ICYMI Fintech Funding Round-Up EnFi, Incard, Bits and More the global fintech landscape continues to evolve at a rapid pace, with new startups emerging and established players expanding their reach through strategic funding rounds. The latest ICYMI fintech funding round-up highlights a wave of investments across multiple segments of the financial technology ecosystem, including digital banking, embedded finance, credit solutions, payment platforms, and AI-driven wealth tools. Companies such as EnFi, Incard, Bits, and Sidekick have captured investor attention, demonstrating how innovation in financial services is attracting both venture capital and strategic backing.

This fintech funding round-up reflects broader trends shaping the industry. Investors are increasingly prioritizing startups that focus on financial inclusion, data-driven decision-making, and scalable infrastructure. The growing demand for neobanking services, digital wallets, and automated financial tools has created fertile ground for companies offering unique solutions to modern financial challenges. As global markets shift toward cashless economies and real-time transactions, fintech startups are positioning themselves as critical players in the future of finance.

We take a closer look at the latest ICYMI fintech funding round-up, examining the companies that secured capital, the trends driving investor interest, and what these developments mean for the broader fintech ecosystem.

ICYMI Fintech Funding Round-Up EnFi

The recent ICYMI fintech funding round-up highlights how investor appetite for financial technology remains strong despite macroeconomic uncertainties. Venture capital firms and strategic investors continue to allocate resources to companies that demonstrate strong product-market fit and scalable technology.

One of the key drivers behind this momentum is the increasing adoption of digital payment solutions and financial automation platforms. Consumers and businesses alike are seeking faster, more convenient, and more transparent financial services. This demand is fueling innovation in areas such as embedded payments, AI-powered credit scoring, and open banking infrastructure.

Investor Focus on Scalable Fintech Models

Investors participating in the fintech funding round-up are showing a clear preference for startups that offer scalable, technology-driven solutions. Companies that can quickly expand into new markets or integrate with existing financial systems are attracting higher valuations and larger funding rounds.

Scalability often comes from strong API-based infrastructure, automated workflows, and partnerships with financial institutions. These elements allow fintech companies to serve a wider customer base without significantly increasing operational costs.

The Role of Financial Inclusion

Another recurring theme in the ICYMI fintech funding round-up is the focus on financial inclusion. Many of the funded startups aim to provide access to financial services for underserved populations.

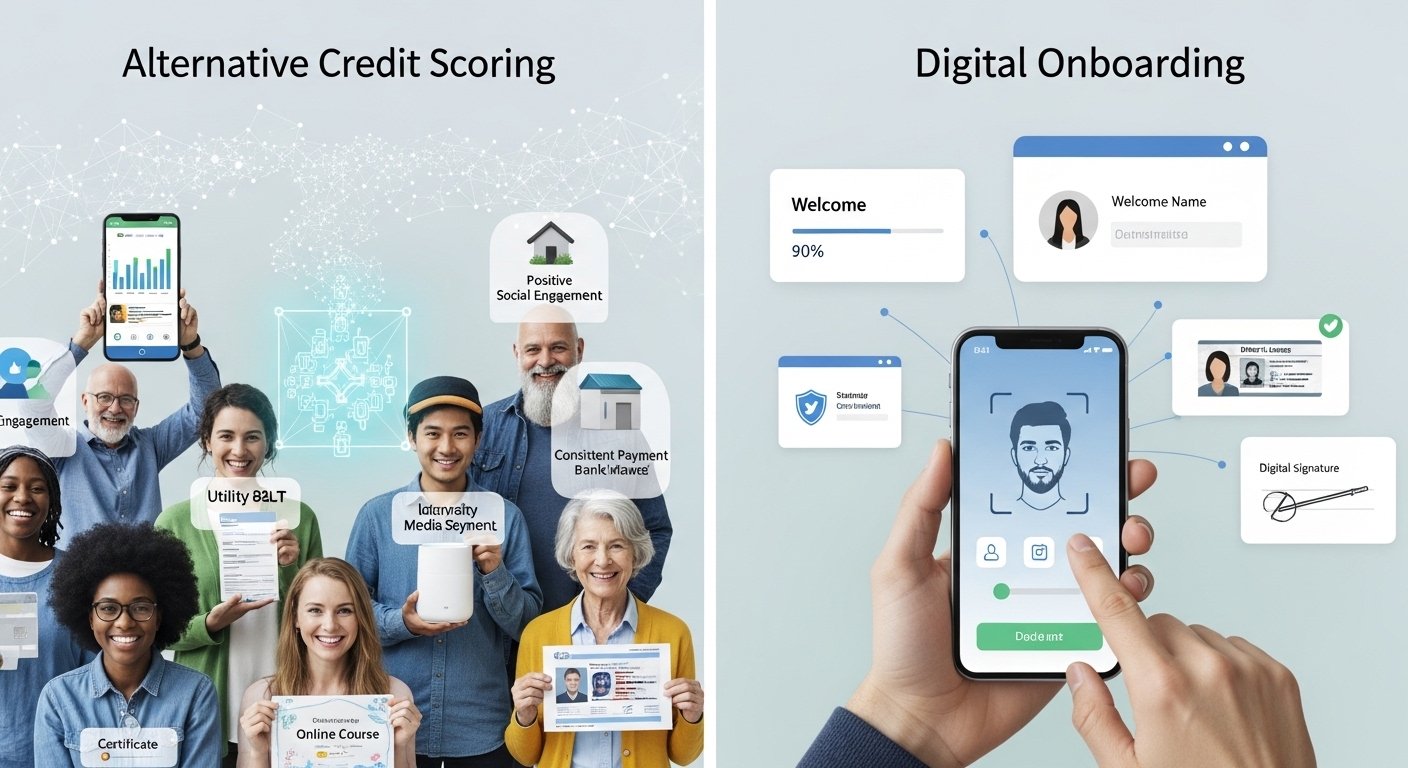

By leveraging mobile banking, alternative credit scoring, and digital onboarding, these companies are bringing financial tools to users who were previously excluded from traditional banking systems.

EnFi’s Funding Signals Growth in Embedded Finance

EnFi’s appearance in the fintech funding round-up reflects the rising importance of embedded finance solutions. The company focuses on integrating financial services directly into non-financial platforms, enabling businesses to offer payments, credit, and financial management tools without building the infrastructure themselves.

How EnFi’s Model Works

EnFi provides businesses with the tools to embed financial features into their platforms. This could include payment processing, lending services, or digital wallets integrated directly into e-commerce or SaaS environments. By removing the complexity of traditional financial systems, EnFi allows companies to offer financial services seamlessly to their users.

Investor Confidence in Embedded Finance

The funding secured by EnFi in the ICYMI fintech funding round-up underscores investor confidence in embedded finance. As more companies seek to create all-in-one digital experiences, the demand for integrated financial services is expected to grow significantly.

Incard’s Expansion in Corporate Card Solutions

Incard’s inclusion in the fintech funding round-up highlights the growing interest in corporate fintech platforms. The company focuses on providing digital corporate cards and expense management solutions for businesses.

The Rise of Digital Corporate Cards

Traditional corporate expense management systems are often slow, complex, and difficult to track. Incard addresses these issues by offering real-time expense tracking, automated reporting, and customizable spending controls.

This approach aligns with broader trends in business fintech, where companies are seeking more efficient ways to manage finances. Digital corporate cards also provide valuable data insights, helping organizations optimize spending and improve financial planning.

Funding to Support Market Expansion

The investment secured by Incard in the ICYMI fintech funding round-up will likely be used to expand its product offerings and enter new markets. As businesses increasingly adopt cloud-based financial tools, companies like Incard are well positioned to capture market share.

Bits Targets the Credit-Building Market

Bits stands out in the fintech funding round-up for its focus on credit-building solutions. The company offers tools designed to help consumers improve their credit profiles through responsible spending and repayment behavior.

Addressing the Credit Gap

Millions of consumers around the world lack access to traditional credit products due to limited or nonexistent credit histories. Bits aims to solve this problem by offering credit-building cards and digital tools that report positive payment behavior to credit bureaus. This model aligns with the broader trend of financial inclusion fintech, where startups are creating products tailored to underserved demographics.

Why Investors Are Backing Credit-Focused Fintech

Investors participating in the ICYMI fintech funding round-up recognize the long-term potential of credit-focused fintech platforms. As more consumers seek access to credit, companies like Bits are positioned to benefit from growing demand.

Sidekick Brings AI to Personal Finance

Sidekick’s presence in the fintech funding round-up reflects the increasing role of AI-driven financial tools. The company focuses on helping users manage their investments and personal finances through automation and intelligent insights.

The Shift Toward Automated Wealth Management

Consumers are increasingly turning to robo-advisors and automated financial platforms for investment guidance. Sidekick leverages artificial intelligence to analyze market data, assess risk, and recommend investment strategies. This approach reduces the complexity of investing and makes wealth management accessible to a broader audience.

AI as a Competitive Advantage

The funding secured by Sidekick in the ICYMI fintech funding round-up highlights the growing importance of AI in financial services. Startups that incorporate machine learning and predictive analytics are gaining a competitive edge in the fintech market.

Other Notable Deals in the Fintech Funding Round-Up

Beyond EnFi, Incard, Bits, and Sidekick, the ICYMI fintech funding round-up includes several other notable deals. These investments span a range of sectors, including payment infrastructure, digital lending, blockchain finance, and regtech solutions.

Payments and Infrastructure Startups

Payment infrastructure companies continue to attract significant funding as the demand for real-time and cross-border transactions grows. These startups are building the backbone of the digital economy, enabling faster and more secure payments.

Lending and Alternative Credit Platforms

Alternative lending platforms are also a major focus in the fintech funding round-up. By using AI-powered underwriting and data-driven credit models, these companies are expanding access to loans for individuals and small businesses.

Key Trends Emerging From the Latest Funding Rounds

The latest ICYMI fintech funding round-up reveals several important trends shaping the future of financial technology.

Embedded Finance Continues to Dominate

Embedded finance is one of the fastest-growing segments in fintech. By integrating financial services into everyday platforms, companies are creating new revenue streams and improving user experiences.

AI and Automation Are Reshaping Financial Services

Artificial intelligence is becoming a central component of fintech innovation. From automated investing to fraud detection, AI is transforming how financial services are delivered.

Focus on User-Centric Financial Tools

Another key theme in the fintech funding round-up is the emphasis on user-centric design. Startups are building intuitive platforms that simplify complex financial tasks, making services more accessible to everyday users.

What This Means for the Fintech Ecosystem

The latest ICYMI fintech funding round-up demonstrates that fintech innovation remains strong across multiple segments. Investors are backing companies that address real-world financial challenges with scalable, technology-driven solutions.

This wave of funding is likely to accelerate the development of new financial products, improve competition, and drive further innovation across the industry. As startups continue to push the boundaries of digital finance, consumers and businesses can expect more convenient, transparent, and efficient financial services.

Conclusion

The ICYMI fintech funding round-up featuring EnFi, Incard, Bits, Sidekick, and other startups provides a clear snapshot of where the industry is heading. Embedded finance, AI-driven tools, credit-building solutions, and corporate fintech platforms are attracting strong investor interest, reflecting broader shifts in the financial services landscape.

These funding rounds not only support the growth of individual companies but also signal the continued evolution of fintech as a whole. As technology reshapes how people save, spend, borrow, and invest, the fintech sector is poised for sustained growth in the years ahead.

FAQs

Q: What is the ICYMI fintech funding round-up and why is it important for the industry?

The ICYMI fintech funding round-up is a summary of recent investment deals involving fintech startups. It provides insights into which companies are attracting capital, what sectors are gaining traction, and how investor sentiment is shifting. For industry observers, these round-ups offer a snapshot of emerging trends, including new technologies, market opportunities, and areas of rapid innovation within financial technology.

Q: Why are investors continuing to pour money into fintech startups?

Investors remain interested in fintech because the sector addresses major inefficiencies in traditional financial systems. Fintech companies often use technology to offer faster, cheaper, and more accessible services. As digital adoption increases worldwide, the potential market for fintech solutions continues to expand, making it an attractive investment opportunity.

Q: How does embedded finance influence the future of financial services?

Embedded finance allows companies outside the financial sector to integrate banking, payments, and lending directly into their platforms. This creates more seamless user experiences and opens new revenue streams for businesses. As a result, embedded finance is expected to play a major role in shaping the next generation of financial services.

Q: What role does artificial intelligence play in modern fintech platforms?

Artificial intelligence is used across fintech platforms for tasks such as fraud detection, credit scoring, investment analysis, and customer support. AI enables companies to process large amounts of data quickly, automate decision-making, and provide personalized financial recommendations, improving efficiency and user experience.

Q: What trends can we expect in future fintech funding round-ups?

Future fintech funding round-ups are likely to highlight continued growth in embedded finance, AI-driven financial tools, digital lending, and payment infrastructure. Investors are also expected to focus on startups that promote financial inclusion and offer scalable, user-friendly solutions that address real-world financial challenges.