The advent of cryptocurrency has also profoundly affected the Chinese financial sector. It would be a shame to gloss over China’s unconventional stance on digital currencies while discussing the world’s most famous cryptocurrencies, such as Bitcoin and Ethereum. Here, we have “China Coin” (or, more precisely, the Digital Yuan), the CBDC, or Digital Currency Electronic Payment, the official name for China’s central bank digital currency. China is setting itself apart from decentralized digital assets with this excursion into the realm of state-backed cryptocurrency.

Learn about China Coin Crypto in this in-depth essay that will answer all your questions and more. We’ll look at its features, compare it to other cryptocurrencies, discuss its worldwide implications, and more.

To what does the China Coin Refer

Despite what the name “China Coin” might lead you to believe, this is not a decentralized cryptocurrency reminiscent of Bitcoin. The Digital Yuan (e-CNY), the digital currency controlled by the Chinese government, is what it refers to. The People’s Bank of China (PBoC) is in charge of the Digital Yuan, officially established as part of China’s Central Bank Digital Currency (CBDC) project. It is a digital representation of the Renminbi, the money of China.

China has been working on the Digital Yuan since 2014, and the country’s ambitions to become a leader in the digital currency area have been scaled up in recent years. Unlike Bitcoin and Ethereum, decentralized and run on peer-to-peer networks without central authority, the Digital Yuan operates on a centralized blockchain that the Chinese government controls.

Key Features of the Digital Yuan

State-backed and Centralized Control

The Digital Yuan differs from decentralized cryptocurrencies because it is issued and managed by the People’s Bank of China. To ensure total control over the circulation of the Digital Yuan, the government may monitor and record all transactions utilizing the currency.

Blockchain-Based, But Not Decentralized

The Digital Yuan uses blockchain technology; however, it is not a decentralized network. A permission blockchain, in contrast, allows participation from only a subset of the population. Cryptocurrencies, such as Bitcoin, stand in stark contrast since they enable transaction participation by anybody with processing capacity.

Digital Payments and Wallets

The Digital Yuan aims to facilitate efficient and frictionless digital payments. Both consumers and companies can access it, and it can be stored in a digital wallet. To make a transaction, a smartphone app, like Alipay or WeChat Pay, can be used.

Offline Usability

The Digital Yuan’s capacity for offline transactions is one of its standout advantages. This makes the money useful in areas with spotty internet service or when the power goes out, as users can still make payments even when they’re not online.

How Does the Digital Yuan Compare to Other Cryptocurrencies?

In sharp contrast to Bitcoin and Ethereum, which are decentralized cryptocurrencies, there is the Digital Yuan. Check out this side-by-side comparison:

Decentralization vs. Centralization

No one entity has power over Bitcoin and Ethereum because they are decentralized. The network participants, miners, or validators ensure blockchain security. However, the Chinese government controls the digital yuan’s issues, transactions, and data monitoring, making it centralized.

Privacy

Since Bitcoin and similar decentralized cryptocurrencies are pseudonymous, no one’s actual identity is ever associated with their Bitcoin transactions. But you can’t stay anonymous with the Digital Yuan. There are legitimate worries regarding data privacy and surveillance because the Chinese government can track all transactions.

Use Case and Adoption

At their inception, Bitcoin and Ethereum served as substitutes for conventional fiat money (Bitcoin) and infrastructure for decentralized apps (Ethereum). But the Digital Yuan, essentially just a digital rendition of the Chinese Renminbi, is an expansion of the current fiat system.

Global Impact

Although China may have plans to promote the Digital Yuan internationally, its current focus is on internal use, in contrast to Bitcoin’s global user base and asset class. If the Digital Yuan takes off, it would cause a stir in international trade and threaten the dollar’s hegemony, particularly in areas where China’s economy is particularly powerful.

Potential Global Implications of the Digital Yuan

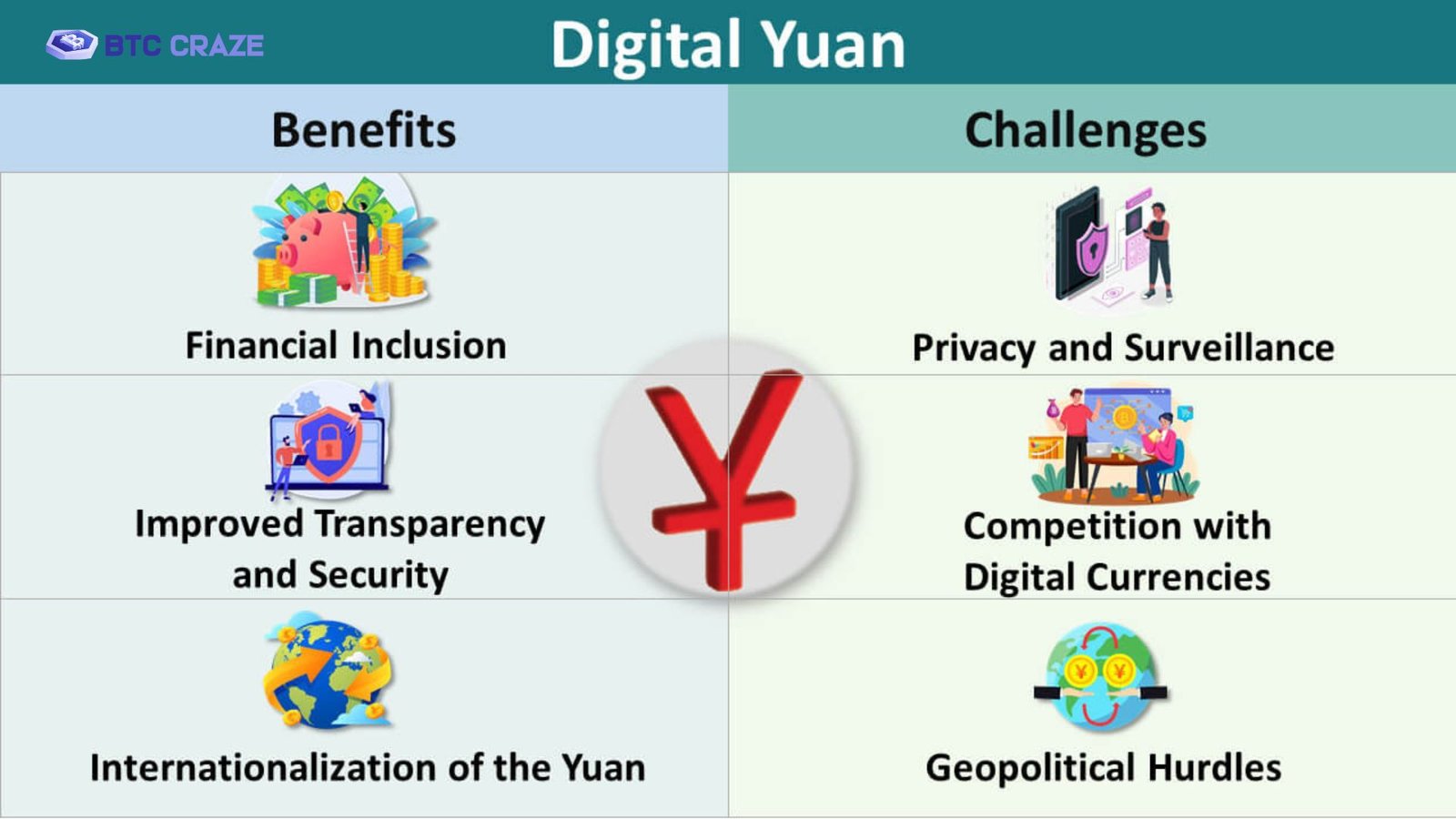

There are possible worldwide ramifications for China’s Digital Yuan beyond its status as a technical innovation. The possible global effects are as follows:

International Trade

The Digital Yuan could facilitate cross-border trade, particularly between China and its trading partners in Asia, Africa, and beyond. It could provide an alternative to the US dollar in international settlements, reducing China’s dependency on the US financial system and increasing the Renminbi’s prominence in global trade.

Challenge to US Dollar Hegemony

When it comes to reserve currencies, the US dollar reigns supreme. But in areas where China’s Belt and Road Initiative (BRI) is heavily present, the dominance of the dollar could be progressively eroded if China’s quest for the Digital Yuan for international trade is successful.

Monetary Policy Control

With the Digital Yuan, the Chinese government can manipulate the currency like never before. The ability to monitor all transactions in real-time allows the government to swiftly manage inflation, fiscal policy, and the money supply. Money laundering, tax evasion, and other forms of criminal financial activity could be better tackled with this.

Financial Inclusion

People in rural China who don’t have easy access to traditional banking could be able to use the Digital Yuan to get the financial services they need. Because it is digital, users can use their cellphones to make purchases and have access to services even in places without a bank.

Also Read: Gold Backed Crypto Coins: The Future of Safe Investment

Final Thoughts

A sea change has occurred in the world of international finance with China’s foray into digital money, the Digital Yuan. Even though it isn’t technically a cryptocurrency, China’s state-backed Digital Yuan has the potential to revolutionize online payments in the country and beyond. Its distinctive characteristics, government oversight, and centralization make it an effective instrument for monetary regulation; yet, it also begs the issues of privacy and international monetary influence. Pay close attention to the effects of the Digital Yuan as it evolves, both in China and beyond.

FAQs

1. Is the Digital Yuan a cryptocurrency like Bitcoin?

Unlike Bitcoin, the Digital Yuan does not function as a cryptocurrency. In contrast to Bitcoin’s decentralized blockchain, which allows for unlimited user transactions, China’s Digital Yuan is subject to strict government oversight.

2. Can foreigners use the Digital Yuan?

The Digital Yuan is usable by non-Chinese citizens. People from all over the world were able to use the Digital Yuan during big events like the Beijing 2022 Winter Olympics. Its broad acceptance on a global scale, though, is in its infancy.

3. Is the Digital Yuan anonymous?

No, you can’t stay anonymous with the Digital Yuan. Every every Digital Yuan transaction is traceable and observable by the Chinese authorities. Although users’ anonymity is preserved to a certain extent, the money is structured such that authorities can monitor transactions to forestall illegal activity.

4. How can I get Digital Yuan?

Buying Digital Yuan is now only possible through official channels, such some of China’s largest banks or by taking part in experiments supported by the government. Digital wallets offered by banks and other financial institutions allow users to keep the currency that is issued and distributed by the People’s Bank of China.

5. Will the Digital Yuan replace cash in China?

It is highly improbable that digital currency would soon supersede physical currency, even though the Digital Yuan is meant to work in tandem with current payment systems like cash. Nonetheless, it aligns with China’s larger objective of shifting toward a digital and trackable economy, which aims to decrease dependence on currency.