TRUMP Meme Coin Price Prediction 2026–2030 the rise of meme coins has transformed the cryptocurrency landscape in ways few could have predicted just a few years ago. What began as internet jokes and cultural commentary has evolved into a multi-billion-dollar segment of the digital asset market. Among the most talked-about political meme tokens is TRUMP, a coin that blends crypto speculation, online culture, and political symbolism into a single highly volatile asset. As investors look beyond short-term hype, attention is increasingly shifting toward long-term outlooks, especially the TRUMP meme coin price prediction 2026–2030 and the increasingly debated question of whether the token can realistically approach or surpass the $50 level.

The fascination with TRUMP as a meme coin is rooted not only in price action but also in narrative power. Meme coins thrive on attention, controversy, and community energy, and few global figures generate as much sustained discussion as Donald Trump. This makes TRUMP a unique case study when analyzing long-term meme coin potential. However, long-term predictions require more than hype. They depend on broader crypto market cycles, regulatory developments, community engagement, tokenomics, and evolving investor sentiment.

We provides an in-depth and human-written analysis of the TRUMP meme coin price prediction 2026–2030, carefully examining the critical $50 question. By exploring historical behavior, market drivers, adoption trends, and realistic growth scenarios, this guide aims to help readers understand both the upside potential and the risks involved in holding or speculating on TRUMP over the next several years.

TRUMP Meme Coin

TRUMP is a meme coin built around political branding and internet culture rather than traditional blockchain utility. Like many meme tokens, its value is driven largely by social engagement, community narratives, and speculative interest. Unlike generic meme coins, however, TRUMP taps into an existing global political identity, giving it a built-in audience that extends beyond typical crypto communities.

The appeal of TRUMP lies in its ability to convert political sentiment into market momentum. Supporters, critics, and neutral observers alike often contribute to visibility simply by discussing it. This attention economy is central to meme coin valuation and plays a major role in shaping long-term expectations for the TRUMP meme coin price prediction 2026–2030.

Meme Coins as Narrative-Driven Assets

Meme coins do not behave like traditional cryptocurrencies. Their value is less about transaction efficiency or smart contract innovation and more about narrative strength. Community-driven tokens, viral crypto assets, and political meme coins tend to move sharply based on news cycles, social media trends, and cultural relevance.

For TRUMP, the narrative is closely tied to political developments, elections, media coverage, and public discourse. This means its price trajectory may follow a very different path compared to utility-focused projects. Understanding this distinction is essential when analyzing long-term price potential.

Historical Performance and Market Behavior of TRUMP

Early Price Action and Volatility Patterns

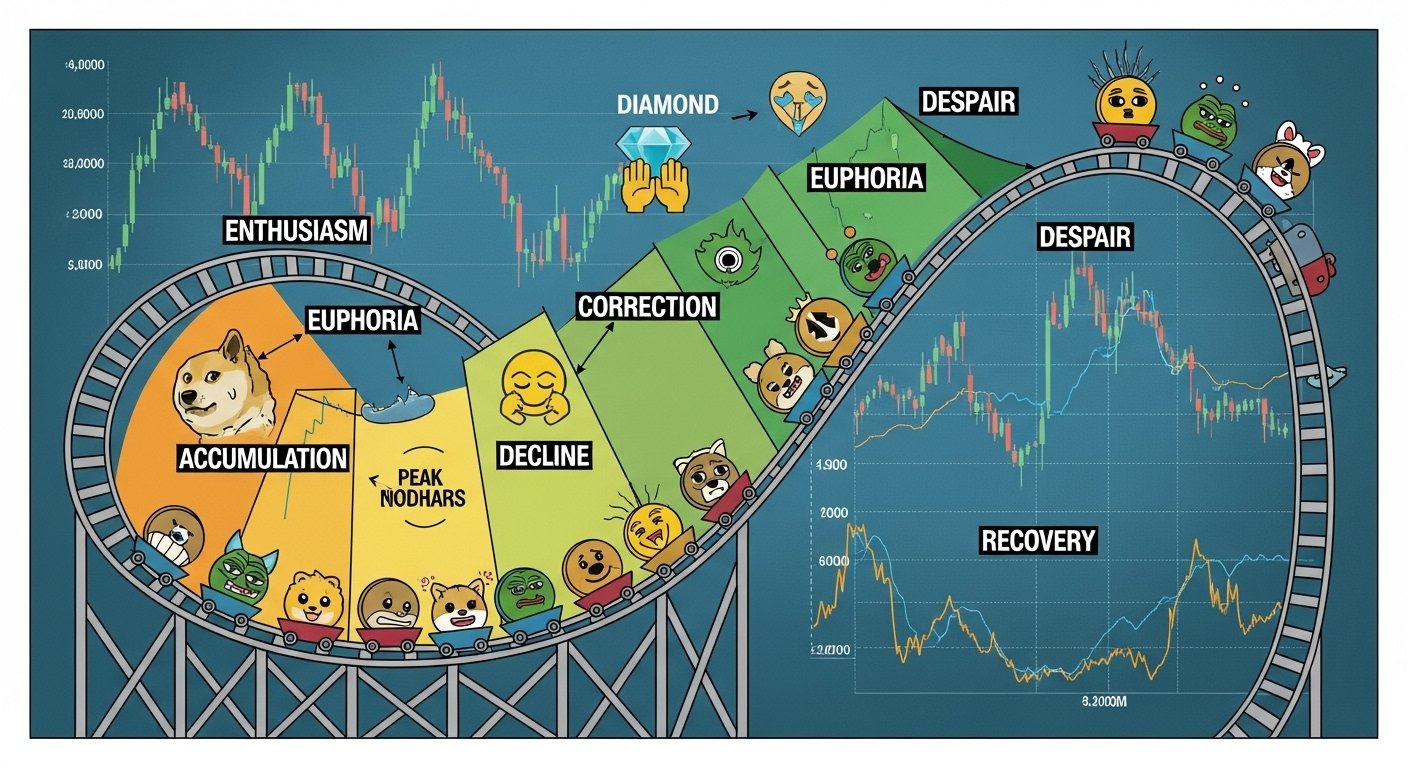

Like most meme coins, TRUMP experienced extreme volatility in its early stages. Initial launches are often marked by rapid price spikes fueled by speculative buying, followed by sharp corrections as early participants take profits. These boom-and-bust cycles are not unusual and often set the tone for how meme coins evolve over time.

The early trading behavior of TRUMP showed how quickly sentiment can shift. Sudden bursts of interest led to short-term rallies, while periods of reduced attention resulted in price stagnation. This historical volatility provides important context for evaluating whether long-term targets like $50 are achievable between 2026 and 2030.

Lessons From Other Meme Coins

When assessing the TRUMP meme coin price prediction 2026–2030, it helps to look at precedents set by other major meme coins. Tokens that survived multiple market cycles often did so because they maintained strong communities and adapted their narratives over time. Meme coin market cycles, speculative crypto rallies, and retail investor psychology all play roles in determining long-term survival.

TRUMP’s challenge is to remain culturally relevant beyond short bursts of political attention. If it manages to do so, it could follow a similar path to long-lasting meme assets rather than fading into obscurity.

Key Factors Influencing TRUMP Meme Coin Price 2026–2030

Broader Crypto Market Cycles

No meme coin exists in isolation. The overall state of the cryptocurrency market will heavily influence TRUMP’s long-term price potential. Historically, crypto markets move in multi-year cycles characterized by accumulation phases, bull runs, and corrections.

If the broader market enters a strong bullish phase between 2026 and 2030, speculative assets like TRUMP could benefit disproportionately. During bull markets, risk appetite increases, and meme coins often see exponential gains as retail investors chase high-volatility opportunities. This macro context is critical when considering whether the $50 question is realistic.

Political and Cultural Relevance

TRUMP’s price is uniquely sensitive to political developments. Elections, legal proceedings, media narratives, and public debates can all trigger increased interest. Unlike utility tokens, where adoption grows steadily, TRUMP may experience episodic surges tied to real-world events.

This dynamic creates both opportunity and risk. Sustained political relevance could drive long-term demand, while declining attention could limit growth. The political crypto narrative, social sentiment, and media-driven volatility will be central to the TRUMP meme coin price prediction 2026–2030.

Tokenomics and Supply Considerations

How Supply Impacts Long-Term Price Potential

Token supply plays a major role in determining how high a coin’s price can realistically go. Meme coins with extremely large supplies require massive market capitalization increases to achieve high per-token prices. Understanding TRUMP’s circulating and total supply is therefore essential when evaluating the $50 target.

If supply remains high without mechanisms to reduce it, reaching $50 would require extraordinary levels of demand. However, changes in tokenomics, such as burns or reduced emissions, could alter this equation. Token supply dynamics, market capitalization growth, and scarcity narratives are all important variables.

Community-Driven Value Creation

Meme coins often rely on their communities to create perceived value. Grassroots marketing, social media campaigns, and cultural engagement can amplify demand without traditional advertising. TRUMP’s community plays a significant role in sustaining interest and driving speculative momentum.

A highly engaged community could help support higher valuations over time, especially if it remains active through multiple market cycles. This community factor is a key pillar of long-term price projections.

The Critical $50 Question Explained

What Would It Take for TRUMP to Reach $50

The idea of TRUMP reaching $50 is both enticing and controversial. From a purely mathematical standpoint, such a price would require a substantial increase in market capitalization. This would likely only be possible under a combination of favorable conditions, including a strong crypto bull market, sustained political relevance, and intense speculative demand.

Reaching $50 would also require widespread belief in the narrative. Meme coins thrive when investors collectively buy into a story. In this case, the story would need to extend beyond short-term hype and into a long-lasting cultural symbol within crypto.

Realistic Versus Speculative Scenarios

While a $50 price point is not impossible, it sits firmly in the high-speculation category. More moderate growth scenarios may be more realistic for long-term holders. These scenarios still offer significant upside potential without relying on extreme assumptions.

The TRUMP meme coin price prediction 2026–2030 should therefore be viewed as a range of possibilities rather than a single outcome. Investors who understand this nuance are better equipped to manage expectations and risk.

Adoption, Utility, and Future Development

Can TRUMP Evolve Beyond a Meme

One factor that could dramatically influence long-term price potential is whether TRUMP develops additional use cases. While meme status can drive early growth, sustained value often requires some form of utility, even if limited.

Potential integrations with NFT ecosystems, community platforms, or symbolic digital collectibles could extend TRUMP’s lifespan. Meme token evolution, crypto community utility, and brand-based digital assets could all contribute to future development.

Long-Term Holder Behavior

The behavior of long-term holders will also shape price action between 2026 and 2030. If a large portion of the supply is held by investors committed to the long term, selling pressure may be reduced during rallies. Conversely, heavy profit-taking could cap upside potential.

Understanding holder psychology is essential when evaluating long-term price trajectories for speculative assets like TRUMP.

Risks and Challenges Facing TRUMP Meme Coin

Regulatory and Market Risks

Political meme coins face unique regulatory risks. Increased scrutiny of politically themed digital assets could impact trading availability or investor confidence. Additionally, broader regulatory crackdowns on meme coins or speculative tokens could affect liquidity.

Market risks such as declining interest, competition from newer meme coins, and changing social media trends also pose challenges. These risks must be weighed carefully when considering long-term price predictions.

Sustainability of Hype-Driven Assets

Hype can drive prices quickly, but it can also fade just as fast. Sustaining momentum over several years is difficult, especially in a rapidly evolving crypto environment. TRUMP’s ability to remain relevant through 2030 will be a decisive factor in whether ambitious price targets can be approached.

Conclusion

The TRUMP meme coin price prediction 2026–2030 is a complex topic shaped by market cycles, political relevance, community engagement, and speculative psychology. The critical $50 question captures investor imagination, but it also highlights the uncertainty inherent in meme coin investing. While reaching such a level would require extraordinary conditions, the long-term outlook is not solely defined by that single number.

TRUMP’s future will depend on its ability to maintain cultural relevance, navigate market cycles, and adapt to an evolving crypto landscape. For investors, understanding both the potential rewards and the significant risks is essential. Rather than focusing solely on extreme price targets, a balanced view that considers multiple scenarios offers a more realistic framework for evaluating TRUMP’s long-term prospects.

FAQs

Q: What makes the TRUMP meme coin price prediction 2026–2030 different from other meme coins?

The TRUMP meme coin price prediction 2026–2030 is unique because it is heavily influenced by political events and public discourse rather than purely internet humor. This gives it access to a broader audience but also introduces higher volatility tied to real-world developments.

Q: Is the $50 price target for TRUMP meme coin realistically achievable?

The $50 target is highly speculative and would require a strong crypto bull market, massive demand, and sustained political relevance. While not impossible, it represents an aggressive scenario rather than a baseline expectation for the TRUMP meme coin price prediction 2026–2030.

Q: How do crypto market cycles affect TRUMP meme coin long-term predictions?

Crypto market cycles play a major role in shaping long-term price trends. During bullish cycles, speculative assets like TRUMP often outperform, while bear markets can significantly suppress prices. These cycles are central to any long-term forecast.

Q: What are the biggest risks associated with holding TRUMP until 2030?

Major risks include regulatory uncertainty, declining social interest, intense competition from new meme coins, and the inherent volatility of hype-driven assets. These factors can all impact the TRUMP meme coin price prediction 2026–2030.

Q: Should long-term investors rely solely on meme coin narratives for decisions?

Long-term investors should not rely solely on narratives. While community and hype are important, understanding market structure, risk management, and broader crypto trends is essential when evaluating speculative assets like TRUMP over the 2026–2030 period.