XRP Drops 5% as Ripple-Linked Token Eyes $1.70 Risk the cryptocurrency market has once again turned cautious, and Ripple-linked XRP has found itself under renewed selling pressure. Over the past trading sessions, XRP has dropped 5%, signaling a shift in short-term momentum and reopening discussions around downside risk toward the $1.70 level. While XRP has historically shown resilience during periods of market stress, the latest price action suggests that bearish forces are regaining control.

XRP’s movements rarely occur in isolation. As one of the most closely watched digital assets, its price reflects not only broader crypto market sentiment but also developments surrounding Ripple, regulatory clarity, and on-chain activity. When Ripple-linked XRP drops 5%, traders and long-term holders alike begin reassessing risk exposure, support levels, and future expectations.

We will explores the reasons behind the recent decline, analyzes technical and fundamental factors, and explains why downside risk toward $1.70 is back in focus. By examining market psychology, network fundamentals, and comparative trends, we aim to provide a clear and balanced perspective on XRP’s current position.

XRP Drops 5% as Ripple

XRP’s recent decline has unfolded over a relatively short timeframe, catching the attention of market participants. A 5% drop may appear modest compared to historical volatility, but its timing is significant.

The move occurred as XRP struggled to maintain higher support zones, indicating weakening buying interest. When Ripple-linked XRP drops 5%, it often reflects a combination of profit-taking, reduced momentum, and broader market hesitation.

This price behavior has shifted attention toward lower support levels, particularly the psychologically important $1.70 area.

Broader Market Conditions Influencing XRP

Cryptocurrency markets operate within a tightly interconnected environment. Bitcoin and Ethereum movements often set the tone, while altcoins like XRP tend to amplify broader trends.

Recent market uncertainty has reduced risk appetite, pushing traders toward caution. In such conditions, assets with unresolved narratives or sensitivity to news can experience sharper pullbacks.

As Ripple-linked XRP drops 5%, it mirrors a market environment where investors prioritize capital preservation over aggressive accumulation.

Ripple’s Role in XRP Market Sentiment

XRP is uniquely tied to Ripple, and market sentiment around the token is frequently influenced by developments related to the company.

Regulatory clarity, partnerships, and adoption of Ripple’s payment solutions can all impact XRP demand. Conversely, periods of silence or uncertainty can weigh on price action.

The recent decline does not necessarily signal negative news from Ripple, but it highlights how closely XRP sentiment remains linked to expectations around Ripple’s long-term trajectory.

Technical Analysis and Key Support Levels

From a technical perspective, XRP’s chart structure has weakened. After failing to sustain upward momentum, sellers have gradually taken control.

The $1.70 level now stands out as a critical area of interest. Historically, this zone has acted as both support and resistance, making it a focal point for traders.

As Ripple-linked XRP drops 5%, technical indicators suggest that a retest of lower levels is possible if buying pressure does not return soon.

Understanding the Downside Risk Toward $1.70

Downside risk does not imply inevitability, but it highlights potential scenarios if current trends persist. The $1.70 level represents a confluence of technical and psychological factors.

A move toward this zone could attract dip buyers, but a decisive break below it may open the door to further weakness. Market participants are closely watching volume and momentum for clues.

This is why the narrative that Ripple-linked XRP drops 5%, opening downside risk toward $1.70, has gained traction.

On-Chain Activity and Network Signals

On-chain metrics provide valuable insight into network health and user behavior. Transaction volume, active addresses, and wallet activity help gauge real demand.

Recent data suggests steady but unspectacular network usage. While this indicates stability, it may not be strong enough to counteract broader market selling pressure.

When Ripple-linked XRP drops 5%, the absence of a sharp increase in on-chain demand can limit the chances of an immediate rebound.

Investor Psychology and Market Confidence

Investor psychology plays a crucial role in short-term price movements. Fear and uncertainty often intensify during pullbacks, even modest ones.

For XRP, prior periods of strong performance may encourage profit-taking when momentum slows. This behavior can accelerate declines as stop-loss orders are triggered. The psychological impact of seeing Ripple-linked XRP drop 5% reinforces caution and keeps buyers on the sidelines.

The Role of Liquidity and Trading Volume

Liquidity conditions influence how sharply prices move. Lower trading volume can exaggerate price swings, making declines appear more severe.

Recent sessions have shown moderate volume, suggesting that sellers are active but not aggressive. However, without strong buying interest, prices can drift lower. This dynamic contributes to the downside risk narrative surrounding XRP.

XRP Compared to Other Major Altcoins

Comparing XRP to other large-cap altcoins provides useful context. Some assets have shown relative strength, while others have mirrored XRP’s weakness.

XRP’s performance highlights its sensitivity to sentiment shifts. Unlike tokens driven primarily by decentralized finance or smart contract adoption, XRP’s narrative is more concentrated. As Ripple-linked XRP drops 5%, it underscores how narrative-driven assets can experience sharper sentiment-based moves.

Regulatory Environment and Its Subtle Influence

Regulation remains a long-term factor in XRP valuation. Even in the absence of immediate news, lingering uncertainty can influence investor behavior.

Traders often price in risk preemptively, especially during broader market downturns. This can limit upside potential and increase downside vulnerability. While regulation is not the direct cause of the current drop, it remains part of the background influencing XRP sentiment.

Short-Term Traders Versus Long-Term Holders

Market participants approach XRP with different strategies. Short-term traders focus on technical levels and momentum, while long-term holders emphasize fundamentals.

The recent 5% drop may prompt traders to seek lower entry points, adding selling pressure. Long-term holders may remain patient but cautious. This divergence in behavior shapes how Ripple-linked XRP drops 5% and how the market reacts afterward.

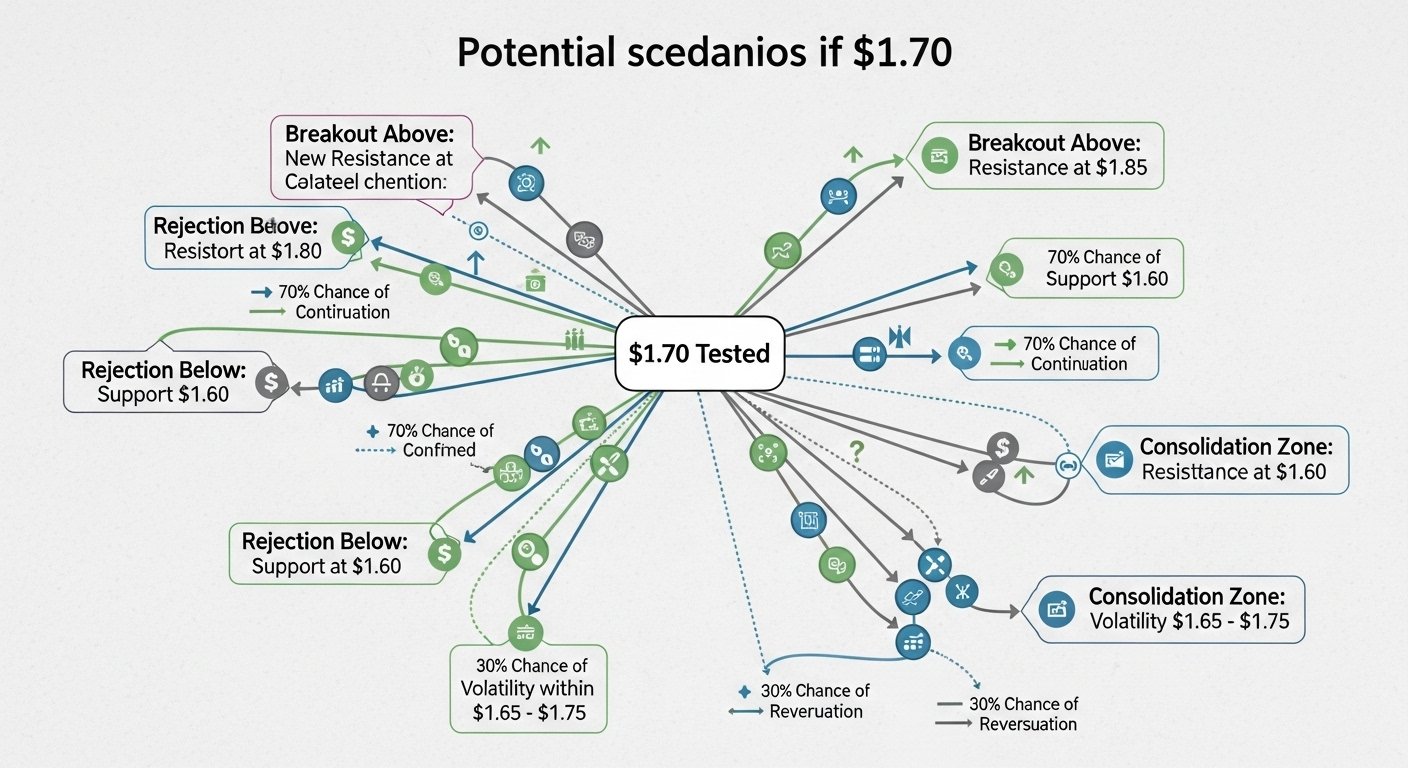

Potential Scenarios if $1.70 Is Tested

A test of the $1.70 level could unfold in several ways. Strong buying interest may lead to a bounce, reinforcing confidence in that support.

Alternatively, a weak response could signal further downside risk, potentially extending the bearish phase. The outcome will depend on market sentiment, volume, and broader crypto trends at the time of the test.

Bullish Factors That Could Limit the Decline

Despite current weakness, XRP retains several supportive factors. Its established position, active community, and integration into payment solutions provide a foundation. Positive developments from Ripple or renewed market optimism could quickly shift sentiment. These elements remind investors that while Ripple-linked XRP drops 5%, the long-term story remains open-ended.

Risk Management in a Volatile Environment

Periods of heightened volatility require disciplined risk management. Understanding key levels, position sizing, and time horizons becomes essential. For XRP traders, recognizing the downside risk toward $1.70 helps set realistic expectations rather than reacting emotionally. Clarity and preparation can reduce the impact of sudden market moves.

Long-Term Outlook for XRP

XRP’s long-term outlook depends on adoption, regulatory clarity, and broader crypto market cycles. Short-term declines do not necessarily define long-term value. However, repeated tests of lower levels can influence perception and patience among investors. The current phase, where Ripple-linked XRP drops 5%, represents another chapter in a long and evolving market journey.

Conclusion

The recent move where Ripple-linked XRP drops 5%, opening downside risk toward $1.70, highlights the delicate balance between market sentiment and underlying fundamentals. While the decline has raised caution, it has not fundamentally altered XRP’s long-term narrative.

Technical weakness, cautious investor psychology, and broader market uncertainty have combined to push prices lower. The $1.70 level now serves as a critical reference point for traders and investors alike.

Whether XRP stabilizes or extends its decline will depend on how confidence, volume, and external factors evolve. For now, the market remains watchful, navigating a phase defined by caution rather than conviction.

FAQs

Q: Why did Ripple-linked XRP drop 5% recently?

XRP dropped due to weakening market momentum, reduced risk appetite across the crypto market, and profit-taking after earlier price movements, rather than a single negative event.

Q: Why is the $1.70 level important for XRP?

The $1.70 level is a key technical and psychological support zone. A strong reaction there could stabilize price, while a break below it may increase downside risk.

Q: Does this drop mean XRP’s long-term outlook is negative?

Not necessarily. Short-term price declines are common in crypto markets. XRP’s long-term outlook still depends on adoption, regulation, and broader market cycles.

Q: How does Ripple influence XRP price movements?

XRP sentiment is closely tied to expectations around Ripple’s partnerships, adoption of its payment solutions, and overall regulatory clarity, even when no direct news is released.

Q: What should investors watch next for XRP?

Investors may monitor price behavior near $1.70, overall market sentiment, trading volume, and any developments related to Ripple that could influence confidence and demand.