The market woke up to Crypto News Today that feels like a broken record: BTC consolidates in a tight range while traders wrestle for control around the psychologically towering $100k level. After months of dramatic upside and sharp shakeouts, Bitcoin’s price is now coiling—building energy, frustrating breakout chasers, and rewarding disciplined risk management.

Consolidation at a round number this colossal is more than a line on a chart; Crypto News Today it’s a narrative battleground where expectations, leverage, and liquidity meet.In this deep-dive, we’ll map the battlefield. We’ll look at how spot flows, derivatives positioning, and on-chain metrics are shaping the current range. We’ll explore whether BTC dominance can keep absorbing capital while altcoins tease a rotation.

We’ll put today’s chop in the context of macro forces—U.S. dollar index (DXY) moves, Treasury yields, and possible Fed rate cuts—and we’ll outline the scenarios that could propel Bitcoin decisively above $100,000 or send it searching for support below. If you’re trying to make sense of the noise and position smartly for the next leg, this is the guide.

Why $100,000 Matters More Than Other Round Numbers

The $100k figure is not just an arbitrary milestone. In markets, round numbers act like magnets because they cluster stop orders, take-profit targets, and psychological anchors. For Bitcoin, six digits symbolize mainstream validation—an inflection point where legacy capital can justify larger allocations and retail sentiment can swing from cautious to euphoric. The result is a thick band of liquidity on both sides of the level.

Psychological Anchoring And Options Gravity

Options markets amplify that magnetism. As open interest stacks around $100k strike prices, options gamma dynamics can compress or expand spot volatility. Dealers hedging flows around these strikes often create self-reinforcing price action: a slow squeeze higher on upward drift and a quick air-pocket if price slips under hedging thresholds. This helps explain why BTC consolidates despite frequent intraday feints.

The Liquidity Map Where Orders Are Hiding

Order books reveal stepped sell walls slightly above $100k and chunky bid ladders just below, creating a corridor of back-and-forth skirmishes. These structures shift rapidly as high-frequency market makers fade momentum and hunt liquidity sweeps, but the net effect is a range where breakouts must be decisive to stick.

Spot Buyers vs. Leverage: Who’s Really In Control

When Crypto News Today headlines scream about Bitcoin stalling, it’s tempting to blame “weak demand.” The truth is more nuanced. Spot demand and leverage often push in different directions.

Spot Inflows The Quiet Accumulators

Institutional allocators and high-net-worth buyers continue to trickle into spot Bitcoin—particularly through spot Bitcoin ETF products and regulated broker-dealer channels. Crypto News Today: These flows tend to be price-insensitive and patient, favoring dollar-cost averaging and rebalance windows. Their steady bid underpins the higher range, reducing crash risk even when sentiment turns shaky.

Derivatives: The Volatility Engine

Meanwhile, the derivatives market—perpetual futures, quarterlies, and options—supplies the fireworks. Elevated funding rates signal crowded longs, while negative funding can hint at exhaustion or defensive hedging. Today’s regime features whipsawing funding near neutral as open interest rebuilds after each flush. That speaks to a tug-of-war rather than unilateral control. In short: spot sets the floor, leverage tests the ceiling.

On-Chain Metrics What The Network Is Whispering

On-chain data is a window into conviction. As BTC consolidates, several on-chain metrics are worth watching.

Long-Term Holders And Dormancy

Long-term holder supply remains near cycle highs, a sign that strong hands are not distributing aggressively into $100k. Coin dormancy—how long coins remain unmoved—leans elevated, consistent with longer-horizon conviction. When these cohorts start to realize profits en masse, tops can form; their restraint so far supports the consolidation thesis.

Exchange Balances And Stablecoin Dry Powder

Exchange reserves of BTC have stabilized at historically low ranges, suggesting limited ready-to-sell supply. At the same time, stablecoin market cap growth provides dry powder for risk-on, especially if BTC dominance cools and altcoin rotation gains traction. Watch stablecoin inflows to exchanges; spikes often precede impulsive moves.

Macro Backdrop Dollar, Rates, And The Risk Cycle

Crypto doesn’t trade in a vacuum. The path through $100k will likely rhyme with macro currents.

DXY, Yields, And Liquidity Tide

A softer U.S. dollar index (DXY) and easing Treasury yields typically benefit risk assets, including Bitcoin. If bond market volatility calms and Fed rate cuts approach, the liquidity tide can lift BTC’s boat. Conversely, a hawkish repricing or growth scare can sap appetite, deepening the range or triggering downside liquidity sweeps.

Equities Correlation Fair-Weather Friends

BTC’s correlation with U.S. equities ebbs and flows. During expansions, growth-style rallies can coincide with crypto strength, but stress regimes remind us that Bitcoin is still a high-beta asset in the eyes of many allocators. Keeping an eye on earnings season beats and VIX spikes offers early clues about cross-market sentiment.

Technical Picture The Anatomy Of A Coil

If you’re wondering why BTC consolidates instead of trending, the chart provides a straightforward answer: impulse, pullback, range, repeat.

Moving Averages, RSI, And Market Structure

Price has chopped around key moving averages on the 4-hour and daily timeframes, flipping them from support to resistance and back. RSI oscillates in the mid-range, refusing to deliver a clear overbought or oversold signal. The higher-timeframe market structure remains bullish while the lower-timeframe structure carves a rectangle—with failed breaks in both directions.

Support And Resistance That Matter

Immediate resistance sits in the low-hundreds just above the century line, where prior wicks died out and supply absorbed. First support spans the high-$90ks down to the mid-$90ks—zones that hosted consolidation before the last leg higher. Deeper levels coincide with volume nodes from earlier bases; if those hold on a retest, the bull structure remains intact.

Scenarios From Here What Breaks The Deadlock

With Crypto News Today highlighting the stalemate, traders want to know what unlocks the next trend. Two clean scenarios dominate the board.

Bullish Breakout: Acceptance Above Six Digits

A breakout with high volume, compressing order book offers, and rising spot market participation would increase the odds of acceptance above $100k. Follow-through requires more than a wick; look for daily closes in six digits, funding rates that don’t spike into unsustainable territory, and an orderly build in open interest. In this case, momentum traders could pile in while long-term holders continue to sit tight, creating a path toward price discovery.

Bearish Fade: Squeeze And Reversion

Alternatively, repeated failures near $100k could embolden shorts, especially if options dealers lean short gamma into options expiry. A swift rejection that cuts through nearby supports, coupled with rising liquidations and negative funding, might push BTC into a deeper pullback. As long as higher-timeframe bases hold—and spot Bitcoin ETF inflows don’t reverse—such a drawdown would likely be corrective rather than a trend change.

Altcoin Rotation Will Liquidity Spill Over

No Crypto News Today update is complete without asking whether altcoins will steal the show. Historically, prolonged BTC consolidates phases set the table for altcoin rotation as traders search for higher beta.

ETH And The Blue-Chip Complex

If ETH narratives heat up—think ETH ETF flows, staking dynamics, or L2 throughput—blue-chips can attract capital without undermining Bitcoin’s structure. A measured drop in BTC dominance during steady BTC price action is the classic rotation signature. Sudden dominance declines during BTC drawdowns, on the other hand, are usually risk-off.

Gaming, AI, And Infra: The Narrative Lanes

Beyond majors, AI-adjacent tokens, gaming ecosystems, and infrastructure plays often respond quickly to liquidity shifts. Traders should track developer activity, total value locked (TVL), and network-specific catalysts rather than chasing heat maps. Rotation is healthiest when it’s funded by fresh stablecoin inflows, not panic profit-taking.

How Pros Survive The Chop

Ranging markets punish impatience. With BTC consolidates and headlines swirling, the pros fall back on process.

Define The Trade, Not The Outcome

Pros don’t predict; they prepare. Define your invalidations, size for volatility, and accept that ranges produce false breaks. If you trade futures, monitor funding rates and avoid stacking leverage into obvious levels. If you invest spot, let dollar-cost averaging do the heavy lifting and avoid emotionally buying every green candle.

Read The Tape, Not Just The Tweets

Combine order book cues, liquidation heatmaps, and on-chain flows with simple structure: higher highs and higher lows for momentum, failed reclaims for fades. Remember: the first breakout isn’t always the real one. Waiting for acceptance—multiple closes and volume confirmation—reduces whipsaw risk.

Also Read: OnePay Crypto Trading Bitcoin & Ethereum Launch

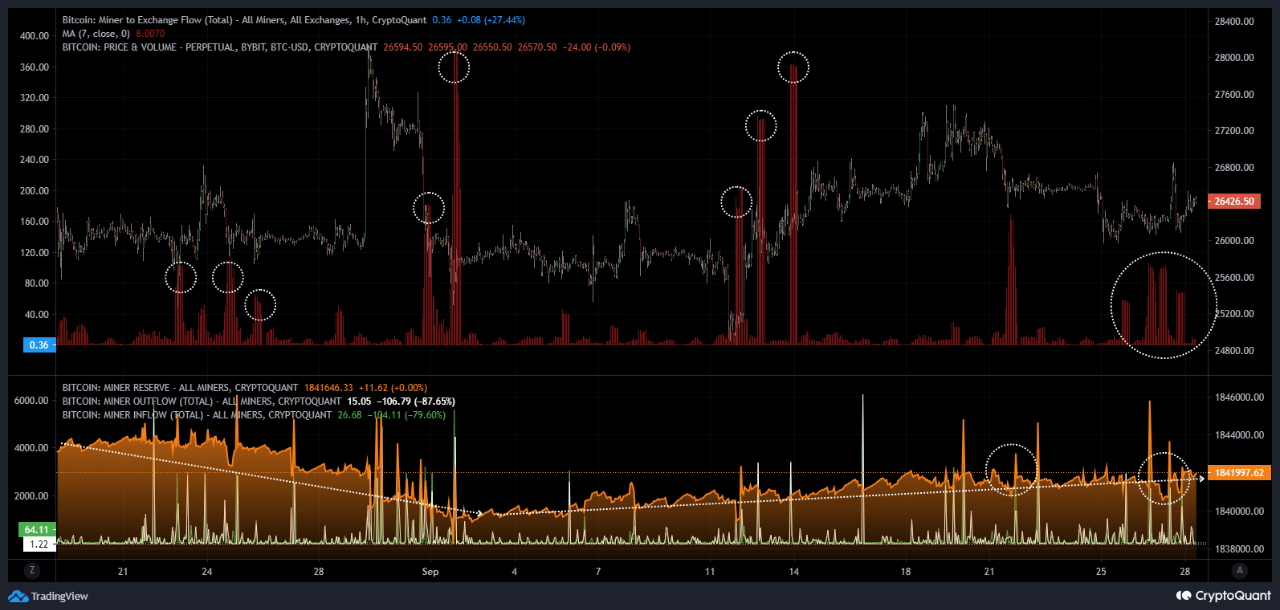

Miner Behavior And Supply Dynamics

Every cycle, miners and their balance sheets quietly shape supply.

Post-Halving Adjustments

Following each halving, miners reassess breakevens, hedge production via futures, and occasionally raise capital. Periods when miners increase exchanges’ BTC deposits can add incremental sell pressure; when they hoard inventory, they’re voting for future upside. Today’s miner flows look more tactical than directional, aligning with the broader consolidation theme.

Hashrate And Security

A resilient hashrate underpins network security and investor confidence. It also tends to trend with price at a lag, reflecting miners’ reinvestment cycles. Sustained hashrate growth during consolidation suggests miners remain constructive even as traders argue over $100k.

What To Watch This Week

The line between dull range and explosive move is thin. Here’s what typically tilts it.

Funding, OI, And Liquidations

If funding rates grind higher while price stalls, risk of a long squeeze rises. Conversely, if funding stays tame and open interest builds on a steady advance, the market can support a real breakout. Keep an eye on liquidation clusters just above and below the range; once triggered, they can accelerate the move.

ETF Inflows And Macro Prints

Daily ETF flows are a clean read on institutional spot appetite. Pair that with upcoming CPI, jobs data, or central bank commentary to gauge whether macro will add tailwinds or headwinds. A dovish surprise can light the fuse above $100k; a hawkish jolt can press the lower boundary.

Consolidation Is The Tax You Pay For Trend

For all the noise, the story is simple: Crypto News Today shows BTC consolidates at a monumental level while market structure remains constructive. Consolidation is the market’s way of testing conviction, balancing supply and demand, and shaking out the impatient before the next expansion. Whether the next chapter is a clean break into six-figure price discovery or a deeper retest of support, disciplined strategies will outlast the headlines.

As traders fight to control the $100k level, the smart move is to respect the range, track the signals that actually move price, and be ready for acceptance when it shows. The market is coiling. Don’t let the chop write your plan.

Conclusion

Bitcoin’s battle at $100,000 is equal parts psychology, liquidity, and positioning. Spot inflows and long-term holder conviction underpin the floor; derivatives and options shape the edges; macro winds decide whether the sails fill or slacken. In this environment, patience and process beat predictions. If Crypto News Today feels repetitive, that’s because ranges are designed to be boring—until they aren’t. When the move comes, it tends to reward the traders who prepared for confirmation rather than guessing its direction.

FAQs

Q: Why does Bitcoin keep stalling near $100k?

Round numbers concentrate liquidity, stop orders, and options exposure. That clustering makes $100k a magnet, encouraging back-and-forth price action until one side overwhelms the other with volume and conviction.

Q: What signals would confirm a real breakout above $100k?

Look for increasing spot market participation, rising volume on up-moves, restrained funding rates, and sustained daily closes above six digits. A healthy build in open interest without cascading liquidations supports continuation.

Q: Could a pullback be healthy here?

Yes. If BTC consolidates for too long without acceptance, a pullback to prior support and resistance zones can reset leverage, attract fresh bids, and strengthen the base for a later breakout.

Q: How do macro factors influence Bitcoin at these levels?

A softer DXY, easing Treasury yields, and clearer Fed rate cuts expectations typically improve risk appetite, which can help Bitcoin push through resistance. The opposite mix often weighs on price.

Q: Should I rotate into altcoins during BTC’s range?

Rotation can work if BTC dominance drifts lower while BTC remains stable and stablecoin inflows rise. Chasing altcoins during sharp BTC drawdowns is riskier, as liquidity can vanish when you need it most.