (entities who possess significant amounts of Bitcoin). Extreme price swings can result from modest purchase or sell orders in markets with low liquidity.

Regulatory Uncertainty

There is a complicated and ever-changing regulatory landscape in which Bitcoin operates. Investors face more uncertainty as governments worldwide grapple with regulating cryptocurrencies. Suppose large markets like the US or China announce plans to limit or ban cryptocurrency trading or mining, for instance. In that case, Bitcoin’s price will fall sharply because investors worry about the cryptocurrency’s sustainability in the long run. Conversely, when Bitcoin receives positive regulatory news—like El Salvador’s decision to recognize it as legal tender—it might cause a rise among investors who hope for more widespread institutional usage and international recognition of Bitcoin.

Supply and Demand Dynamics

Due to its deflationary nature, Bitcoin has a maximum supply of 21 million coins. In a “halving” every four years, the reward for creating new blocks in Bitcoin is reduced by half. Because fewer Bitcoins will be created due to this occurrence, demand could rise due to the growing scarcity of these digital currencies. In the past, price increases have followed Bitcoin halving events, but in the future, they may cause speculative bubbles to explode.

Macroeconomic Factors

Bitcoin, like more conventional assets, is susceptible to fluctuations in the global economy as a whole. Some people use Bitcoin, like gold, as a “safe-haven” asset when the unstable economy or inflation is rampant. Despite this, Bitcoin’s usefulness as a store of value is still up for question, and the cryptocurrency often acts as a risk asset, particularly in times of rising interest rates or falling stock markets. Further uncertainty is introduced by this association with general economic situations.

Comparing Bitcoin Volatility to Traditional Assets

When compared to more conventional financial assets, Bitcoin’s volatility stands out. The concrete earnings, government support, or economic fundamentals that underpin stocks, bonds, and commodities make them more solid investments. For instance, Apple’s sales, profitability, and business outlook significantly impact the company’s stock price.

On the other hand, Bitcoin does not provide dividends or cash flows, making its value more uncertain and speculative. Gold is significantly less volatile than Bitcoin even tho both are considered valuable. Monetary policy and physical demand from industries like jewelry and manufacturing have a greater impact on its price. Still, not all investors need to be concerned about Bitcoin’s volatility. Market volatility is a boon for short-term traders, who make a killing off of sudden price changes. But these erratic swings can be terrifying for long-term investors, particularly those without a solid plan for mitigating risk.

Strategies for Managing Bitcoin’s Volatility

Investors require targeted approaches to mitigate the risks linked to Bitcoin’s volatility, given its unexpected nature:

Dollar-cost averaging (DCA)

Regardless of the price of Bitcoin, one common method is dollar-cost averaging, in which the investor buys Bitcoin at regular intervals. Because the investor purchases more Bitcoin when prices are low and less when prices are high, the overall cost is smoothed out, reducing the influence of market timing.

Portfolio Diversification

Adding a diversified portfolio to your Bitcoin investment strategy is another way to spread the risk. To mitigate the impact of Bitcoin’s unpredictable price fluctuations, investors should diversify their holdings into more conventional assets such as equities, bonds, or commodities. In this manner, if anything goes wrong in one area, it might be possible to fix it by fixing something else.

Stop-Loss Orders

Stop-loss orders are set up so that Bitcoin can be sold automatically if its price falls below a specific threshold. In the case of a sudden decline, this assists investors in mitigating their losses. While stop-loss orders are useful for protecting against losses, they expose traders to the danger of selling at transitory price drops that could be soon recovered.

Long-Term Holding (HODL)

Believers in Bitcoin’s long-term worth often employ the “HODL” approach, an acronym for “Hold On for Dear Life,” to protect their investment. HODLers believe that Bitcoin’s price will climb in the long run regardless of how the price moves in the short term.

Conclusion

Bitcoin’s volatility distinguishes it. The value fluctuations reflect a new asset class’s adoption, regulatory uncertainty, and speculative actions. Volatility presents risks and opportunities for those who can navigate it. Market sentiment, macroeconomic factors, and Bitcoin’s supply dynamics will continue to affect price volatility. The crypto market is a rollercoaster, but those who understand and manage volatility will win. But any promising possibility is risky.

Also Read: Bitcoin Drying Up Exchanges, 22,647 BTC Removed In 7 Days

FAQs

-

Why is Bitcoin so volatile compared to other financial assets?

Since Bitcoin is still a new asset class, its market is highly dependent on speculation and general market mood, making it more susceptible to extreme price swings. Bitcoin is decentralized and its value is determined by market forces rather than any underlying corporation or government support. Wild price swings are caused in part by variables such as poor liquidity, regulatory uncertainty, and its restricted supply.

-

What are the main factors that drive Bitcoin’s price fluctuations?

Several factors influence Bitcoin’s volatility, including:

- Speculation and market sentiment (news, tweets, and public perception)

- Liquidity (lower compared to traditional markets, making large trades more impactful)

- Regulatory uncertainty (evolving government policies around the world)

- Supply and demand dynamics (such as halving events that reduce new Bitcoin supply)

- Macroeconomic factors (inflation, interest rates, and global market trends)

-

Is Bitcoin’s volatility likely to decrease over time?

Like other assets that have steadied over time, Bitcoin’s volatility may progressively reduce as it becomes older and gains more widespread adoption. Possible solutions to lessen the impact of wild price fluctuations include more institutional investment, better liquidity, and more transparent laws. Nevertheless, Bitcoin is still a young and revolutionary technology, therefore its value will fluctuate more than that of more established assets for the time being.

-

How can investors manage the risks associated with Bitcoin’s volatility?

Investors can manage Bitcoin’s volatility using strategies like:

- Dollar-cost averaging (DCA): Investing a fixed amount regularly to reduce the impact of short-term price swings.

- Portfolio diversification: Balancing Bitcoin with other traditional and stable assets.

- Stop-loss orders: Setting automatic sell triggers to limit losses during significant downturns.

- Long-term holding (HODLing): Trusting in Bitcoin’s long-term potential and riding out short-term volatility.

-

Is Bitcoin’s volatility good or bad for investors?

The unpredictability of Bitcoin prices presents both opportunities and threats. Volatility is an opportunity for short-term traders to capitalize on quick price swings. But if not handled correctly, it can cause long-term investors worry and substantial losses. Bitcoin has long-term growth potential, but it takes careful preparation and risk tolerance to ride out the inevitable ups and downs.