A novel idea has arisen in the ever-changing realm of cryptocurrency that seeks to combine the time-tested reliability of gold with the adaptability of blockchain technology: the gold-backed crypto coin. The demand for security and stability in the digital currency market is rising with the popularity of these assets. That is precisely what you get with a cryptocurrency backed by gold; it combines the reliability of gold with the efficiency, openness, and decentralization of blockchain technology. This article explores the merits and cons of Gold Backed Crypto Coins and their role in the overall financial system.

Gold-backed crypto coins?

One kind of digital asset is the “gold-backed cryptocurrency,” which has its value linked to a specific quantity of genuine gold. As a result, you can rest assured that every currency or token is backed by a specific amount of gold that is safely kept in reserves. Keeping the intrinsic stability of gold while enabling the ease and speed of transactions inherent in blockchain technology is the major objective of this sort of coin.

In this case, the peg would be one gram of gold. As the price of gold rises, so does the coin’s value, and the opposite is true. In contrast to more established cryptocurrencies, such as Bitcoin or Ethereum, the value of gold-backed cryptocurrencies is substantially more stable and less subject to extreme price fluctuations.

For countless generations, gold has stood as a metaphor for monetary prosperity. Many people see the economy or markets as a haven asset when the economy or markets are unstable. In times of inflation or financial instability, many investors seek refuge in gold due to its tendency to maintain its value over time. Developers and investors who choose to back cryptocurrencies with gold are bringing together the best of both worlds: the stability and innovation of digital currencies with the time-tested reliability of gold.

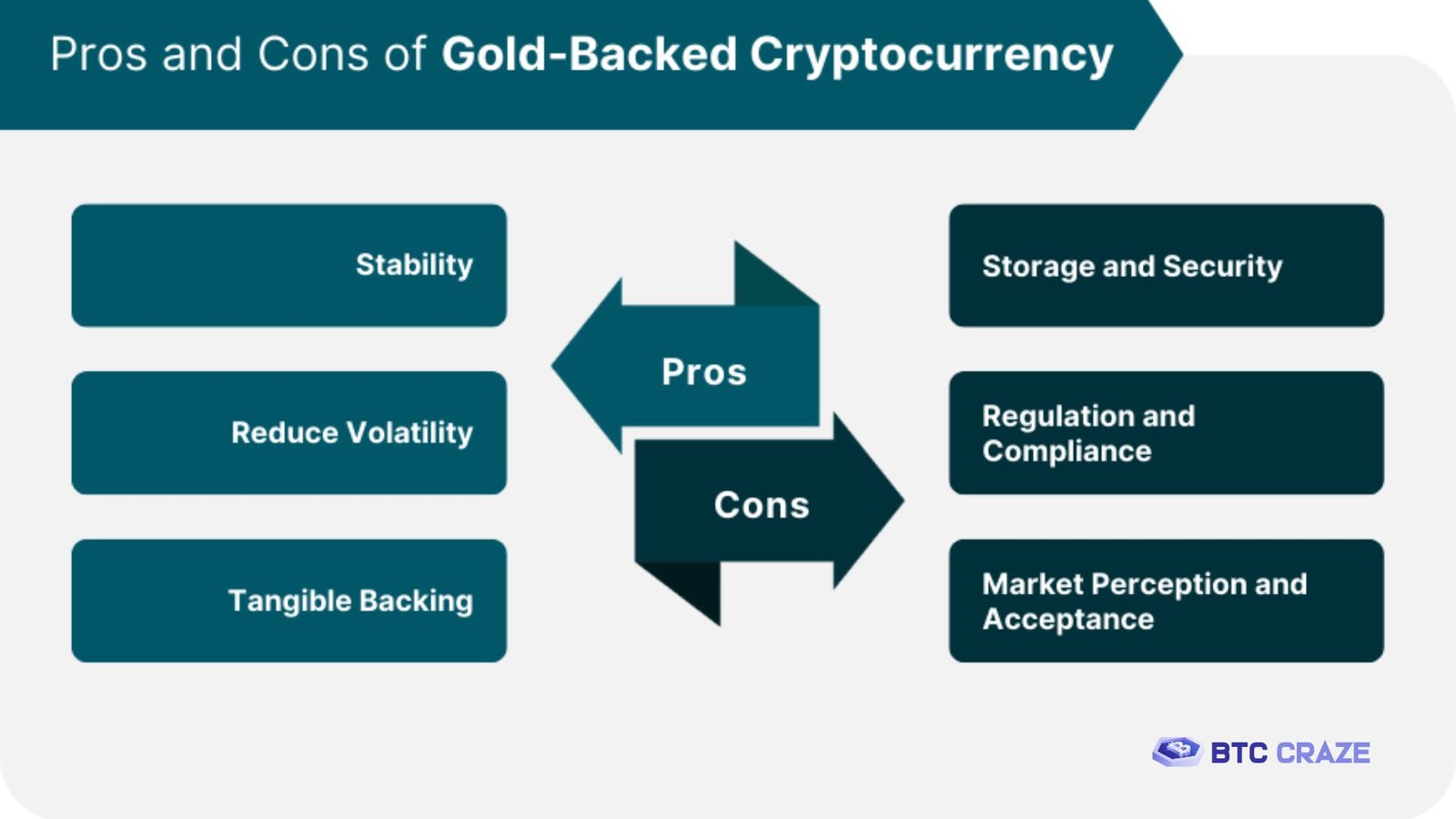

Benefits of Gold-Backed Crypto Coins

Stability

The tremendous volatility of cryptocurrencies is a major point of contention. This includes Ethereum and Bitcoin. Due to short-term volatility, prices are unreliable as investment vehicles or trade means. On the other hand, a cryptocurrency backed by gold offers security due to its association with a tangible item whose value has historically been stable.

Tangible Asset Support

A gold-backed coin’s value is not based on market speculation and demand like most cryptocurrencies are; rather, it is related to physical gold. Investors can rest easy knowing that this digital currency, unlike many others, could one day be traded for physical gold.

Inflation Hedge

For a long time, gold was considered a haven against inflation. Inflation causes fiat currencies to fall, while gold’s value tends to grow. Investing in a cryptocurrency coin backed by gold allows you to participate in the cryptocurrency market while protecting your investment against inflationary pressures.

Transparency and Security

Blockchain technology’s decentralization, security, and transparency are advantageous to gold-backed coins because they are built on it. The immutability and transparency of all transactions recorded on the blockchain are undeniable.

Global Accessibility

Cryptocurrencies with a gold backing are also available all over the world. You can engage in the market from anywhere worldwide as long as you have an internet connection. Transactions are speedy and secure. The ownership of physical gold renders the storage, transit, and security concerns irrelevant.

Challenges and Drawbacks

Despite their many benefits, gold-backed crypto coins are not without their challenges.

Regulatory Uncertainty

Cryptocurrency regulations are in a constant state of flux. The regulation of digital currencies, including those backed by gold, varies from country to country. Anxieties for investors can arise if some governments embrace them while others apply stringent restrictions or outright prohibitions.

Trust and Audits

The reliability of the organizations in charge of the gold reserves is more important than blockchain technology’s transparency. Comprehensive and regular audits are necessary to ensure the amount of gold claimed to back the coin is held in reserve. Some issuers may not have enough gold to back all the coins in circulation if reliable third-party audits are not in place.

Storage and Insurance Costs

There is a need to store the actual gold backing these coins safely, which can result in storage and insurance charges. The potential for management fees to cover the costs of owning gold-backed cryptocurrencies makes them slightly more expensive to hold than regular cryptocurrencies.

Popular Gold-Backed Cryptocurrencies

Several projects have launched gold-backed cryptocurrencies, each with their unique features:

- Paxos Gold (PAXG): PAXG is among the most well-known digital currencies backed by gold. An ounce of pure gold from Brink’s vaults is represented by one PAXG token. Paxos Trust Company oversees and audits the reserves regularly.

- Tether Gold (XAUT): There is also the well-known cryptocurrency Tether Gold, which is backed by gold. It combines the security of gold with the decentralization of Tether’s network. You can own one troy ounce of gold with each token.

- GoldMint (MNTP): Besides providing a platform for exchanging digital tokens for actual gold, GoldMint also sells tokens backed by gold. One of their goals is to establish a system where gold can be used for regular purchases.

Also Read: Crypto Mining Coins: Trends and Insights 2024

Conclusion

A potential combination of old and new investment tactics, gold-backed cryptocurrencies provide a lot of hope. They combine the security of gold with the immutability, decentralization, and accessibility blockchain technology offers. The necessity for trustworthy audits, storage expenses, and regulatory hurdles are other considerations investors should consider.

Cryptocurrencies backed by gold might gain traction as more people seek to diversify their holdings with both digital and real assets. They provide an alternative to risky investment strategies by merging digital currencies with more conventional investment vehicles.

FAQs

1. What is the main advantage of gold-backed cryptocurrencies over traditional cryptocurrencies?

One major perk is how stable it is. Bitcoin and other traditional cryptocurrencies are notoriously unstable in value, while gold-backed cryptocurrencies are pegged to the ever-steady price of gold. They will be less affected by sudden changes in price because of this.

2. Can I exchange my gold-backed crypto coins for physical gold?

Yeah, for the most part. Although platform and region-specific restrictions may apply, holders of many gold-backed cryptocurrencies can often exchange their tokens for real gold.

3. Are gold-backed cryptocurrencies regulated?

The legal standing of cryptocurrency tokens backed by gold differs from nation to nation. Some nations have begun to handle this emerging type of digital asset by creating regulatory frameworks, while others have completely ignored it. You should be familiar with the local laws and regulations.

4. How can I ensure the gold reserves are properly managed?

Honest third-party auditors will check in on cryptocurrency initiatives with gold backing regularly. These checks ensure that there is really enough gold on hand to back the coins.

5. Do gold-backed cryptocurrencies protect against inflation?

You can protect yourself from the depreciation of fiat currencies by investing in a gold-based cryptocurrency since gold generally rises during inflation.