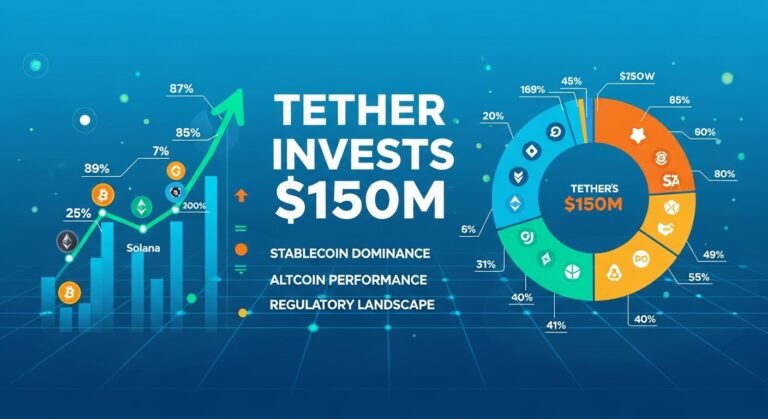

Crypto Market Update: Tether Invests $150M in Gold.com the crypto market update has taken an unexpected turn as Tether, the issuer of the world’s largest stablecoin, announced a significant $150 million investment in Gold.com. The move highlights a broader strategic shift toward asset diversification and signals a deeper relationship between digital assets and traditional safe-haven investments. At a time when the cryptocurrency market continues to navigate volatility, regulatory scrutiny, and evolving investor sentiment, Tether’s latest decision may reshape how stablecoin issuers manage reserves and hedge risk.

This development arrives amid growing interest in gold-backed assets, stablecoin reserves, and alternative investment strategies within the digital finance ecosystem. The decision to double down on a gold-focused venture demonstrates Tether’s commitment to strengthening its financial position while appealing to investors seeking stability. As global markets face economic uncertainties, the convergence of digital currency and precious metals could represent a pivotal moment for both sectors.

In this comprehensive crypto market update, we explore the motivations behind Tether’s investment, its potential impact on the broader crypto industry, and what it means for investors, regulators, and the future of stablecoins.

Crypto Market Update Tether Invests $150M

The crypto market update surrounding Tether’s investment has sparked discussions across the financial sector. Gold.com, known for its focus on precious metal investments and digital access to gold, offers a bridge between traditional assets and modern technology-driven markets. Tether’s $150 million stake suggests a long-term strategy aimed at strengthening reserve diversification.

Stablecoin issuers, especially those managing large circulating supplies, face increasing scrutiny regarding reserve composition. By investing in a gold-focused platform, Tether is effectively expanding its exposure to tangible assets. This move aligns with the broader trend of digital asset firms integrating traditional financial instruments into their portfolios to reduce risk and improve credibility.

Gold has historically been considered a safe-haven asset during periods of economic instability. In the context of this crypto market update, Tether’s decision reflects a desire to anchor part of its reserves in an asset known for long-term value preservation. The investment could also serve as a hedge against currency devaluation and global financial turbulence.

The Role of Gold in Stablecoin Reserves

Within the crypto market update, one of the most important aspects of Tether’s decision is the increasing role of gold in stablecoin reserve strategies. Traditionally, stablecoins like USDT have relied heavily on cash, cash equivalents, and short-term government securities. However, incorporating gold introduces a new layer of diversification.

Gold-backed strategies can enhance investor confidence by adding a non-correlated asset to the reserve mix. In times of market downturns, gold often retains or increases its value, providing a stabilizing effect. For Tether, this could mean greater resilience during periods of crypto market volatility.

This approach also aligns with a growing trend among digital asset companies to explore real-world asset integration. The concept of linking blockchain technology with tangible assets like gold is gaining traction, particularly as investors seek more stable investment options.

How the Investment Reflects Broader Crypto Market Trends

The Shift Toward Real-World Assets

The latest crypto market update highlights a major industry trend: the integration of real-world assets (RWAs) into blockchain ecosystems. From tokenized real estate to gold-backed tokens, the industry is increasingly looking beyond purely digital assets.

Tether’s investment in Gold.com underscores this movement. By aligning itself with a gold-focused platform, Tether is positioning itself at the intersection of traditional finance and decentralized technology. This shift reflects changing investor preferences, as many market participants now seek assets with intrinsic value.

The rise of tokenized commodities, asset-backed tokens, and hybrid financial products is reshaping the landscape. The crypto market update indicates that companies like Tether are adapting to these changes by expanding their reserve strategies.

Market Sentiment and Investor Confidence

Investor sentiment plays a crucial role in the cryptocurrency market, and Tether’s move could influence perceptions of stability and trust. Stablecoins serve as the backbone of trading activity, providing liquidity and acting as a bridge between fiat currencies and digital assets.

In this crypto market update, Tether’s investment signals confidence in traditional safe-haven assets. This could reassure investors concerned about reserve transparency and long-term stability. By diversifying into gold-related ventures, Tether may be addressing both regulatory concerns and market expectations.

The move also highlights the growing importance of financial transparency and reserve backing in the stablecoin sector. As regulators worldwide tighten oversight, stablecoin issuers are under pressure to demonstrate robust and diversified reserve structures.

Potential Impact on the Stablecoin Market

Increased Competition Among Stablecoin Issuers

The crypto market update surrounding Tether’s investment may prompt other stablecoin issuers to reconsider their reserve compositions. Competitors could follow suit by exploring alternative assets such as gold, commodities, or tokenized real estate.

This potential shift could lead to greater innovation within the stablecoin ecosystem. As issuers seek to differentiate themselves, reserve diversification may become a key selling point. Investors may begin to evaluate stablecoins based not only on liquidity but also on the quality and diversity of their backing assets.

Regulatory Implications

Regulatory scrutiny remains a defining factor in the crypto market update. Stablecoins have attracted attention from financial authorities worldwide, with concerns ranging from systemic risk to consumer protection. Tether’s investment in a gold-focused platform could be interpreted as a proactive step toward regulatory alignment. By incorporating tangible assets into its ecosystem, Tether may be aiming to strengthen its position in future regulatory discussions.

However, the move also raises questions about how regulators will treat stablecoins backed by a mix of traditional and alternative assets. The crypto market update suggests that regulatory frameworks may need to evolve to accommodate these hybrid financial models.

The Intersection of Gold and Cryptocurrency

Historical Relationship Between Gold and Digital Assets

The crypto market update also revives the long-standing debate over the relationship between gold and cryptocurrency. Both assets are often viewed as hedges against inflation and economic uncertainty.

Gold has served as a store of value for thousands of years, while Bitcoin and other cryptocurrencies are relatively new entrants. Despite their differences, both assets share certain characteristics, such as limited supply and resistance to centralized control. Tether’s investment highlights a growing trend toward combining the strengths of both asset classes. By linking stablecoin reserves to gold-related ventures, the company is effectively blending traditional financial security with modern digital infrastructure.

The Rise of Gold-Backed Digital Assets

Another key theme in this crypto market update is the increasing popularity of gold-backed tokens. These digital assets represent ownership of physical gold stored in secure vaults, offering investors the benefits of both gold and blockchain technology.

Gold-backed tokens provide transparency, liquidity, and ease of transfer, making them attractive to modern investors. Tether’s investment in Gold.com could potentially accelerate the adoption of such products.

The integration of gold into the digital asset ecosystem may also appeal to institutional investors who are cautious about pure cryptocurrency exposure. By offering a familiar asset in a digital format, companies can attract a broader range of participants.

What This Means for the Broader Crypto Industry

Strengthening the Role of Stablecoins

The crypto market update suggests that stablecoins are evolving beyond simple dollar-pegged tokens. They are becoming sophisticated financial instruments with diversified reserves and strategic investments.

Tether’s move into gold-related ventures demonstrates the growing complexity of the stablecoin market. As issuers expand their portfolios, stablecoins may begin to resemble traditional financial institutions in terms of asset management and investment strategies. This evolution could strengthen the role of stablecoins within the global financial system, making them more resilient and attractive to institutional investors.

Implications for Crypto Adoption

The integration of traditional assets like gold into the crypto market could accelerate mainstream adoption. Many investors remain skeptical of purely digital assets, viewing them as speculative or volatile.

By linking stablecoins to tangible assets, companies like Tether may bridge the gap between traditional finance and blockchain-based systems. This crypto market update indicates that the industry is moving toward a more hybrid model, combining the best of both worlds. Such developments could encourage greater participation from institutional investors, governments, and traditional financial institutions.

Conclusion

The latest crypto market update surrounding Tether’s $150 million investment in Gold.com marks a significant moment for both the stablecoin sector and the broader digital asset industry. The move reflects a strategic shift toward reserve diversification, greater transparency, and stronger ties with traditional financial assets.

By embracing gold-related ventures, Tether is positioning itself at the forefront of a growing trend that merges digital currency with tangible assets. This approach could enhance investor confidence, address regulatory concerns, and reshape how stablecoins operate in the future.

As the cryptocurrency market continues to evolve, the integration of real-world assets is likely to play a central role. Tether’s investment may serve as a blueprint for other stablecoin issuers, signaling a new era of hybrid financial models that combine the stability of traditional assets with the innovation of blockchain technology.

FAQs

Q: Why did Tether invest $150 million in Gold.com?

Tether’s investment is part of a broader strategy to diversify its reserves and strengthen its financial stability. By gaining exposure to gold-related assets, the company aims to reduce reliance on traditional cash-based reserves and improve investor confidence. The move also aligns with industry trends that emphasize real-world asset integration into the cryptocurrency ecosystem.

Q: How does gold benefit stablecoin reserves?

Gold is widely regarded as a safe-haven asset that retains value during economic downturns. By incorporating gold into stablecoin reserves, issuers can reduce risk and improve resilience against market volatility. This diversification strategy can enhance trust among investors and regulators, especially during uncertain economic conditions.

Q: What does this crypto market update mean for other stablecoins?

Tether’s decision could influence competitors to explore similar reserve diversification strategies. Other stablecoin issuers may consider adding alternative assets like gold, commodities, or tokenized real estate to their reserves. This could lead to increased innovation and competition within the stablecoin market.

Q: Will this investment affect the price of cryptocurrencies?

While the investment itself may not directly impact cryptocurrency prices, it could influence market sentiment. Greater confidence in stablecoin reserves can improve liquidity and stability across the crypto market, which may indirectly support price stability and investor participation.

Q: How does this move reflect broader trends in the crypto industry?

The investment highlights the growing importance of real-world assets within the digital finance ecosystem. As the crypto industry matures, companies are increasingly integrating traditional assets like gold into blockchain-based platforms. This trend reflects a shift toward hybrid financial models that combine the strengths of both traditional and digital markets.