Crypto Regulation 2026 Huge Excitement & Market Impact in year 2026 stands poised as a transformative milestone for crypto regulation—a development that could spark unprecedented excitement across markets, institutions, and retail investors alike. After years of uncertainty, fragmented policy responses, and legal ambiguities, regulators around the world are finally shaping coherent frameworks that seek to balance innovation with safety. As a result, digital assets are not only gaining legitimacy, but they are also becoming increasingly integrated into mainstream finance, fueling optimism and engagement across the global economic landscape. In this article, we’ll explore the anticipated regulatory shifts of 2026 and how they may electrify interest in cryptocurrency while shaping the future of blockchain economies, decentralized finance (DeFi), and institutional participation.

Drawing on major trends emerging from the United States, the European Union, Asia, and other regions, this comprehensive analysis highlights why crypto regulation in 2026 is not merely about compliance—but an inflection point that could reshape the industry’s trajectory for years to come. From stablecoin oversight to global reporting standards, this regulatory evolution will redefine how people, institutions, and governments interact with digital assets.

Crypto Regulation 2026 Huge Excitement

At its core, crypto regulation in 2026 is a reflection of years of dialog between policymakers and industry innovators. What once was a largely chaotic domain with minimal oversight is gradually giving way to robust policy frameworks designed to encourage market integrity, protect investors, and promote responsible innovation.

The Shift from Uncertainty to Clarity

By 2026, regulators across the globe are expected to move beyond reactive enforcement measures—often driven by crisis response—to proactive rules and standards that align digital assets with traditional financial regimes. Countries and regions that have historically lagged in clarity are now embracing dedicated frameworks for cryptocurrency governance, propelling excitement among investors and developers alike.

This shift is critical, because real regulation transforms cryptocurrencies from speculative instruments into recognized components of the financial ecosystem. For institutional players, this transition reduces compliance risk and elevates confidence—ultimately attracting capital that has previously stayed on the sidelines.

The United States Is A Focal Point of 2026 Regulation

The United States is expected to be one of the most impactful theaters for crypto regulation in 2026. After decades of ambiguity, U.S. policymakers are advancing major legislative efforts aimed at clarifying digital asset classifications, tax treatment, and market operations. These developments are fueling excitement among market participants and signaling a new era of regulatory confidence.

U.S. Legislative Milestones

One of the most anticipated legislative developments is the CLARITY Act, slated for intensive review in early 2026. This bill aims to clearly define how cryptocurrencies are treated under federal law, helping to resolve longstanding debates about whether digital assets are commodities or securities.

Another pivotal U.S. regulatory milestone is the GENIUS Act, already signed into law in 2025. This act establishes specific standards for stablecoins—cryptocurrencies pegged to fiat currencies like the U.S. dollar—mandating that they are backed by reliable reserves and audited routinely.

The momentum generated by these developments is driving excitement among institutional investors eager to participate in an ecosystem that promises greater regulatory clarity and safer market infrastructure.

The Importance of Clear Rules for Institutional Adoption

Clear, well-defined regulation is a necessary precondition for large-scale institutional adoption. Financial institutions, pension funds, and insurers typically avoid markets with unclear legal status due to the risk of litigation and compliance failures. The regulatory reforms expected in 2026 will help mitigate these concerns, unlocking new capital flows into digital assets and pushing cryptocurrency into the heart of modern investment portfolios.

Europe’s MiCA Framework and Widening Regulatory Influence

Across the Atlantic, the European Union’s Markets in Crypto-Assets (MiCA) regulation is reshaping how digital assets are governed within the bloc. Fully entering into effect by 2024 and expanding through 2026, MiCA provides one of the most comprehensive crypto regulatory frameworks globally, offering unified rules for service providers, issuers, and investors.

A Unified European Digital Asset Market

The strength of MiCA lies in its harmonization of crypto laws across EU member states. By 2026, many companies operating in or entering the European market will have aligned their business models with these standards. This clarity has two major effects: first, it gives a clear path for market entry, and second, it fosters investor trust by enforcing consistent rules across borders.

Driving Innovation under Regulatory Safeguards

Contrary to fears that regulation stifles innovation, MiCA both protects and enables innovation by requiring consumer safeguards without restricting technological development. For example, MiCA’s rules for issuer licensing, consumer protection, and prudential requirements help ensure projects are both compliant and competitive.

This combination of clarity and compliance in Europe is a significant reason why crypto regulation in 2026 will generate notable excitement among projects, businesses, and investors looking to establish a strong foothold in the region.

Diverse Approaches Reflect Varied Priorities

Asia’s role in the crypto regulatory picture is more diverse and nuanced compared to the unified movements seen in the U.S. and EU. Some countries are embracing digital assets with open arms, while others proceed cautiously or under strict state control.

Innovation in Regulatory Friendly Hubs

Countries like Singapore and Japan are building structured frameworks designed to attract blockchain innovation while protecting consumers and market integrity. Singapore’s licensing regimes and Japan’s defined asset classifications are examples of how regulation can coexist with growth.

Continued Caution by Large Economies

In contrast, countries such as China maintain strict prohibitions on private cryptocurrencies, while focusing on state-issued digital currencies. These differences highlight the complexity of the global regulatory landscape and underscore that crypto regulation in 2026 will not look uniform across borders.

Key Global Regulatory Themes Driving Excitement

Several overarching regulatory themes in 2026 are contributing to positive sentiment and industry anticipation:

1. Stablecoin Regulation Becoming Standard

Stablecoins are gaining clear legal frameworks in many jurisdictions, including the U.S. and Europe. This clarity boosts confidence among both individual and institutional users, as stablecoins often serve as the bridge between traditional finance and newer digital ecosystems.

2. International Information Exchange for Transparency

New reporting standards like the Cryptoasset Reporting Framework (CARF) are being implemented globally to curtail tax evasion and expose illicit activity. For instance, firms in the UK and 47 other countries must now share detailed transaction data with tax authorities.

3. Licensing Requirements for Exchanges

Countries are introducing licensing and compliance requirements for cryptocurrency exchanges and service providers, which help to legitimize operations while protecting users. This reduces market fragmentation and enhances trust.

4. Integration with Traditional Finance

Regulators are increasingly allowing traditional banking institutions to interact with digital assets within supervised frameworks, enabling banks to custody crypto, issue assets, and integrate blockchain into existing services.

Balancing Regulation with the Spirit of Decentralization

While regulation brings many benefits, the core ethos of decentralization still plays a central role in the crypto narrative. Finding harmony between legal requirements and decentralized principles remains one of the industry’s biggest challenges.

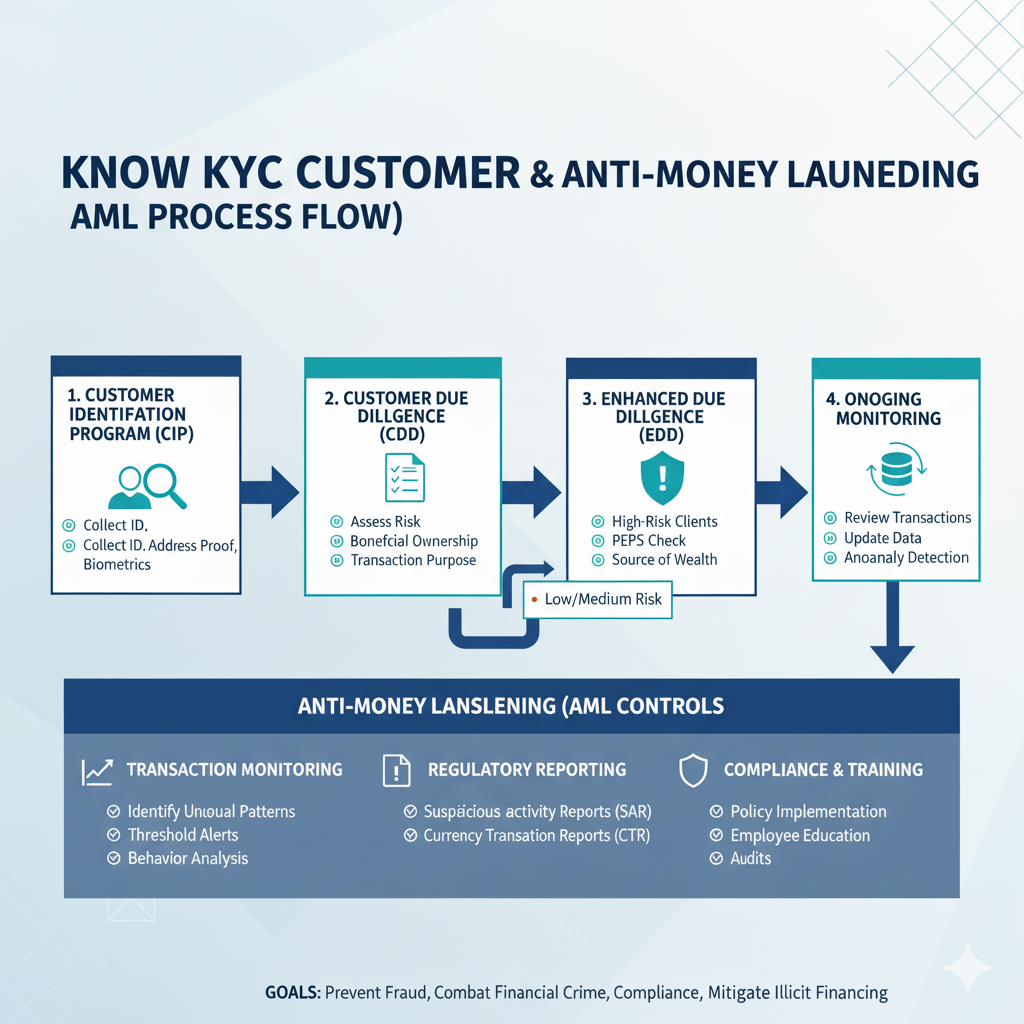

Some regulatory measures—particularly stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) mandates—could push projects toward more centralized intermediaries. This tension highlights the need for creative solutions that preserve privacy, user sovereignty, and innovative freedom even as they meet regulatory standards.

Fuels Market Adoption and Innovation

The movement from uncertainty to regulatory clarity in 2026 is not just about legal compliance—it’s a catalyst for broad market adoption, innovation, and economic integration.

Retail Participants Gain Confidence

Clear regulation empowers retail investors by providing protections against fraud, market manipulation, and other risks. This makes digital asset participation more accessible and less intimidating for everyday users, which can boost wider adoption.

Institutional Capital Enters the Market

Regulatory clarity helps institutions allocate capital with confidence. With well-defined rules for custody, stablecoin issuance, and asset classification, institutional investors are more likely to increase allocations to crypto assets.

Innovation Thrives Under Legal Certainty

Regulated environments enable innovators to build products with confidence that their efforts can scale without running afoul of unclear or shifting legal standards. This dynamic encourages deeper innovation within areas like DeFi, Web3, and tokenized real-world assets.

Conclusion

2026 is shaping up to be a defining year for crypto regulation—not just in terms of policy frameworks, but in market excitement, institutional participation, and global integration. As countries move beyond fragmented approaches and embrace coherent rules, the digital asset industry is likely to experience heightened legitimacy, broader participation, and a stronger connection to traditional financial systems.

For participants at every level—from retail traders to institutional capital allocators—the promise of real regulation brings the excitement and potential for long-term growth and stability. What once was largely uncharted territory is rapidly becoming a more predictable, transparent, and accessible frontier.

FAQs

Q. Why is crypto regulation in 2026 generating so much excitement?

2026’s regulatory push offers clarity and legitimacy to digital assets, easing compliance, attracting institutional capital, and enhancing investor protections.

Q. Which countries are leading the charge in crypto regulation in 2026?

The United States, European Union, and several Asian nations like Singapore and Japan are introducing comprehensive frameworks, while tax reporting rules expand globally.

Q. How will stablecoin regulation impact the crypto market?

Stablecoin regulation—such as the U.S. GENIUS Act—helps ensure transparency, backing, and risk management, fostering confidence and broader adoption.

Q. Can regulation hurt innovation in crypto?

If poorly designed, regulation can hamper decentralized innovation. However, balanced policies aim to protect consumers while enabling technological growth.

Q. What does crypto regulation mean for everyday investors?

Enhanced regulation offers clearer tax guidelines, greater transparency from exchanges, and protections against fraud, making crypto investing safer and more mainstream.