Epstein Ties in Early Bitcoin Investment Revealed the cryptocurrency industry has always been surrounded by stories of early adopters, anonymous founders, and unconventional investors. From cypherpunks to venture capitalists, Bitcoin’s early growth phase attracted individuals from many different backgrounds. Recently, new discussions have emerged around the topic of Epstein ties in early Bitcoin industry investment, sparking debate about how some early funding may have been connected to controversial figures.

The idea that individuals linked to high-profile scandals may have participated in early Bitcoin investments has raised questions about the history of crypto funding. While Bitcoin was originally designed as a decentralized financial system independent of traditional institutions, its development still required capital, infrastructure, and business support. This reality meant that venture capital firms, angel investors, and wealthy individuals became part of the ecosystem, especially during the early 2010s when Bitcoin was transitioning from a niche experiment into a global asset class.

The conversation around Epstein ties has therefore focused less on Bitcoin itself and more on the investment networks that helped shape the early crypto economy. It also highlights the broader issue of how capital flows into emerging technologies and the ethical considerations surrounding those investments.

Epstein Ties in Early Bitcoin Investment

In Bitcoin’s earliest years, most activity revolved around hobbyists, developers, and cryptography enthusiasts. The network grew organically, supported by open-source contributors and small online communities. However, as Bitcoin’s price began to rise and public interest increased, venture capital firms started to notice its potential.

By 2012 and 2013, Bitcoin startups began attracting funding for exchanges, payment processors, wallets, and infrastructure services. Investors saw opportunities to build the backbone of a new financial system. This period marked the transition from a purely grassroots movement to a more structured industry supported by venture capital, private equity, and institutional money.

Major investment firms and angel investors entered the space, backing companies that would later become some of the most recognizable names in crypto. These early investments helped legitimize the industry and provided the resources necessary for expansion, compliance, and global adoption.

The Role of High-Net-Worth Investors

Alongside venture capital firms, wealthy individuals also began investing in the crypto sector. Many of these investors were attracted by Bitcoin’s disruptive potential and its promise as a new store of value. Others were simply intrigued by the possibility of massive returns from an emerging asset class.

In these early stages, due diligence processes were often less rigorous than they are today. The crypto industry was still largely unregulated, and investment deals were frequently conducted through personal networks. This environment made it possible for a wide range of investors to participate, including those with controversial reputations or complex financial histories.

It is within this context that discussions of Epstein ties in early Bitcoin industry investment have emerged.

The Alleged Epstein Connections

Financial Networks and Investment Circles

Jeffrey Epstein was known for his connections to influential figures in finance, technology, and academia. He maintained relationships with numerous wealthy individuals and investment professionals. After his criminal activities became widely known, scrutiny increased around the financial networks he was associated with.

Reports have suggested that some individuals connected to Epstein may have been involved in early Bitcoin or cryptocurrency investments. These claims have typically centered around indirect connections, such as shared investment funds, mutual business associates, or overlapping financial networks.

It is important to note that such connections do not necessarily imply direct involvement or endorsement. The world of venture capital and high-finance often involves complex webs of partnerships, co-investments, and advisory roles. In many cases, investors may not be aware of every individual associated with a particular fund or deal.

The Difference Between Direct and Indirect Ties

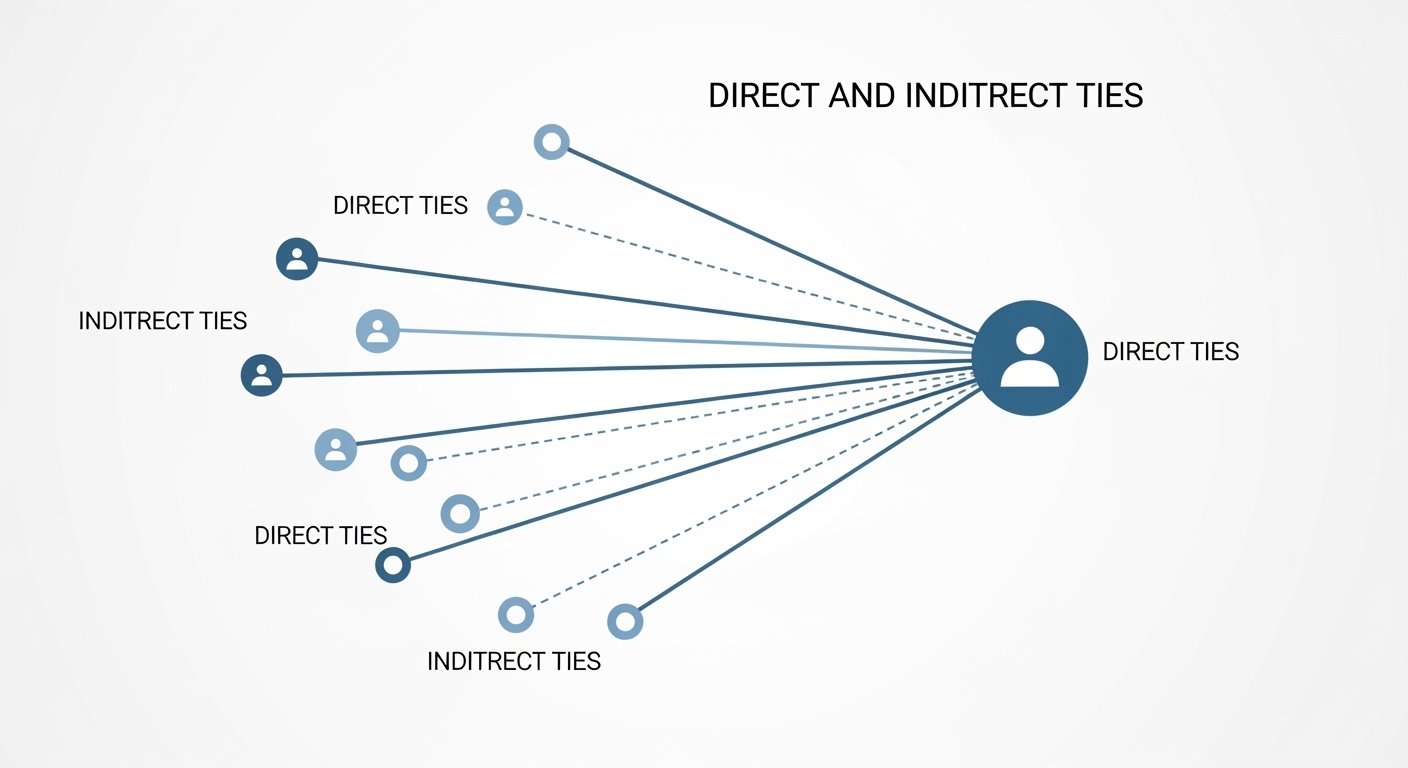

When discussing Epstein ties in the crypto sector, it is essential to distinguish between direct financial involvement and indirect associations. Direct involvement would imply that Epstein himself invested in Bitcoin companies or funds. Indirect ties, on the other hand, may refer to investment vehicles, firms, or individuals who had connections to him.

Most discussions around this topic have focused on indirect links rather than direct investments. These may include venture funds that accepted capital from investors connected to Epstein or business relationships between individuals who later became part of the crypto industry.

This distinction is crucial, as it shapes the interpretation of the issue and its impact on the broader Bitcoin ecosystem.

How Early Bitcoin Startups Were Funded

Seed Funding and Angel Investments

Early Bitcoin startups often relied on seed funding from angel investors. These investors were typically individuals with significant personal wealth who were willing to take risks on new technologies. Many were drawn from the tech industry, finance, or libertarian circles that aligned with Bitcoin’s philosophy.

Seed funding allowed startups to build basic infrastructure such as exchanges, wallets, and payment gateways. Without these early investments, Bitcoin may have remained a niche project without mainstream adoption.

The Emergence of Dedicated Crypto Funds

As Bitcoin gained traction, specialized crypto venture capital funds began to appear. These funds were designed specifically to invest in blockchain projects and digital asset companies. They played a major role in scaling the industry and attracting institutional attention.

However, because many of these funds operated in the early days of crypto, they often accepted capital from a wide range of investors. This open approach, while beneficial for growth, also meant that the origins of some investment capital were not always closely examined.

This environment created the conditions under which controversial associations could later come to light.

Media Attention and Public Reaction

The Impact of Controversial Associations

When reports of Epstein ties in early Bitcoin industry investment surfaced, they quickly attracted media attention. The cryptocurrency industry has long struggled with issues of trust, regulation, and public perception. Any association with a controversial figure inevitably raises concerns.

For some observers, these reports reinforced the perception that the early crypto industry operated in a loosely regulated environment where questionable financial actors could participate. For others, the news was less surprising, given the experimental and unregulated nature of the sector during its formative years.

Industry Responses and Clarifications

Many companies and investors have responded to these reports by clarifying their positions. Some have emphasized that any connections were indirect and that they had no direct dealings with Epstein. Others have pointed out that investment funds often include a wide range of limited partners, making it difficult to track every source of capital.

The crypto industry has also matured significantly since its early days. Today, crypto compliance, regulatory oversight, and investor screening processes are far more rigorous than they were a decade ago. This evolution has reduced the likelihood of controversial capital entering the ecosystem unnoticed.

The Broader Issue of Capital Origins in Tech

Lessons from the Traditional Tech Industry

The situation is not unique to cryptocurrency. Throughout the history of technology, startups have often accepted funding from a wide range of investors, some of whom later became controversial figures. Silicon Valley itself has experienced similar debates about the ethics of venture capital and the origins of investment funds.

In many cases, startups are primarily focused on survival and growth. They may not have the resources or knowledge to thoroughly vet every investor, especially in early funding rounds. This reality has led to ongoing discussions about the responsibilities of entrepreneurs and venture capital firms.

Ethical Considerations in Crypto Investment

The issue of ethical investment in cryptocurrency has become increasingly important as the industry matures. Institutional investors, public companies, and government entities are now involved in the crypto market. As a result, there is greater emphasis on transparency, due diligence, and responsible investment practices.

The conversation around Epstein ties has therefore become part of a larger discussion about how the crypto industry can maintain credibility and integrity.

How the Crypto Industry Has Changed Since the Early Days

Increased Regulation and Oversight

One of the most significant changes in the crypto industry has been the introduction of regulatory frameworks. Governments around the world have implemented rules for exchanges, custodians, and investment firms. These regulations often include strict Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements.

Such measures make it more difficult for controversial figures to invest anonymously in crypto projects. They also provide greater transparency for regulators and the public.

Institutional Participation and Professional Standards

The entry of institutional investors has also raised the standards of the industry. Large financial firms typically conduct extensive due diligence before investing in any project.

This process includes background checks, financial audits, and legal reviews. As a result, the modern crypto industry operates under much stricter standards than it did during the early Bitcoin era.

The Importance of Context in Early Bitcoin Investment

When discussing Epstein ties in early Bitcoin industry investment, it is important to consider the context of the time. During the early 2010s, Bitcoin was an experimental technology with little mainstream attention. The industry lacked regulation, formal structures, and standardized investment practices.

In such an environment, it was common for funding to come from a diverse range of sources. Some investors were visionary technologists, while others were opportunistic financiers. The lack of oversight meant that not all investors were thoroughly vetted. Understanding this context helps explain how controversial associations could occur without necessarily reflecting the values or intentions of the broader Bitcoin community.

The Decentralized Nature of Bitcoin

Bitcoin’s Independence from Individual Investors

One of the key principles of Bitcoin is decentralization. The network does not rely on any single investor, company, or government. Even if certain individuals were involved in early funding, they would not have control over the Bitcoin protocol itself.

Bitcoin operates through a global network of miners, developers, and users. Decisions about the protocol are made through consensus rather than centralized authority. This structure ensures that the actions of individual investors do not determine the future of the network.

Why Bitcoin’s Core Philosophy Remains Unchanged

Despite controversies surrounding certain investors, Bitcoin’s core philosophy remains intact. The system was designed to operate independently of traditional financial institutions and centralized control. Its open-source nature allows anyone to participate, contribute, or build on the technology. This decentralization is one of the reasons Bitcoin has remained resilient despite numerous scandals, market crashes, and regulatory challenges.

Conclusion

The discussion around Epstein ties in early Bitcoin industry investment highlights the complex nature of capital flows in emerging technologies. During Bitcoin’s early years, the industry was largely unregulated and relied on a diverse range of investors. This environment made it possible for indirect associations with controversial figures to emerge. However, these connections appear to be largely indirect and reflective of the broader venture capital landscape rather than the Bitcoin network itself. Over time, the crypto industry has matured, with stronger regulations, improved due diligence, and greater transparency.

Bitcoin’s decentralized design also ensures that no single investor or group can control the network. While the history of early investments may raise questions, it does not fundamentally alter the principles or functionality of Bitcoin. As the crypto industry continues to evolve, conversations about ethical investment and transparency will remain important. They serve as reminders that technological innovation must be accompanied by responsible financial practices.

FAQs

Q: What are the reported Epstein ties in early Bitcoin industry investment?

Reports have suggested that some individuals or investment networks connected to Jeffrey Epstein may have indirectly participated in early Bitcoin or cryptocurrency investments. These ties are generally described as indirect associations through shared venture funds or financial relationships rather than direct investments by Epstein himself.

Q: Did Jeffrey Epstein directly invest in Bitcoin companies?

There is no widely confirmed evidence that Jeffrey Epstein directly invested in Bitcoin companies. Most discussions focus on indirect connections involving financial networks, venture funds, or individuals who had some form of association with him.

Q: How were early Bitcoin startups funded?

Early Bitcoin startups were typically funded through angel investors, small venture capital firms, and high-net-worth individuals. The industry was largely unregulated at the time, and many investments were made through personal networks and informal agreements.

Q: Does this controversy affect Bitcoin’s credibility?

While controversial associations can impact public perception, Bitcoin itself is a decentralized network that does not depend on any single investor or organization. Its protocol and operations are governed by global consensus rather than centralized control.

Q: How has the crypto industry improved its investment standards since then?

The crypto industry has introduced stricter regulations, compliance measures, and due diligence processes. Institutional investors now conduct extensive background checks, and many jurisdictions require KYC and AML procedures, reducing the likelihood of controversial capital entering the ecosystem unnoticed.