Cryptocurrency and precious metals, especially gold, have fascinatedly converged in the past few years. The leading cryptocurrency, Bitcoin, has garnered the nickname “digital gold” for its limited quantity, decentralized structure, and increasing worth as a store of value. Gold, meanwhile, has maintained its value across generations, earning it a reputation as a haven from inflation and economic uncertainty.

Gold as an idea The digital money that has swept the globe in little over a decade and the precious metal that has been revered for thousands of years come together in Bitcoin. Some examples of this merging of ideas are the figurative analogy between Bitcoin and gold, the creation of actual gold coins that either hold or contain Bitcoin, and the use of blockchain technology to tokenize gold. This piece will delve into these intersections, discussing their allure to collectors and investors and speculating on their potential future for this hybrid of digital and traditional assets.

To further explain Gold Bitcoin and its effects on the financial system, we will also answer five commonly asked questions (FAQs).

Bitcoin as Digital Gold

Among the most talked-about subjects in the cryptocurrency community is the analogy between Bitcoin and gold. Bitcoin has been dubbed “digital gold” for the reasons listed below:

Scarcity

Bitcoin and gold are both desirable assets to have because of their scarcity. The fact that there is a finite quantity of gold on Earth is the source of its scarcity. Likewise, the underlying protocol of Bitcoin specifies a maximum supply limitation of twenty-one million coins. Particularly in a time when money can be devalued by printing too much of it, scarcity helps keep and increase value.

Store of Value

For generations, people have put their faith in gold as a haven throughout economic downturns, currency devaluations, and inflation. Bitcoin, which is somewhat more recent, is likewise considered a potential store of value. As governments worldwide keep printing money to address economic problems, many investors see it as a way to protect themselves from inflation. Like gold, Bitcoin is an attractive long-term investment because of its decentralized character and resistance to inflationary pressures.

Decentralization and Independence

The value of gold is independent of governments, and its price changes due to market forces instead of government or central bank policy. The same holds for Bitcoin, which operates independently of any governing body as a decentralized currency built on the blockchain.

Security and Portability

When compared to gold, Bitcoin’s mobility and security are two big pluses. The digital nature of Bitcoin makes international transfers of any value possible in a matter of minutes, in contrast to the physical nature of gold, which can be problematic when transporting large quantities. Transparent and immutable transactions are made possible by Bitcoin’s blockchain technology, which also offers high levels of security.

Market Volatility

Despite its great surge in price, Bitcoin is significantly more volatile than gold. Because of its long history of use in international finance, the value of gold tends to follow a fairly consistent range. Bitcoin, in contrast, is notorious for its wild price fluctuations, which can lead to huge profits—but they can also carry heavy risks. Many people think Bitcoin’s value will settle down in the long run despite all this volatility because of how widely used it is.

The Rise of Physical Gold Bitcoin Coins

Now that the analogy between Bitcoin and gold has worn off, the idea of actual gold Bitcoin coins has surfaced. Offering a physical embodiment of cryptocurrency, these coins merge the monetary worth of gold with that of Bitcoin’s innovative technology.

Tokenized Gold on the Blockchain

Tokenized gold represents a more contemporary meeting point of gold and cryptocurrencies. Making digital tokens on a blockchain with real gold in storage as collateral is the way to go. You can exchange or redeem these tokens for gold like any other cryptocurrency. Each token represents a set quantity. The idea behind this is to merge the security of gold with the efficiency and transparency of blockchain technology.

What Are Gold Bitcoin Coins?

Gold To symbolize Bitcoin, there are tangible coins that are either made of gold or have a coating of gold. You can see the Bitcoin logo or other crypto-related symbols on these coins and even see Bitcoin wallet addresses or QR codes etched into them. Some coins are only meant to be decorative or collected, and then some coins hold Bitcoin encoded through a secret private key.

The Value Proposition of Coins

- Material Value: Gold coins are worth exactly what the gold market currently offers. Regardless of its relationship to Bitcoin, the value of a one-ounce coin, for instance, will be determined by the current price of gold.

- Bitcoin Content: Some Gold Bitcoin coins include a private key that can be used to store a certain quantity of Bitcoin. Because the currency’s value is affected by the price of Bitcoin and gold, this adds another level of value.

- Collectibility: Gold limited edition There is a lot of potential for coins, particularly those made by trustworthy companies, to gain value as a collectible. Some collectors will pay more if the coin is rare or has an unusual design.

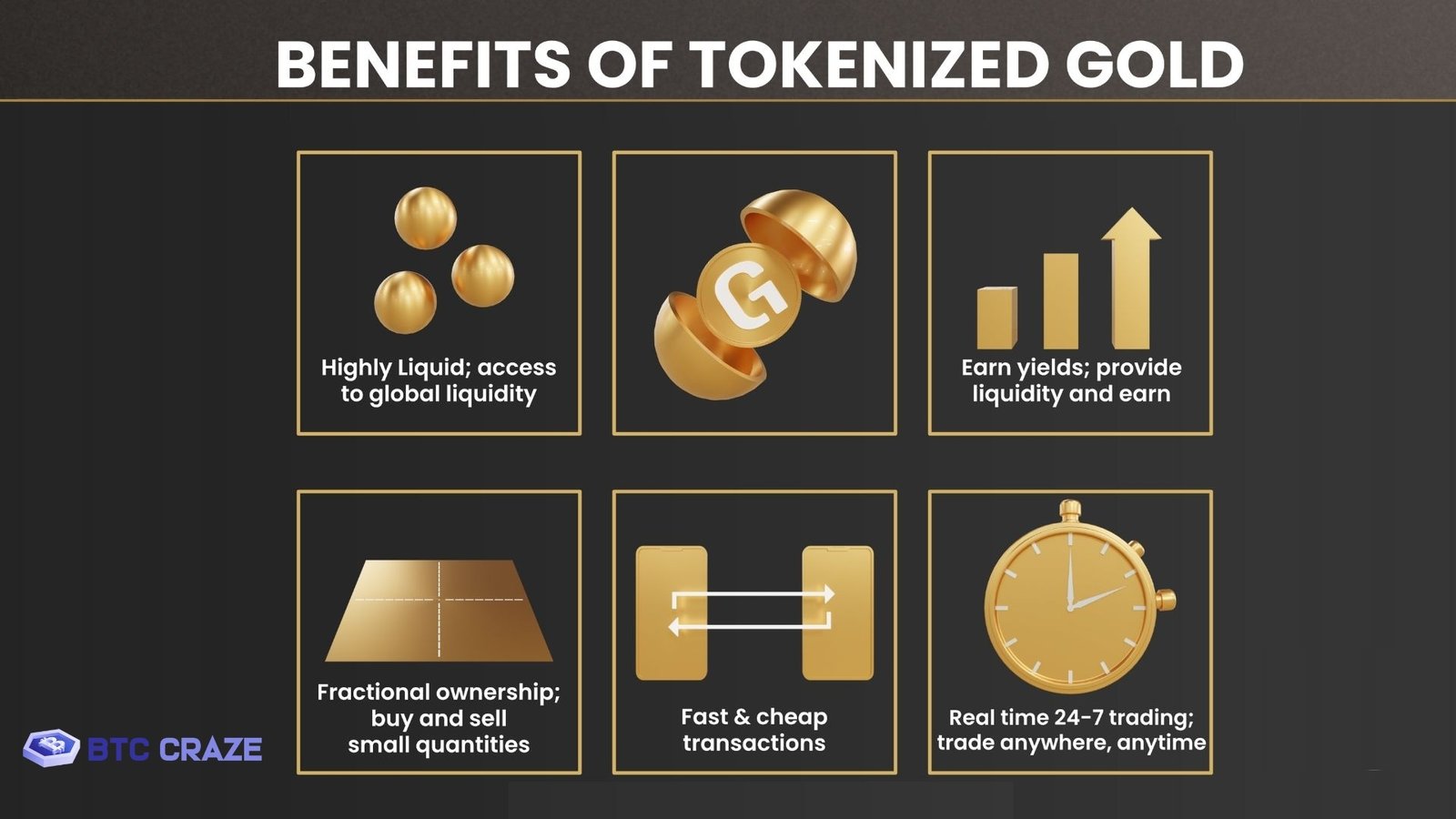

Benefits of Tokenized Gold

- Transparency: Tokens are guaranteed to be backed by actual gold thanks to blockchain’s decentralized ledger, which ensures transparency. Since the blockchain records every transaction and ownership transfer, this contributes to the system’s credibility.

- Liquidity: Tokenized gold offers the convenience and efficiency of trading that cryptocurrencies bring, in contrast to actual gold, which can be difficult to sell or exchange. On digital exchanges, investors can trade tokens backed by gold at any time, day or night.

- Security: Tokenized gold, connected to real gold in vaults, lets investors hold gold without the risks of storage and transit.

- Fractional Ownership: A larger audience can buy tokenized gold since it allows investors to buy small fractions of a gold bar or coin, rather than massive quantities of gold, which may be out of reach for others.

Also Read: Bitcoin Volatility: The Wild Ride of Crypto Markets Revealed

Conclusion

There is a fascinating coming together of analog and digital assets at the crossroads of cryptocurrencies and precious metals, particularly gold. The notion of that coin exemplifies the changing dynamics of wealth, value, and investment in the twenty-first century, which are accompanied by the ongoing evolution of the financial sector. Both gold’s classic allure and Bitcoin’s innovative promise are influencing the financial landscape of the future.

FAQs

1. What is Gold Bitcoin?

Gold In a metaphor, Bitcoin is like gold; in a literal sense, it’s a store of value. Whether gold or Bitcoin, these actual coins give investors and collectors a tangible representation of the digital asset.

2. How is Bitcoin similar to gold?

Scarcity, decentralization, and the ability to store value are a few of the important traits that Bitcoin has with gold. You can think of both assets as protections against currency depreciation and inflation. Contrarily, gold is a tangible commodity, whereas Bitcoin is totally digital. Bitcoin’s decentralization and 21 million coin supply reflect gold’s value and independence from governments.

3. What are tokenized gold assets?

Vault-backed digital tokens are tokenized gold assets.. These are blockchain assets.Digitally buy, sell, or swap gold with each token, which represents a certain amount. Tokenized gold combines the advantages of gold with blockchain technology, making it transparent, liquid, and offering fractional ownership.

4. How do I buy physical Gold Bitcoin coins?

At the intersection of cryptocurrencies and precious metals, notably gold, analog and digital assets fuse fascinatingly. This convergence allows portfolio diversifiers to research Bitcoin as “digital gold” , or investigate blockchain-based tokenized gold.

5. Are Gold Bitcoin coins a good investment?

Gold Depending on the content and rarity of coins, they can be a profitable investment. TGold coins have value dependent on the price of gold, and that coin has value based on the cryptocurrency market. Many collectors appreciate these coins, which fluctuate with market demand and the gold and cryptocurrency industries.